Proctoring solutions help institutions ensure that academic integrity is maintained on assessments, particularly, but not exclusively, in online learning environments. This is accomplished through a number of functions that seek to validate test-taker identity, monitor test-taking, and ensure the authenticity of work. Most proctoring companies offer services that automate the entire proctoring process. Many also offer more engaged proctoring services that involve live proctoring or in-person review of recorded assessments.

The proctoring market has grown substantially in recent years. It includes companies such as Proctorio, Honorlock, ProctorU, and Examity, among others. There are two primary drivers of this growth. First, as the number of students enrolled in wholly and partially online programs has continually grown across all higher education sectors, more remote students means an increased need for remote proctoring. Second, the pandemic forced millions of learners, and thus assessments, online.

The analysis herein provides market size estimates for the proctoring market and a viewpoint on the direction it will take in the future. Our findings are based on our collection and review of thousands of product implementations and hundreds of contracts from 2010 to 2022. We are happy to share this unprecedented view into the US higher education market and look forward to your thoughts on feedback.

The Proctoring Market

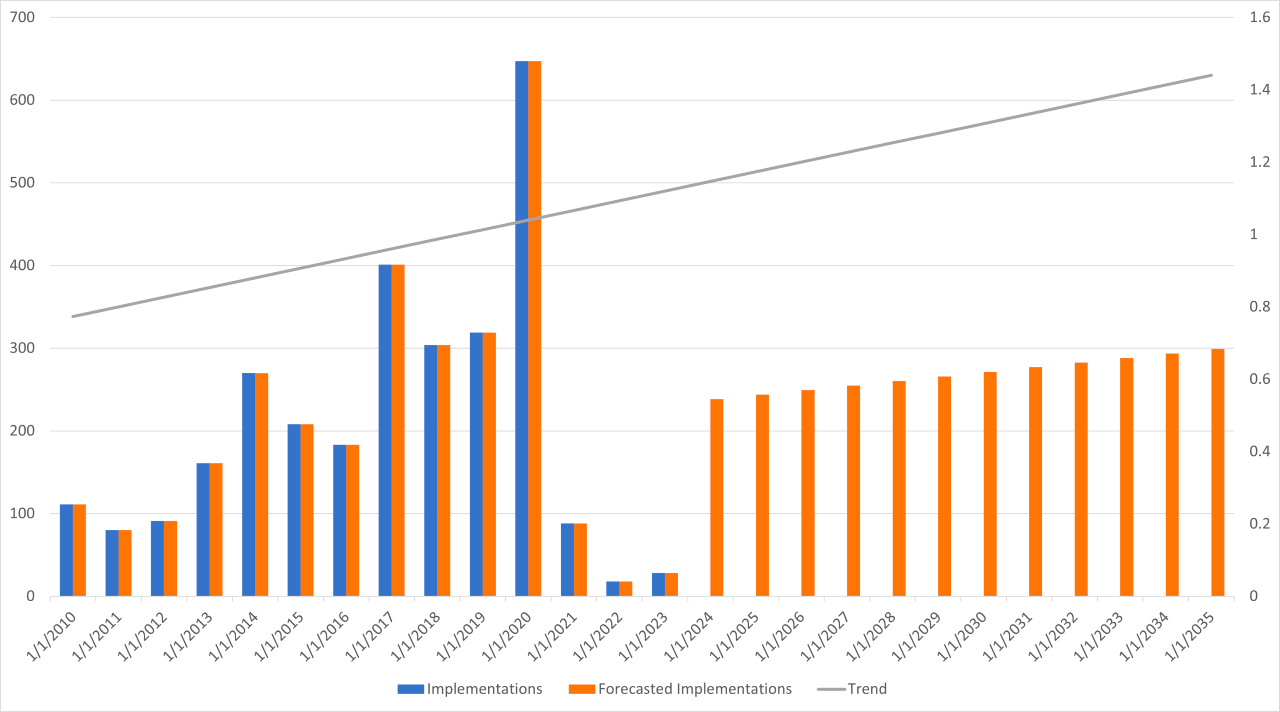

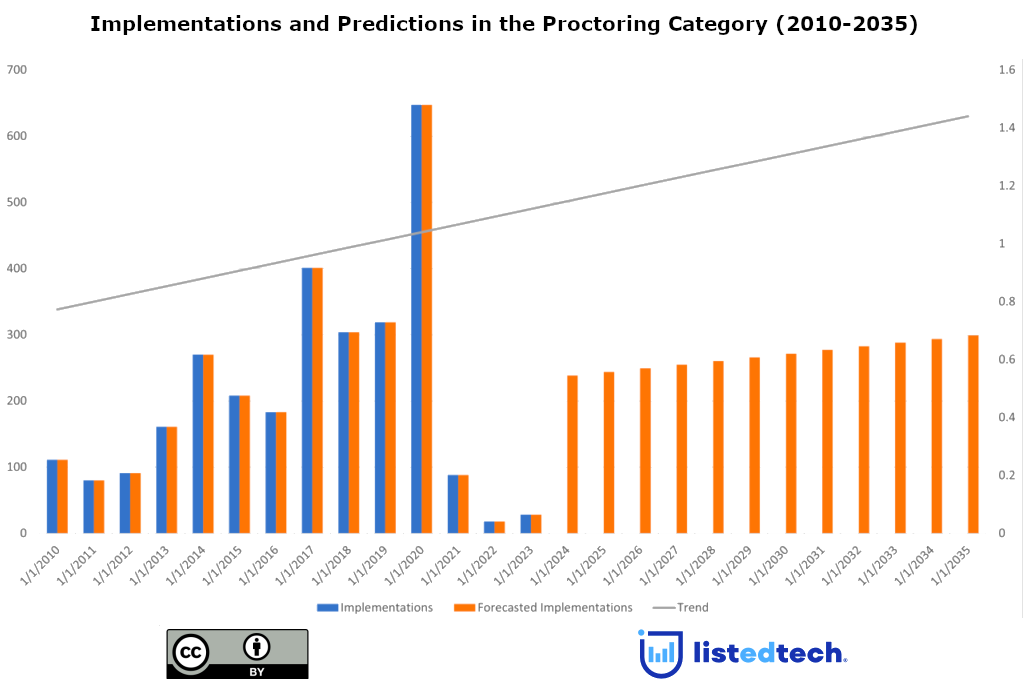

The undeniable growth in online learning is likely the most robust tailwind for proctoring solutions. As previously written, 2020 was a banner year for this edtech segment. Nine hundred new implementations were made in 2020, nearly twice the annual average for the five years before. The previous years in which more and more schools were delivering programs online (and more and more students were enrolled either wholly or partially online) were also significant for proctoring solutions. Institutions of every shape and size are now buying proctoring solutions. Many are using more than one central, enterprise-wide proctoring solution instead of deploying several across different colleges and departments.

In aggregate, our data covers 3,500+ implementations made between 2010 and 2022 at 1,800 higher education institutions in the US. Our estimates are based on a review of over 400 contracts.

