Where students go, what they study, and how they learn impact edtech markets. This post focuses on three trends in undergraduate enrollment that are unfolding across US higher education and how those trends will impact specific education technology segments.

Big Schools Are Getting Bigger.

The higher education landscape, through the lens of the number of colleges and universities, is and has been in a state of consolidation for some time. The number of schools operating in the US declines more and more each year-forecasts suggest that this trend is only expected to continue. Though closures have predominantly been in the for-profit sector, we are also seeing the steady decline of primarily smaller, regional institutions-many of them private schools of another era. Such institutions are either closing their doors for good or being merged with or acquired by another, larger institution. Two recent examples of the latter trend in Boston alone are Boston University’s acquisition of Wheelock College and Boston College’s acquisition of Pine Manor College.

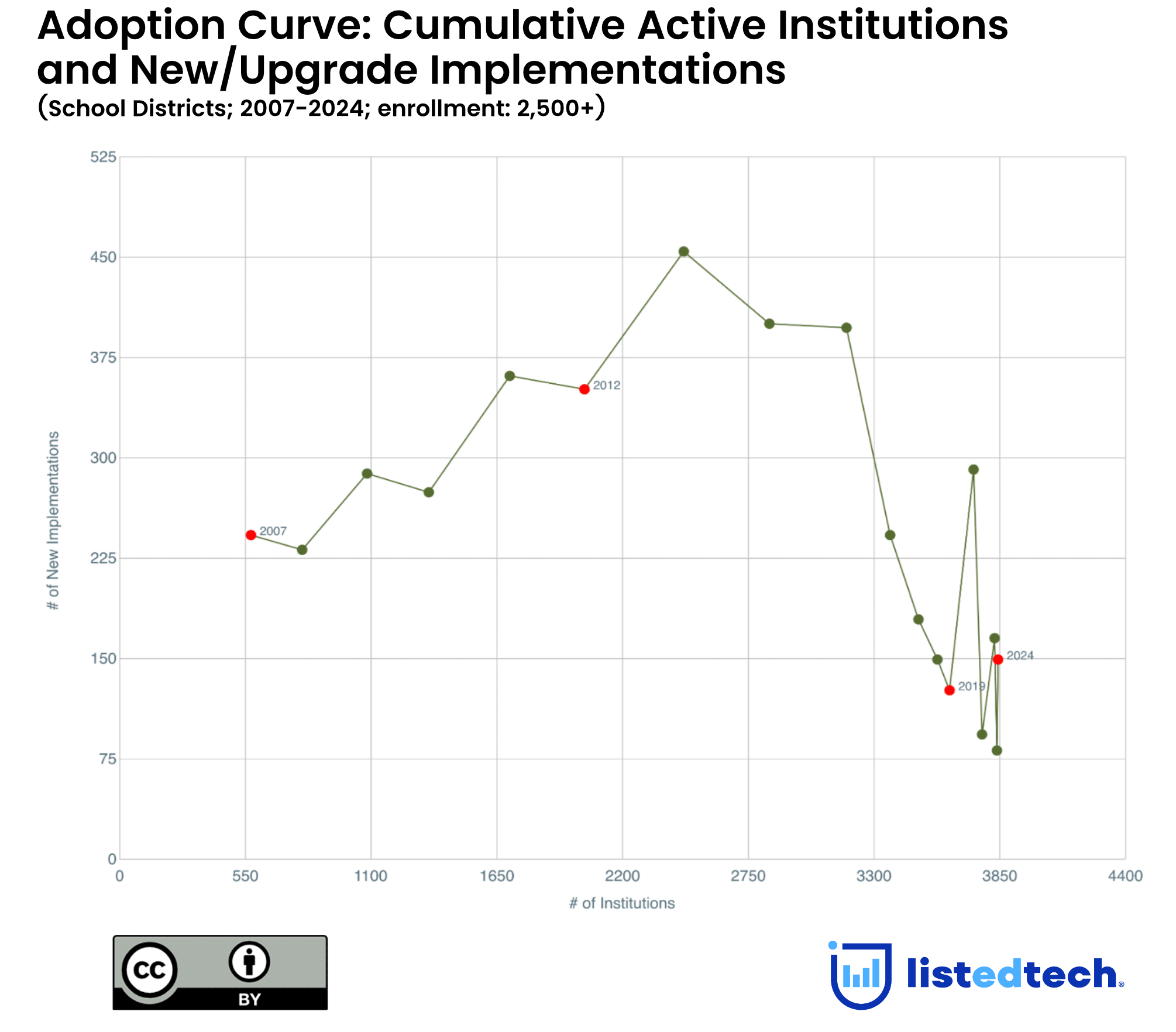

On the other side of the same coin, the big schools (research institutions, flagship publics, regional giants) are generally getting bigger -i.e., enrolling more undergraduates each year. Schools enrolling 20,000 or more students added over 50,000 first-time, full-time undergraduates between 2017 and 2021, while schools with enrollments between 5,000 and 20,000 lost 100,000. For some institutions, especially larger R1s, the upward trend has been ongoing for years.

For these institutions, their technology is being asked to do more. It must scale with growing enrolments, whether through additional seat licenses or acquiring new solutions to administer a safe and successful student journey and deliver learning to larger cohorts. More students enrolled at these institutions will likely result in increased technology acquisitions and use by these institutions.

As we have previously written, several edtech segments have concentrations of market share along the lines of school size. In the SIS market, Jenzabar and Anthology serve smaller schools. Ellucian and Oracle serve larger schools. This trend benefits those solutions used by larger schools and presents headwinds for those most used by smaller institutions.

Further analysis and time will tell if this holds true. Research of our data set indicates that technology acquisitions do not strongly correlate with enrollment size in most cases. But whether they correlate with enrollment growth and what the future looks like remains an open question.

