Timing is crucial if a company wants to set its solution as the leader in one product category. “Being the first in the market means that you can set the standards for the industry [and] establish a dominant market share. This head start could make it much harder for future competitors to catch up.” (source) In this post, using our data, we look into the market concentration to highlight the market share held by the top 3 solutions for the major product groups we follow.

Methodology

- We analyzed 31 product categories for the HigherEd submarket and 11 for the K-12 one.

- We used the current market share (June 2023) and added the percentage of the top 3 solutions.

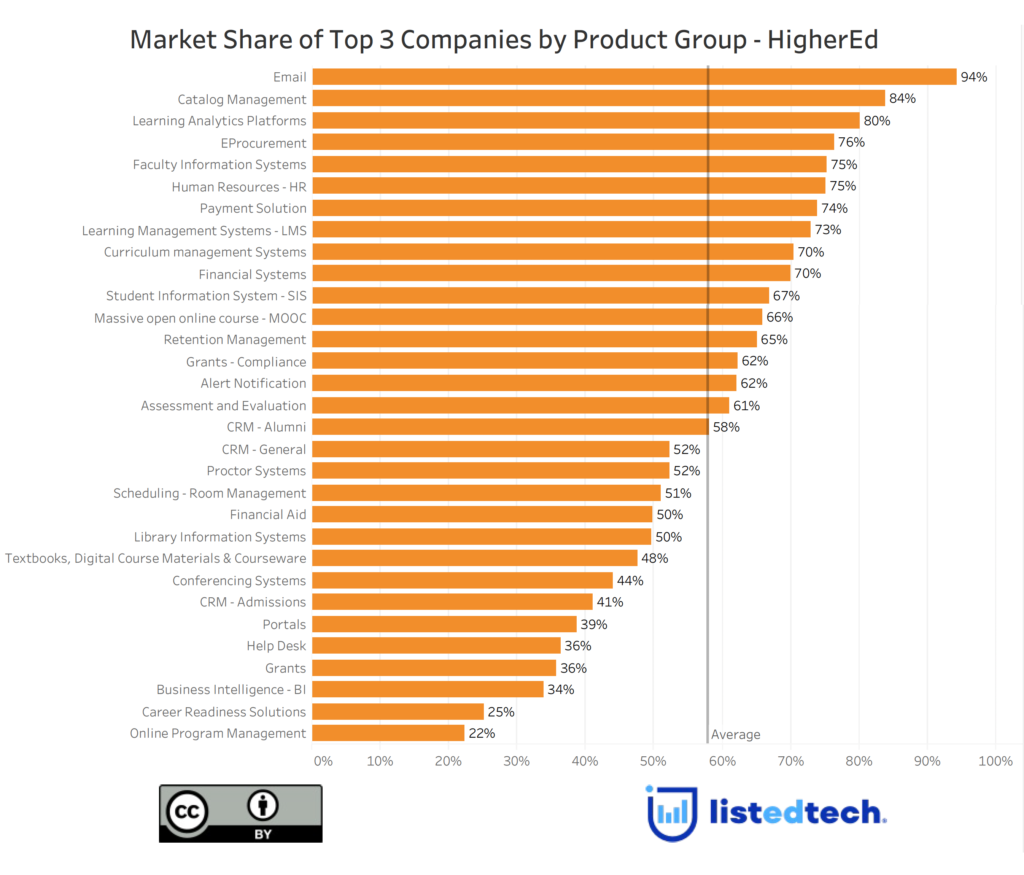

HigherEd

As shown in the HigherEd graph above, the average market share of the top 3 solutions across all product categories is 58%, with Email systems dominating the chart at 94%. Institutions implement Google (Gmail) or Microsoft (Outlook Live or Exchange) in this product category. At the bottom of the graph, we find Online Program Management, Career Readiness and Business Intelligence. These three product groups are known to have dozens of solutions with about 1% of the market share (40+ for OPM, 50+ for BI and 60+ for Career Readiness).

