Last week, James and I attended Anthology Together, where I got the chance to meet with some Anthology executives, clients and service providers. During one of these meetings, I had an interesting discussion on school closures and their impact. When I returned to my hotel room, I looked into Anthology’s clients to better understand the situation.

Before examining Anthology Student’s profile, let’s discuss how the edtech world defines market share. There are several ways to count market share and client base. One can calculate the total student enrollment for all institutions using one product or count the number of institutions. In some scenarios, companies will focus on new clients and not discuss decommissions. At ListEdTech, we often choose to represent our data in terms of the number of institutions and the number of students, given our readers on both sides of the medal.

School Closures

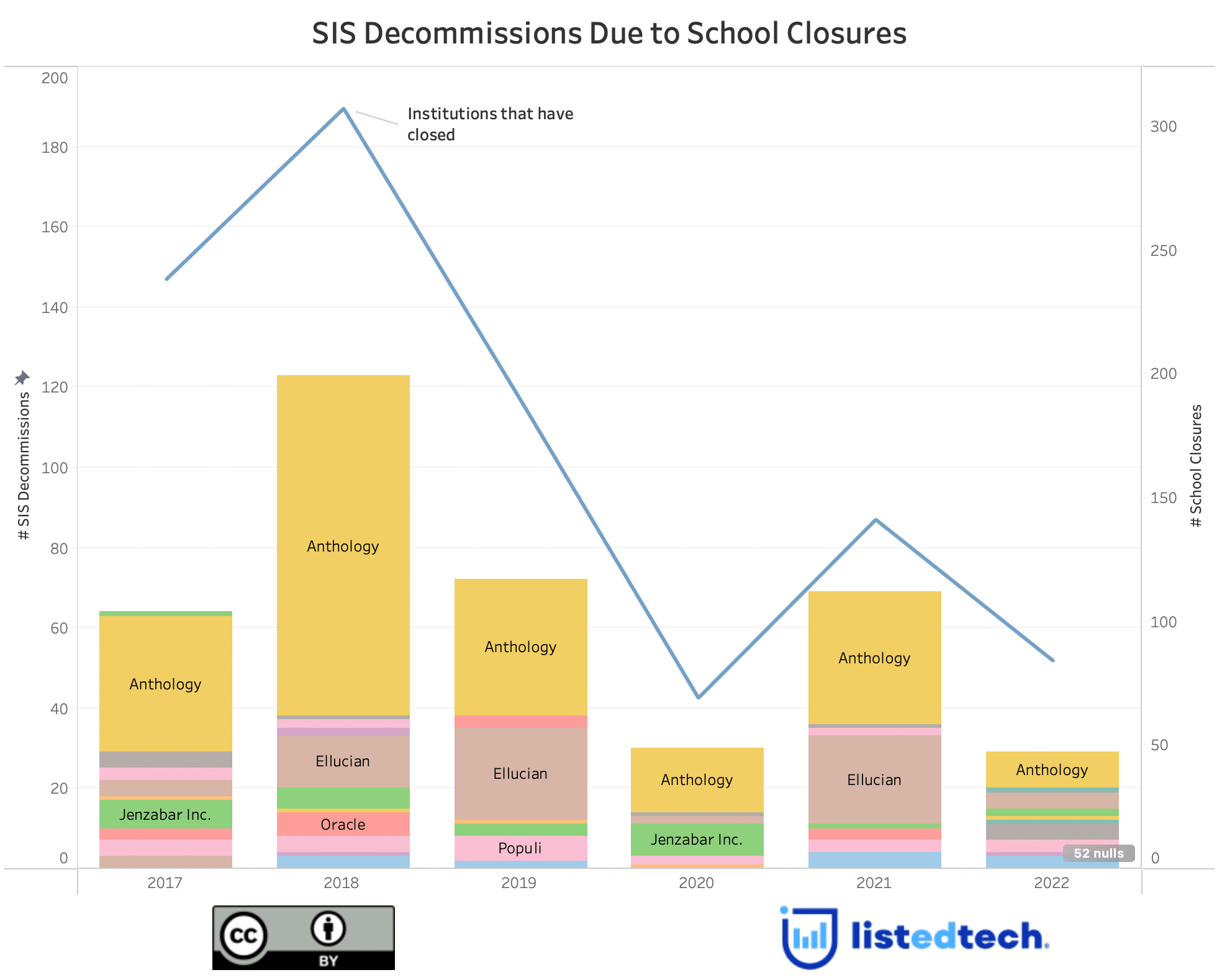

Looking at the SIS Decommissions graph above, we can see how these school closures impacted Anthology’s client base. Since 2017, the defunct institutions have impacted Anthology Student in a high proportion. The year 2018 was undoubtedly the worst for Anthology when they lost about 80 clients due to school closures in one year. The years 2017, 2019 and 2021 have had similar numbers of Anthology Student decommissions (about 30 each year). In 2022, Anthology seemed less impacted by these closures. To be clear, the decommissions above affect all companies and are clearly an annoyance since it’s not like the institutions selected another product and moved away. The school closed. Everyone lost.