Major Shifts: STEM Enrollments Are Up, and Humanities Enrollments Are Down.

In a continuous trend captured by the National Student Clearinghouse, computer science enrollments continue to increase at the graduate and undergraduate levels. Other STEM fields also appear to be rising in enrollments, while some of the historically highest enrolled fields of study, such as healthcare, saw declines in most recent reporting. Enrollments in the humanities are amid a longer-term decline.

Increases in Computer Science and other STEM subject matter areas will impact technological solutions developed to deliver and enhance learning in such programs. Courseware explicitly designed for these subject matter areas will have the wind at its back.

More students in STEM courses means more use cases for solutions facilitating learning in these subject areas.

The technological nature of this increasingly popular curriculum also invites learning innovation. At the extreme end of the spectrum is virtual and augmented reality. Though learning innovations in the classroom apply to any subject matter, the growth in students taking STEM-related courses will benefit tech providers who can prove their solutions in those classrooms.

The Growth of “Some Online” Suggests Modality Shifts.

The development of online learning and its realized and future impacts are widely discussed. But the growth of students taking part of their program online and some in person (a trend measured by the somewhat-vague IPEDS enrollment category of “some but not all distance education courses”) will also substantially impact edtech. Degree- and certificate-seeking undergraduates studying in some but not all online courses grew by more than 50% (or some 1.7 million students) between 2017 and 2021, the most recently available data.

Traditional-aged undergraduate students, those who graduate high school and enroll in predominantly four-year institutions, have, by and large, no desire to take ALL of their classes online. Recent surveys by Eduventures suggest that the desire to come to campus has only increased in the wake of the pandemic. We all knew ZoomU was a band-aid of low to modest quality. The data only helps to prove it.

That said, the pandemic appears to have accelerated the offering of academic programs with some but not all courses online. It is an indicator of shifting pedagogical approaches and will impact edtech providers with solutions in the classroom and the administration.

