Many vendors build their strategy around the idea that implementing same-vendor bundles is more valuable than combining products from various vendors. These vendors suggest bundling their products would help institutions overcome integration challenges, receive richer combined functionality, and lessen issues managing relationships with multiple vendors.

To some degree, this argument makes sense. As many smartphone owners know, pairing a smartphone with a tablet from the same vendor generally works better than mixing and matching a smartphone and a tablet from different companies.

Yet, do we know if institutional leaders are buying into the argument that implementing many products from one vendor is better than many from multiple vendors?

Our Findings

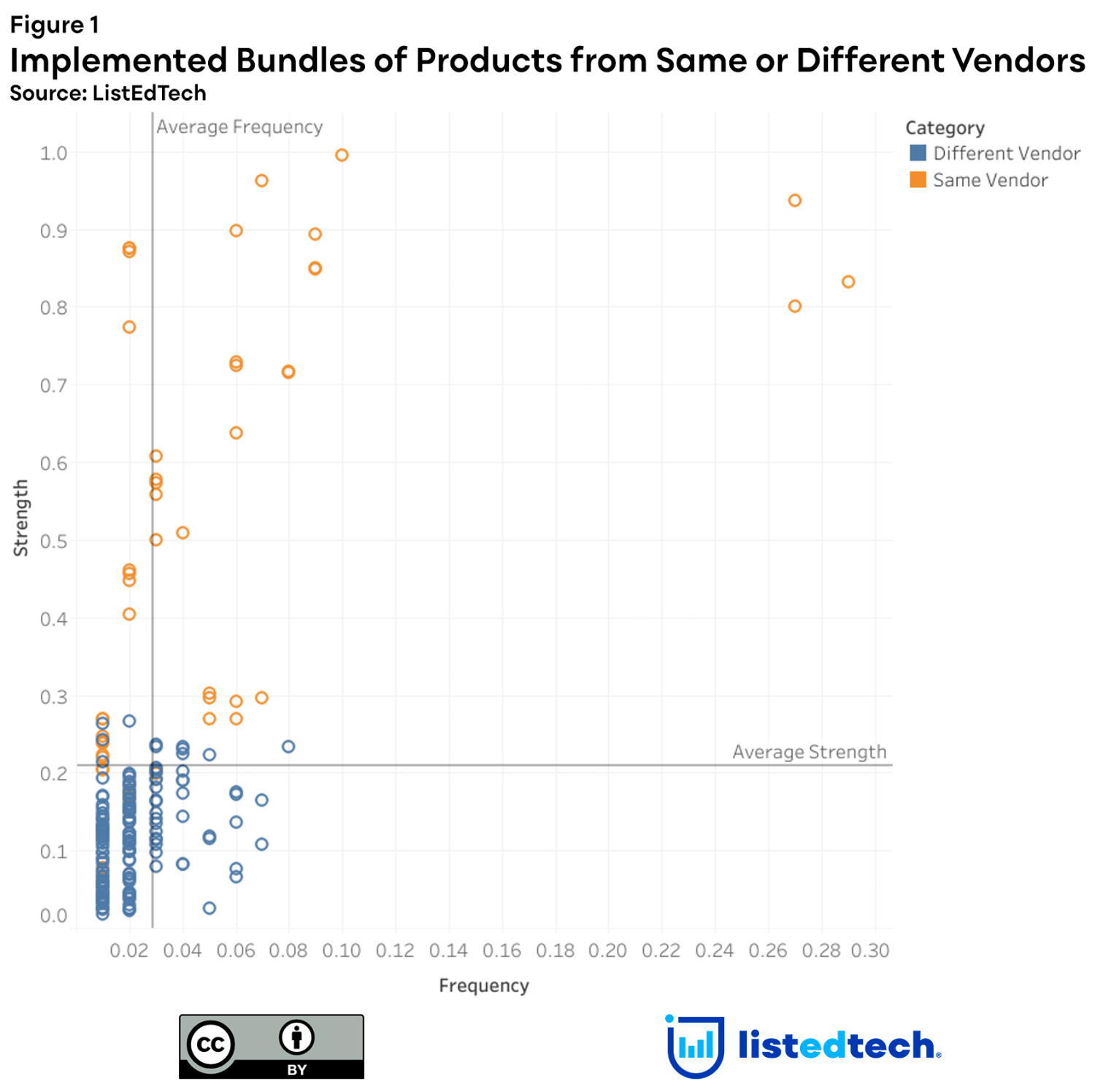

Using a method known as association rules, we analyzed our implementation data of higher education institutions in the United States to uncover how frequently product bundles appeared and the strength of the correlations of the products in the bundles. We then scaled the frequency and strength of the correlations on a zero-to-one scale for clarity. Lastly, we classified the bundles based on whether they consisted of products acquired from the same vendor or different vendors, focusing on those bundles that occurred in more than one percent of institutions.

Our analysis, shown in Figure 1 below, reveals three key takeaways:

- Mixed-vendor bundles are primarily below average: At first glance, it appears from Figure 1 that bundles of products from different vendors dominate the institutional landscape, suggesting that institutions are more likely to mix and match products. However, these bundles occur in much fewer institutional ecosystems and have a lower correlation than bundles from the same vendor. Only sixteen mixed-vendor bundles have a higher-than-average frequency and correlation strength, with Ellucian’s CRM Advance and Technolutions’ Slate occurring in eight percent of institutions and with a 23% correlation strength.

- Same-vendor bundles are primarily above average: Although the number of single-vendor bundles our analysis revealed is fewer than mixed-vendor bundles, they are more prevalent in institutional ecosystems and have a higher correlation than mixed-vendor bundles. For example, the pairing of Ellucian’s student information and financial systems occurs in twenty-nine percent of institutions. Likewise, Jenzabar’s financial and human resource systems nearly always occur together (99% correlation strength), followed by the pairing of Populi’s student information system and financial systems, with 96% correlation strength.