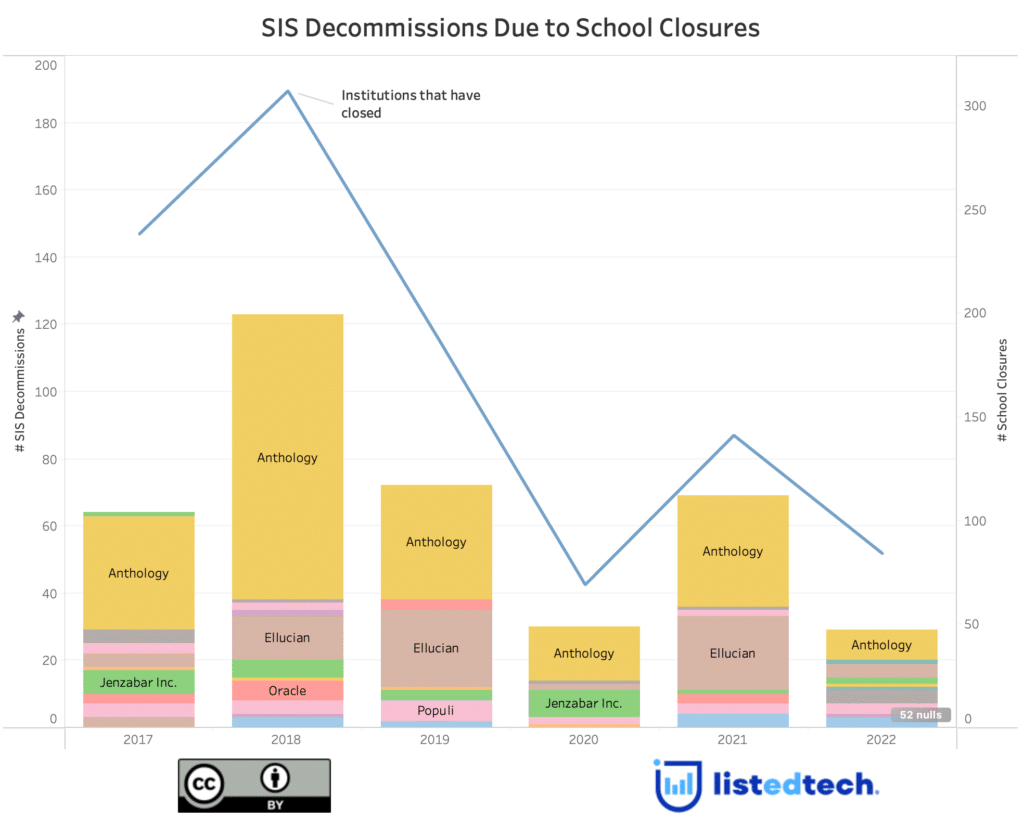

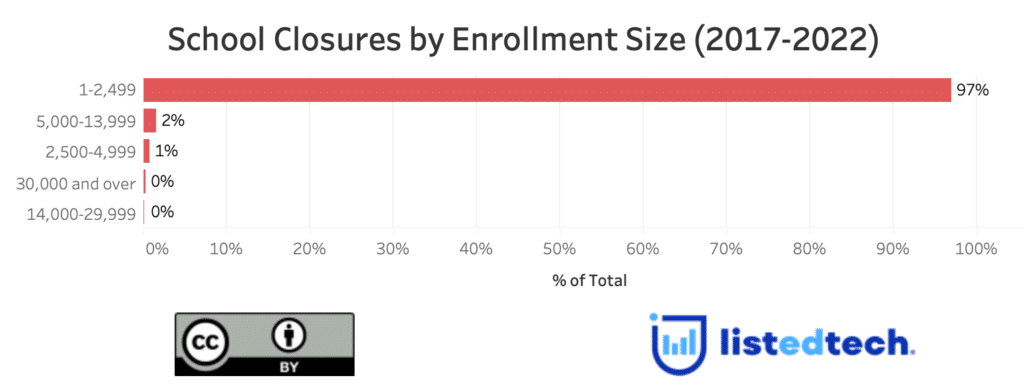

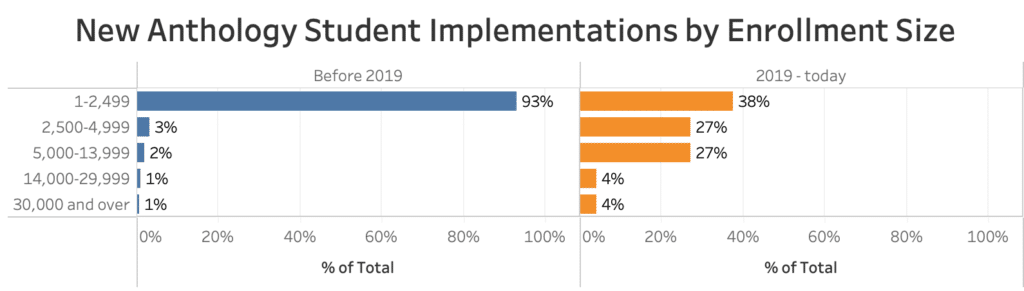

Between 2017 and 2022, most school closures happened in the smallest enrollment band (2,499 or less). Until 2019, this enrollment category was Anthology’s bread and butter. This is where they made a name for themself and developed their products. Since then, Anthology has gained market shares in other enrollment bands (mostly 2,500-13,999). The net student enrollment is positive: Anthology SIS has acquired about 300,000 students between 2019 and 2023, despite the school closures and other decommission types.

Our historical data shows that Anthology has shifted from a small institution-focused provider to a multi-enrollment band solution. While maintaining its position in smaller institutions despite school closures, Anthology is starting to be implemented in larger institutions which will help if other school closures should happen.