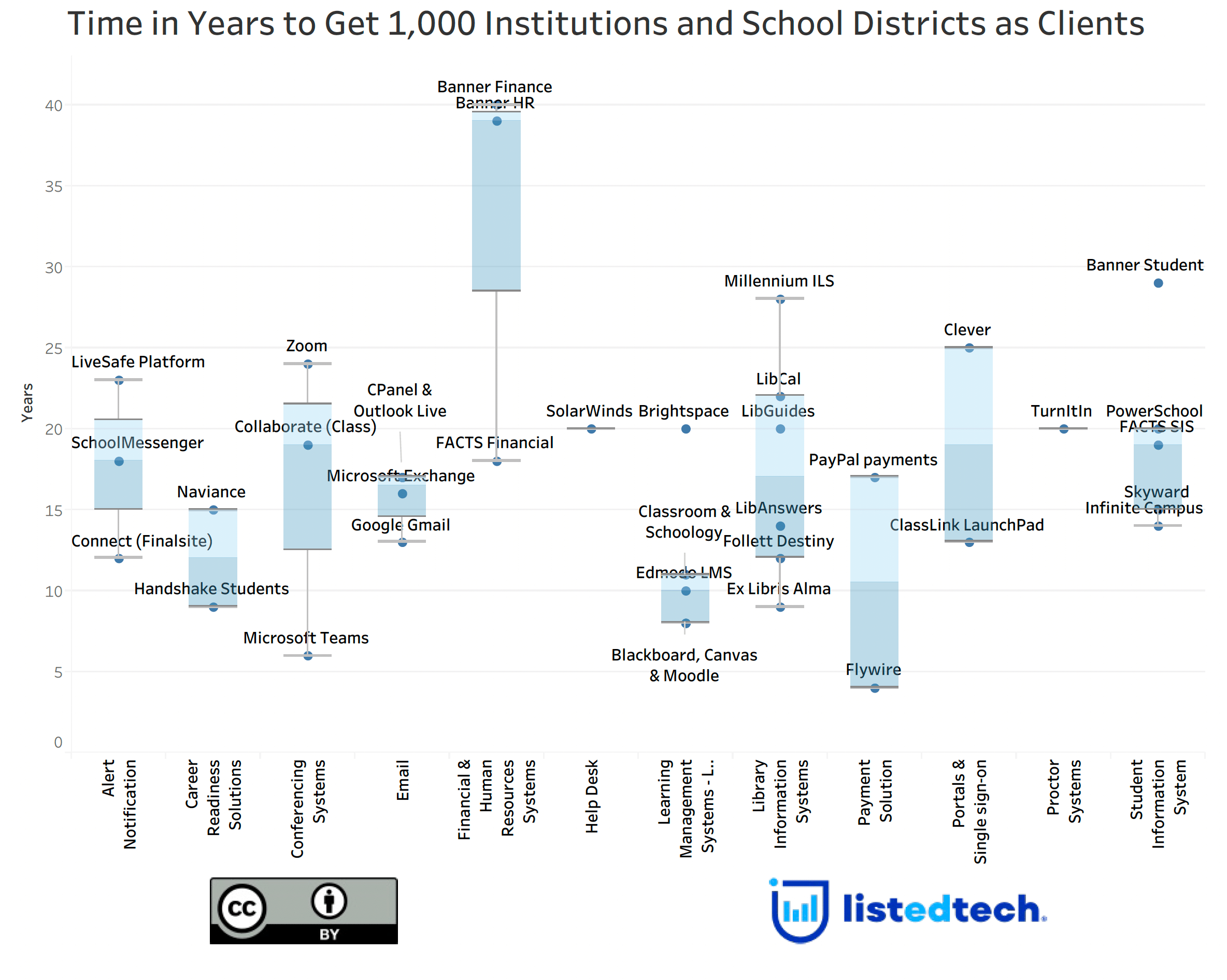

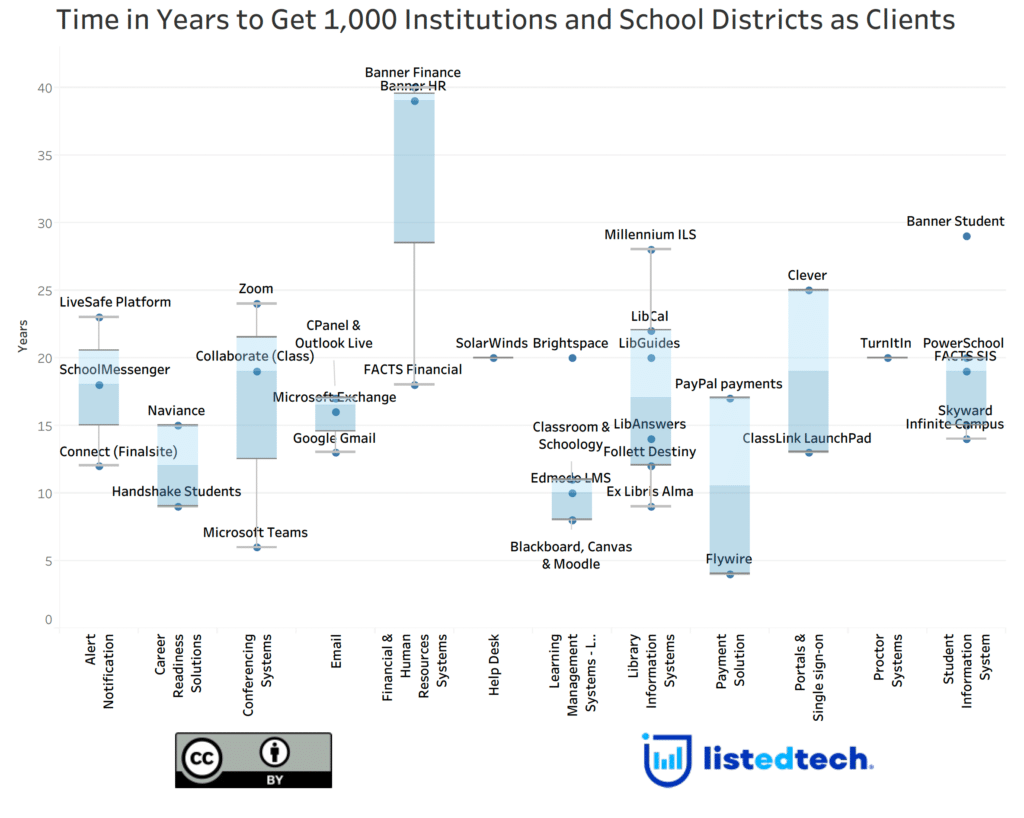

What do Google, Instructure and Datatel have in common? They all started with a powerful idea but with next to no clients. This pathway to success is even the title of a podcast series hosted by Mitch Russo and is often the topic of business articles (here’s an example from inc.com). When we know that almost 90% of businesses fail before getting their first 100 clients, the 1,000 mark is something to be celebrated. In this post, we look at how many years solutions took to acquire their first 1,000 clients.

Before exploring the graph, there are a few things to consider:

- We do not have all the implementation dates, and the older ones are harder to find. Therefore we present this graph as a ballpark.

- We have decided to show data by product groups instead of a list of all products since some product categories have seen a massive increase in implementation demand over the years. For example, universities, colleges and school districts implemented conferencing and learning management systems faster during the pandemic.

Methodology

- For each product group, we selected all solutions for which we have at least 1,000 clients.

- We included all degree types (K-12 and HigherEd).

- We did not count product upgrades as they were already clients during the upgrade implementation.

- Note: we used a box and whisker graph to present the data as it is “very effective and easy to read, [… and] can summarize data from multiple sources and display the results in a single graph.” (source)

Findings

- As a general trend, a product took approximately between 15 and 20 years to acquire 1,000 clients. A few product categories were way faster: Learning Management Systems (ten years) and Payment Solutions (just over ten years). Some groups took longer: Financial & Human Resource Systems are in the high 30s, followed by Portals & Single Sign-On (around 20 years).

- We notice that solutions targeting school districts usually reach the 1,000-client milestone faster than those aimed only at higher education. For instance, FACTS SIS and FACTS Financial took around 18 years, Banner Student got its 1,000th client after almost 30 years, and Banner HR and Banner Finance took nearly 40 years.

It is hard to compare solutions that are 40 years old with software from start-ups, as the business has changed so much in the past two decades. We all remember when Agile became the thing in the early 2000s. Before the popularization of this method, research and development took longer, and product updates took months to get deployed. Thanks to cloud hosting, it’s now a matter of weeks between upgrades.

Hitting the 1,000th customer mark is a significant milestone for any solution. It indicates that the developed product is needed in its market, it creates compelling customer acquisition strategies, and it builds scalable infrastructure and operations while retaining its initial client base. It suggests that the market can support the expansion of the business. This also means that the software obtained feedback from existing customers and has improved its offerings to meet its clientele needs.