- Only some same-vendor bundles stand out: For vendors offering more than one product, the apparent goal is to have your products occurring together in many institutional ecosystems. Yet, our data indicates that only some bundles meet that goal, primarily financial and human resource systems. For example, the upper right of Figure 1 shows only three single-vendor bundles that are popular and closely bundled, i.e., Jenzabar’s financial and human resource systems, Oracle’s financial and human resource systems, and Ellucian’s financial and human resource systems.

Summary

So, it seems as if the answer to whether institutional leaders are buying into the argument that implementing many products from one vendor is better than many from multiple vendors is a qualified “yes.” Indeed, institutional leaders are populating their ecosystems with mixed-vendor bundles, but they are doing so less frequently than with same-vendor bundles. Likewise, vendors such as Jenzabar and Populi are succeeding in presenting a compelling picture to these leaders that the advantages of pairing their products outweigh any benefits of combining their products with those of other vendors.

Yet, despite the frequency and strength of correlation of same-vendor bundles, there are more mixed-vendor bundles than single-vendor ones, suggesting that these bundles remain a viable option for institutional leaders. Also, our findings indicate that many vendors still have a way to go in convincing leaders why they should combine one of their products with another.

Therefore, given the mixed success of vendors’ convincing the market that bundling their products is ideal, we suggest that these vendors pivot away from their strategy of implying that doing so helps institutions overcome integration challenges, receive richer combined functionality, and lessen issues managing relationships with multiple vendors. We suggest instead that these vendors design and position their products in terms of an ecosystem where the entire ecosystem is greater than the sum of its parts. This approach would help with vendor messaging but also help institutions consider how same-vendor bundles might help support institutional initiatives and cross-department processes (admissions and advising, for example). Our next post will cover how one company, Anthology, is trying to achieve this new ecosystem strategy based on conversations and presentations at its last conference.

We look forward to sharing this with you shortly.