This analysis suggests that the current size of the US higher education proctoring solutions market is $60 million.

Even though the accelerated demand for proctoring solutions brought on by the pandemic over the last two years has led to a near-term slowdown in new implementations, we still see more programs being delivered in a format other than face-to-face which should mean increased users of existing solutions.

It is important to note that our analysis is based on partnerships between proctoring solutions and US higher education institutions. It does not include test centers such as Pearson Vue, standardized tests, industry credentials, or a number of other segments in the broader proctoring market. These are predominantly software solutions that have some in-person, live support features.

By some accounts, the global proctoring market is estimated to be $700m as of 2022. Our analysis is much more focused on US higher education.

The Road Ahead for Proctoring Solutions

Even if enrollments continue a slow decline, in the near future, the need for online proctoring services in the US higher education is due to rise.

Academic integrity is only getting more challenging to track. Not only is cheating something that happens, but advanced bad actors make cheating an easy, though often expensive, alternative to doing the work. And then there’s this whole ChatGPT, AI thing.

The need to verify academic integrity seems only to be going up, and proctoring solutions are in a good place to meet institutions’ needs. Our hope is that technology providers in this important market segment will not only ensure that integrity is upheld but that a business model will be developed so that they can use their expertise to work with educators and students to stem the tide of academic dishonesty.

This graph shows that the number of new proctoring solutions implemented every year keeps increasing. Our predictions, shown in orange, show a continuing increase.

Note: Given the small window of years we are including in the piece (2010 – 2022), we cannot be 100% certain of this analysis. Our projections are based on implementation data alone. We will continue to refine them, taking into account potential market pressures (ChatGPT, for example) and other factors.