At its conference this year, Ellucian highlighted Indian River State College’s recent conversion from another student information system (SIS) to its Ellucian Banner SaaS product. In the accompanying video, Dr. Timothy Moore, the college president, highlighted the functional reasons for the product switch and discussed how he sees the new product as better supporting his institution’s operational and student needs.

Product functionality certainly played a large part in Indian River State College’s decision to change student information systems and did in other such decisions at other institutions. But might other institutional factors be at play in why institutional leaders switch student information systems?

Methodology

To answer the question, we analyzed our implemented and decommissioned student information system data for about 2,627 higher education institutions in North America across all sectors (public, private, two-year, four-year, etc.). We then added institutional characteristic data from IPEDS, such as Carnegie Classifications, enrollment size, degree offered, and other variables. We then used several classification approaches to predict the most essential features in predicting whether an institution will change its student information system.

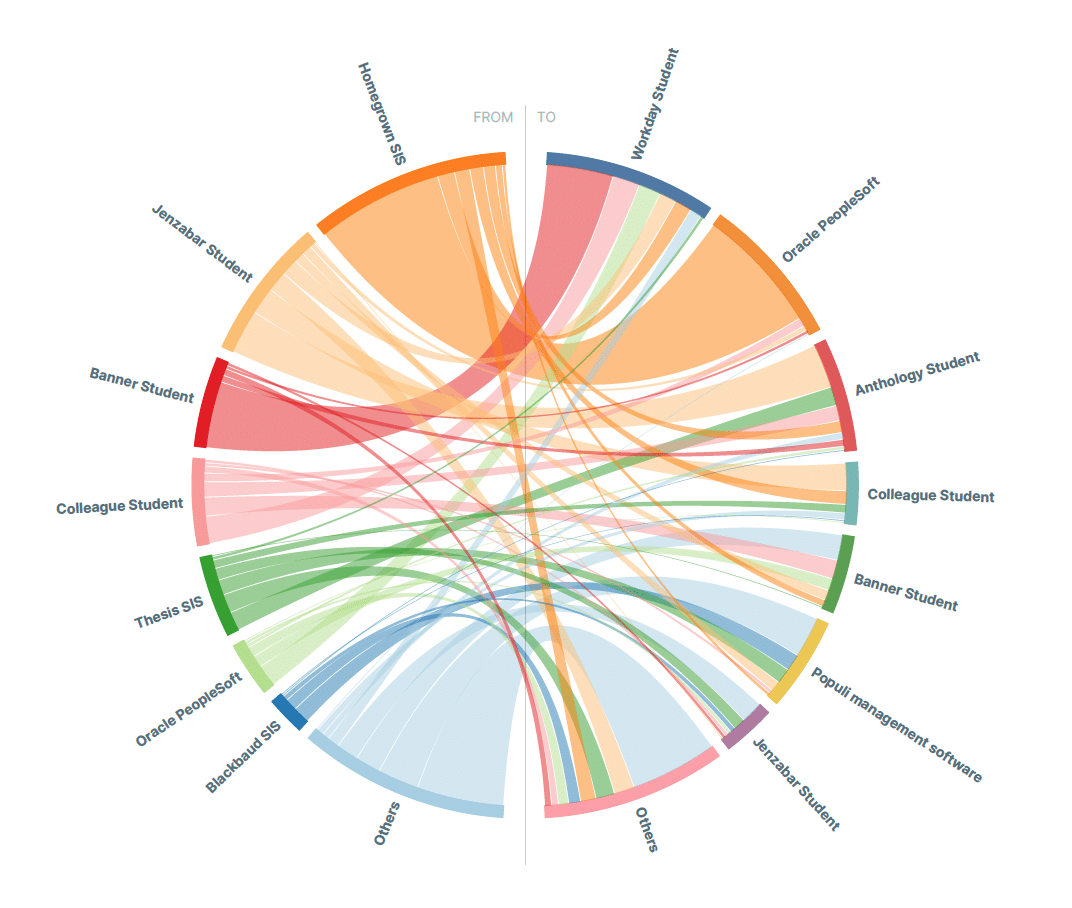

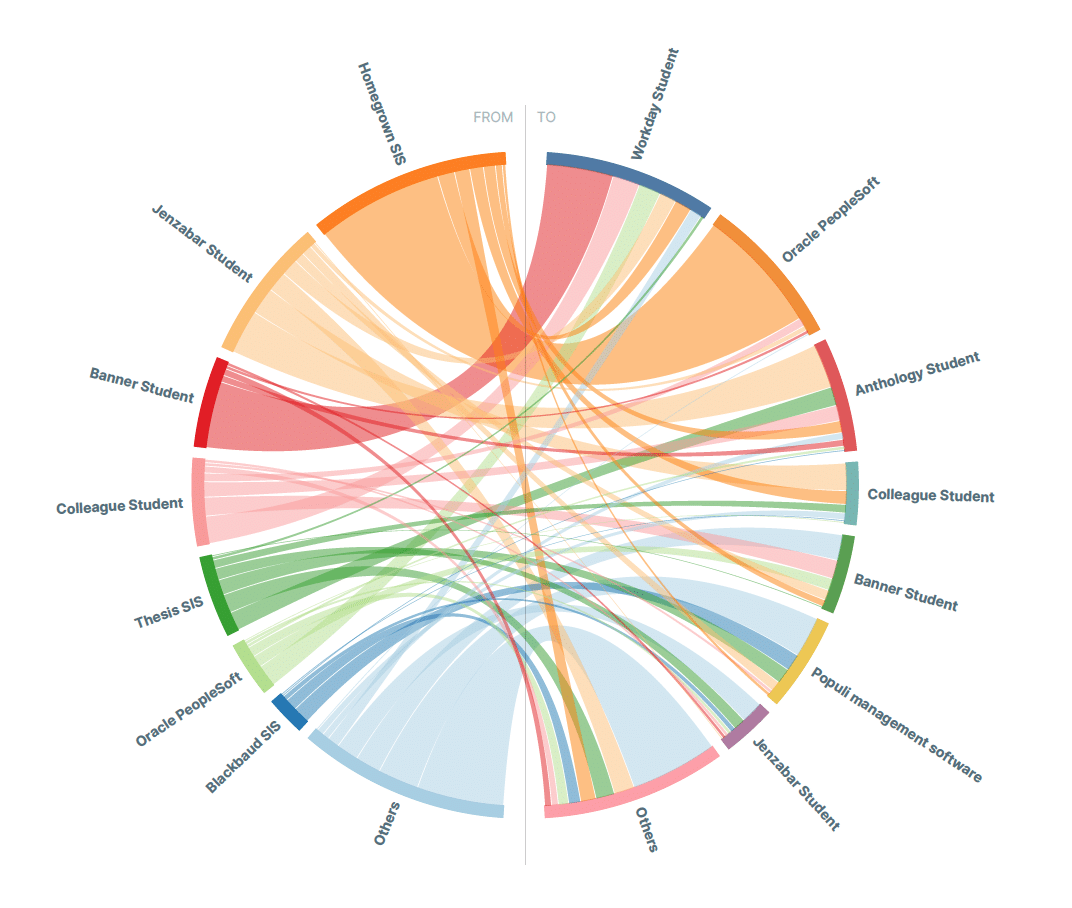

Why is this approach critical? Figure 1 below shows some dynamics of the North American higher education student information market, i.e., which products institutional leaders have selected in favor of others. From this point of view alone, we may be tempted to compare products side-by-side, comparing, for example, their different functionality. We may then conclude that an institution, like Indian River State, selected a particular product over another based on how the other student information systems stacked up against one another at the functional level alone. Yet, our approach suggests more to the story.