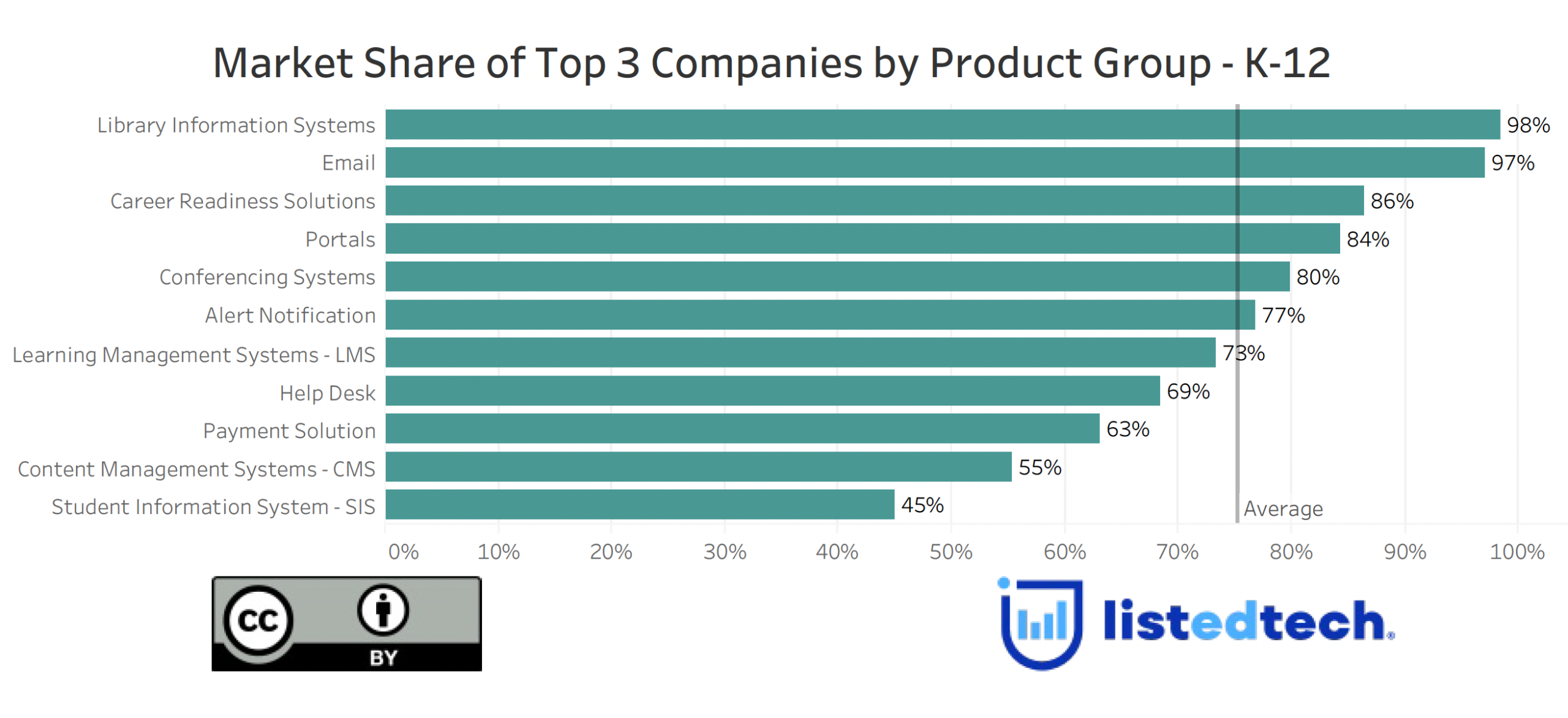

K-12

Looking at the average market share by the top 3 companies in each product group (75%), we can attest that K-12 is a submarket of fewer solutions. For example, oligopolistic (almost monopolistic) situations exist for the Library Information Systems (98%), Email Solutions (97%) and Career Readiness Solutions (86%) categories. It shares similarities with the HigherEd submarket when it comes to Email systems (in the 90%+), Learning Management Systems (73% for both markets) and Alert notifications (this group is just over the average line for the two submarkets). However, in many product categories, the two submarkets are opposite:

- Library Information Systems is the highest category in K-12 (98%) but in the last tier in HigherEd (50%).

- Career Readiness Solutions occupies the third rank in K-12 (86%) with only 25% in HigherEd.

- The top 3 solutions in Conferencing Systems have 80% of the market shares in K-12 while reaching only 44% in HigherEd.

How can we explain these discrepancies between HigherEd and K-12? We can certainly consider that the K-12 submarket is much younger than the higher education market regarding edtech use. Indeed, companies only started offering K-12-specific solutions in the early 2000s, while the HigherEd submarket has been using IT solutions since the 1980s. This supports the idea of the first-mover advantage. Another assumption would be that companies merge faster in the school district business. As an example, PowerSchool acquired 14 companies in the past seven years. This business strategy is aligned with John Henson’s famous quote: “If you can’t beat them, join them!” and is often seen in edtech business strategies.

Impact of Having Fewer Players in a Category

Market concentration in the edtech sector has significant implications for the evolution and accessibility of solutions. As a few key players dominate the market, they wield substantial influence over the development, pricing, and availability of educational technology products. This concentration of power can shape innovation, content standards, and pedagogical approaches within the edtech industry. Additionally, market concentration can affect competition, potentially limiting the entry of new players and stifling diversity and choice for educational institutions and learners.

As Bill Gates once said: “Can any Microsoft endure future competition without innovation? The answer is no. We’ve got to keep changing.” Even if your product dominates the market, it still needs to evolve if you want to keep ahead of your competition. Returning to our initial question, we see that Email systems are a product group with just two or three options. At the same time, business intelligence or career readiness offers dozens of products doing roughly the same thing. Companies that want to take more market share must follow Bill Gates’s advice and continue innovating and proposing new features and functionality to ensure their future growth.