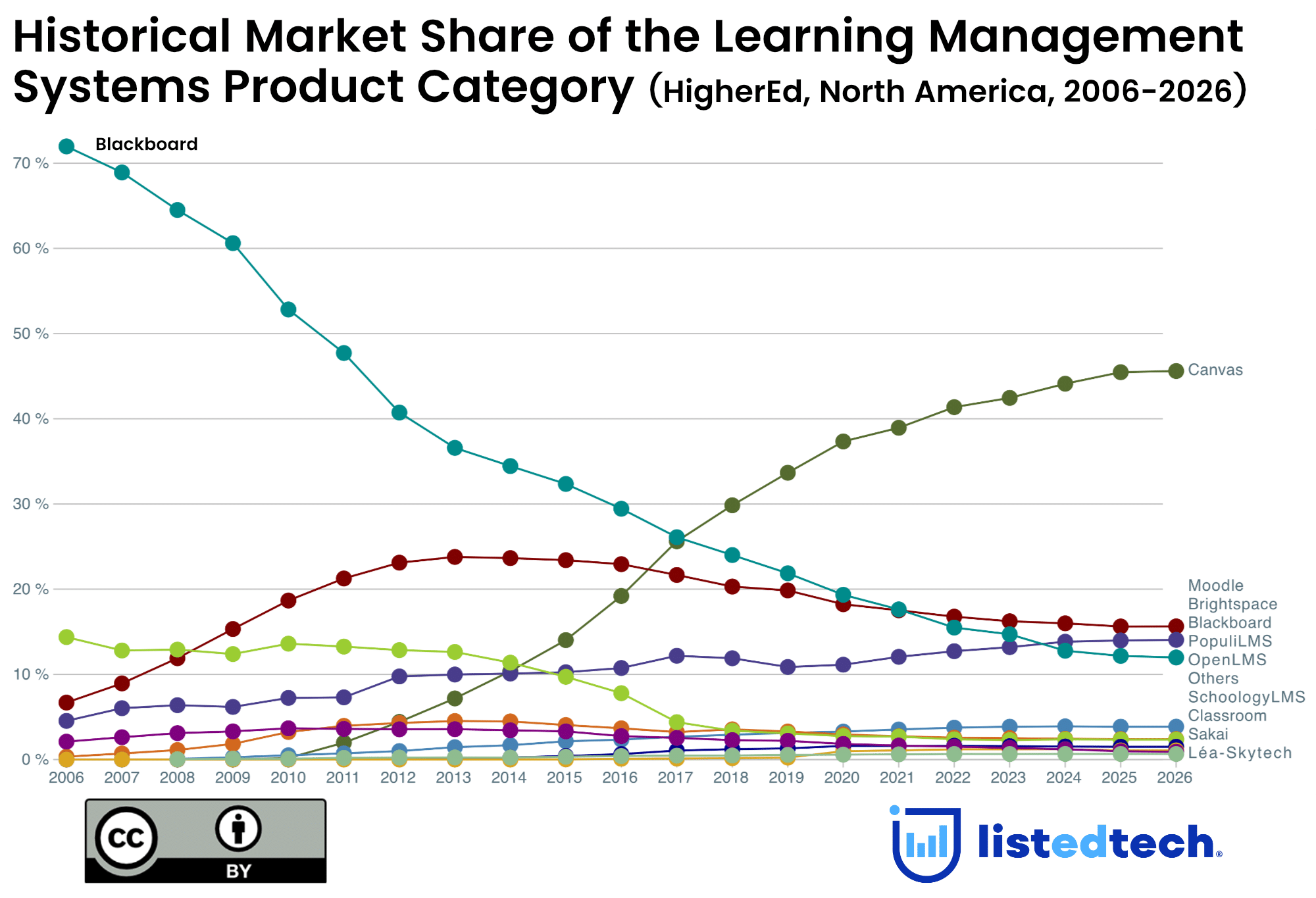

The increase in such learning experiences stands to benefit many technology providers. Lecture capture solutions, for example, will likely see increased adoption as they facilitate the delivery of in-classroom and recorded course sessions. Additionally, the LMS will be called upon to do even more to ensure that the same courses are delivered in multiple modalities.

Enrollment Is One of Many Variables Impacting Tech Adoption.

Enrollment trends impact institutions at an individual level and the entire higher education sector. Larger schools, the popularity of specific subject matter areas, and shifts in learning modalities mean these students must use technologies aligned with those changes. Some will be the same, but many will be different. Changes in enrollments will also transform how learning is delivered and how administrations acquire technologies that are not necessarily student-facing.

Numerous other trends undeniably impact edtech markets, but the strong undercurrents of enrollment flows must be addressed just as they cannot easily be changed. These are slow-moving trends that, over time, impact the whole of higher education. Not paying attention to them is simply not an option.