Findings

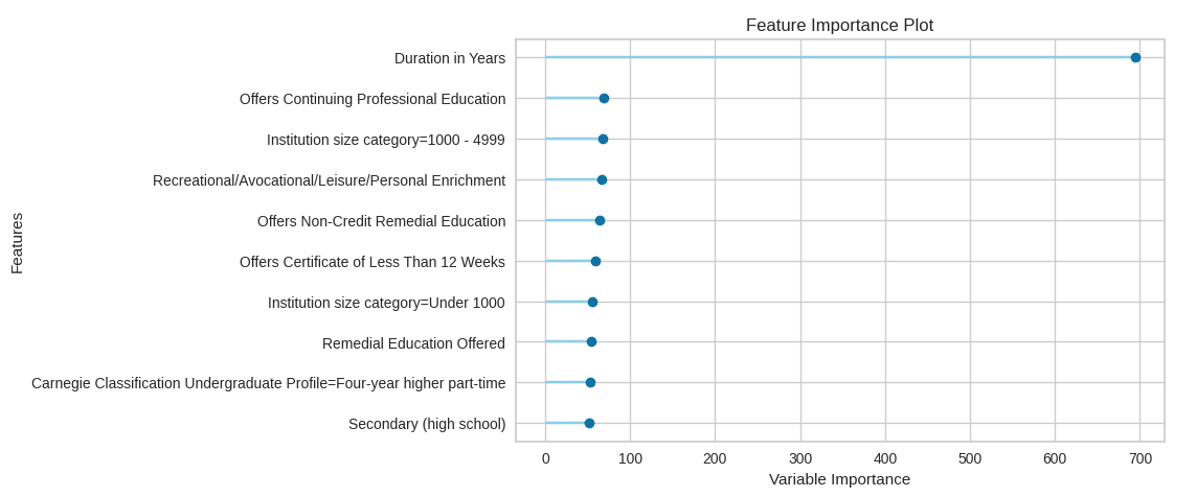

Applying our classification approach to our data shows other critical drivers for changing student information systems. For example, Figure 2 shows the top predictors of institutional SIS decommissions. This analysis reveals three main insights:

- Time is the primary driver: Our data shows that higher education institutions in North America keep their systems between one and 49 years, with the average life of the implementation set at just over 14 years. Our analysis shows, unsurprisingly, that student information systems at these institutions simply age out, i.e., after a more extended period, institutional leaders decide to upgrade to a more modern version of the SIS or decide to move away from homegrown systems to systems developed by vendors or managed by those same vendors in a cloud-based environment.

- For-credit and non-credit offerings are important: IPEDS asks institutions to report the types of for-credit and non-credit courses they offer. Three types of non-credit courses appear in our analysis as crucial predictors. For example, whether an institution provides continuing education (for students who have completed a professional degree and are seeking additional training in their field of study) is the second highest predictor; those who offer courses to students pursuing personal interest and leisure categories without obtaining a certification (recreational/advocational) is the fourth highest predictor, followed by those who provide high-school completion programs (10th highest predictor).

- Usual suspects are mostly missing: While we included the typical features to understand the dynamics of the educational technology (institutional size, Carnegie classification, etc.), our analysis shows that they are missing from the key drivers. The only usual suspects to appear are institutional size (3rd and 7th highest predictors) and the Carnegie undergraduate profile (9th highest predictor), which describes the undergraduate population concerning three characteristics: the proportion of undergraduate students who attend part- or full-time, background academic achievement characteristics of first-year, first-time students, and the proportion of entering students who transfer in from another institution.

Why do these findings matter? First, while our approach does not include user satisfaction—which we do not track—it gives us more insight into which other factors are key predictors of whether an institution will change its student information system. Rather than looking only at comparative functionality, we now have a deeper understanding of why leaders may decide to swap out their current SIS, such as if it does not support both credit and non-credit course offerings.

Summary

Reviewing products by functionality is often an easy way to go, as we adopt this strategy when buying phones, laptops, and tablets, for example. We rate the differences in functionality regarding whether a product meets our needs and then decide which product to purchase.

However, our analysis shows that this approach is not always correct. In the case of student information systems, for example, we can see that differences in educational offerings (credit vs. non-credit) play a more prominent role in decision-making, more so than institutional size. Therefore, we have to assume that leaders are looking to select products that best support their complex student bodies, a topic we have touched on in a post on SIS and continuing education and one on SIS and student personas.

We will apply this analysis at the product level in the future, such as which drivers best predict whether an institution will change a specific product. We look forward to sharing the outputs of this analysis in future posts.