Key Takeaways:

- Market Dynamics: The SIS HigherEd market is competitive, with Ellucian Banner leading at 24% market share, followed by Ellucian Colleague, Jenzabar, and Oracle PeopleSoft. Smaller systems are gaining traction in niche markets.

- Modernization and Adaptability: The market averages 100 new implementations annually, increasing to 150 with upgrades, as institutions prioritize modernization and strategic adaptability.

- Cloud Migration: Cloud adoption continues to reshape the SIS market. Most institutions are transitioning to cloud-based systems offered by their current providers showcasing a preference for vendor continuity and reliability.

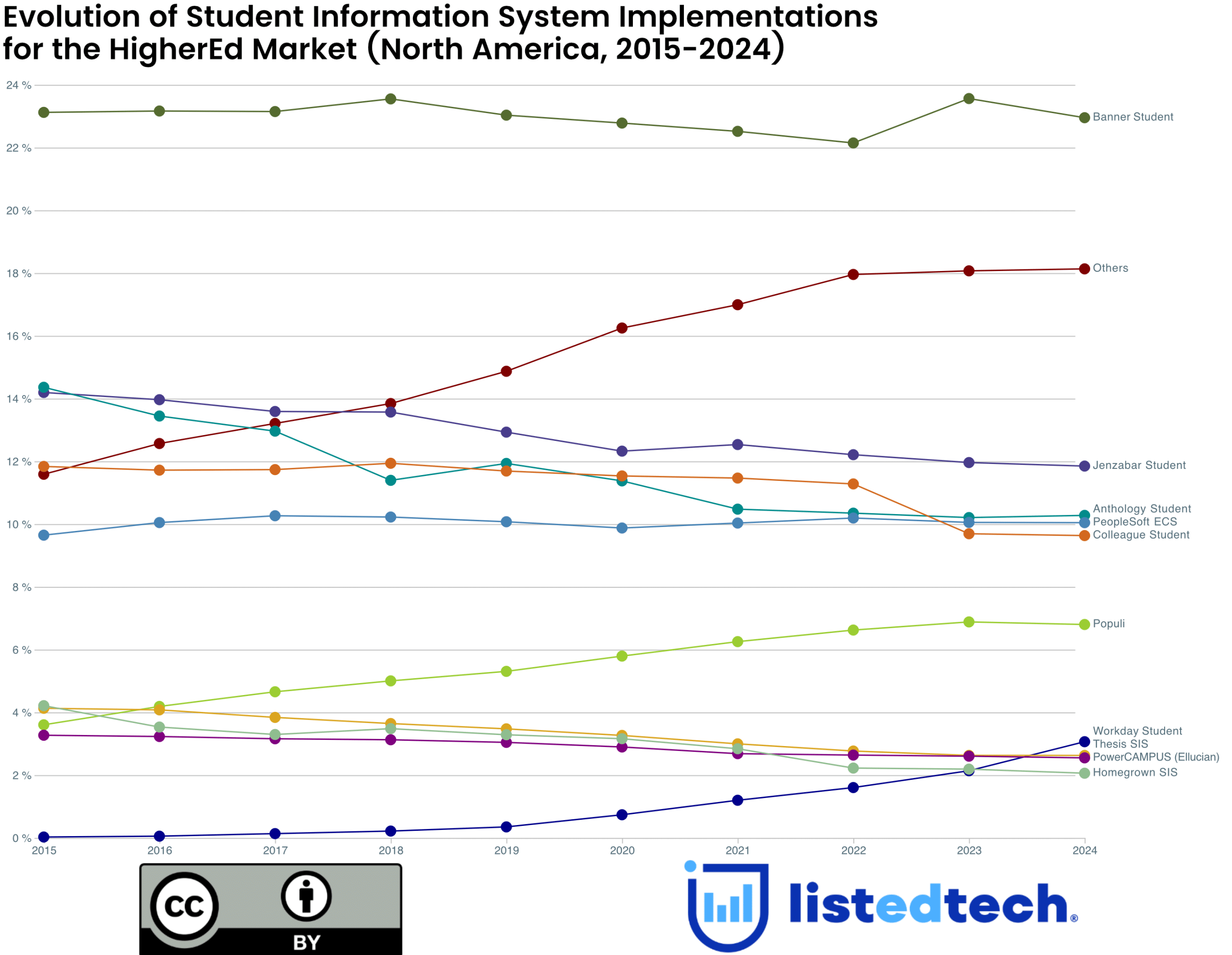

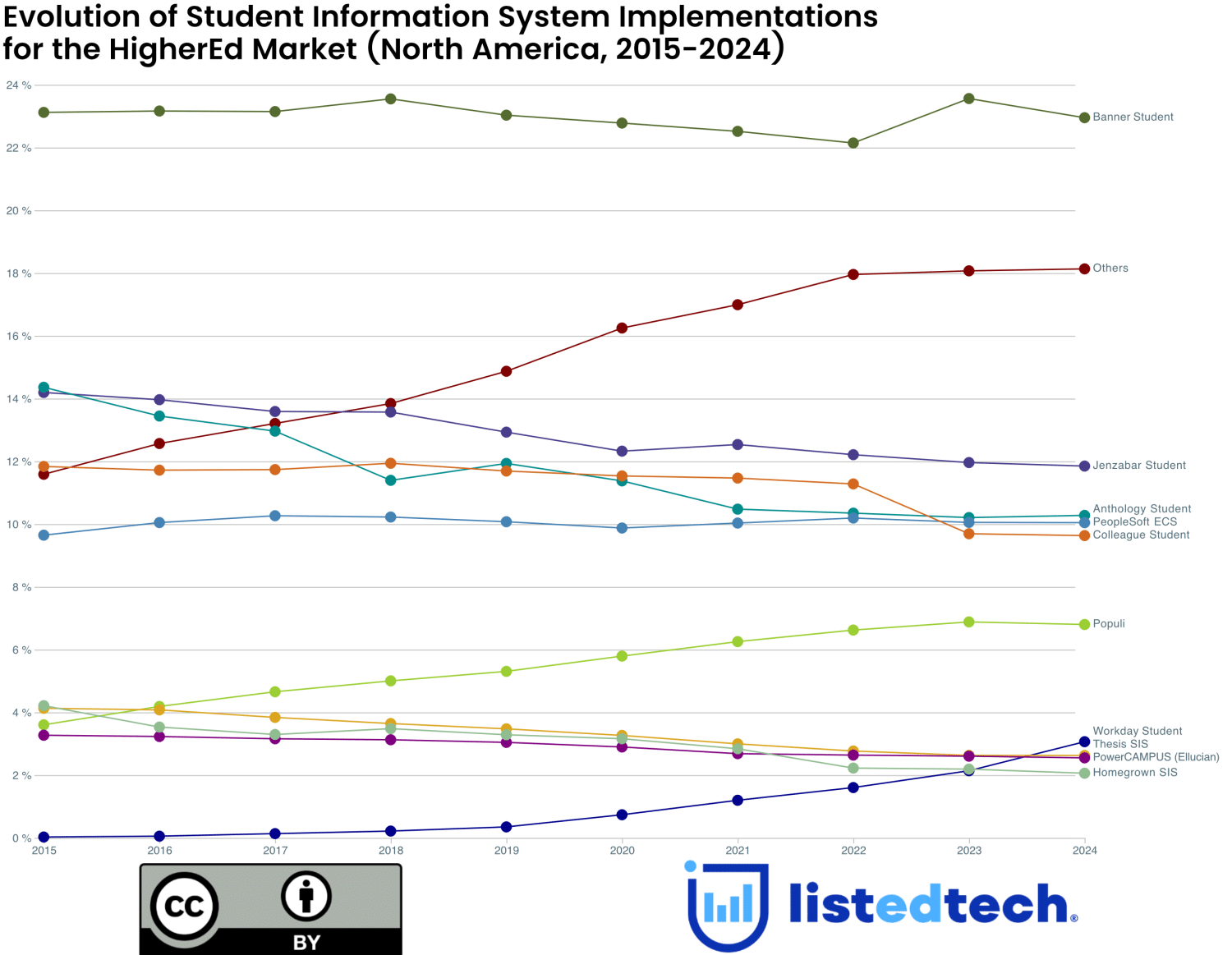

As the year 2025 just started, it’s the perfect time to revisit the dynamic landscape of the North American Student Information System market. Our last analysis in September 2023 highlighted emerging trends and notable shifts in the SIS HigherEd ecosystem. This update delves into how the market has evolved over the past sixteen months, showcasing key developments.

Market Share Overview

The North American SIS HigherEd market remains a competitive space. Here’s the latest snapshot of market share based on our latest data, reflecting growth patterns, challenges, and emerging leaders:

- Ellucian Banner (24%): Growth is driven by upgrades rather than new implementations, with migrations from Colleague and PowerCampus playing a key role.

- Ellucian Colleague (11%): Colleague retains its share but has seen some clients migrate to Banner.

- Jenzabar (11%): Experiencing a slow, steady decline in market share.

- Oracle PeopleSoft (10%): PeopleSoft’s share is constant despite delays in the cloud adoption.

- Anthology (10%): Anthology is maintaining its overall market share but is gaining traction among larger institutions.

- Populi (7%): Populi continues to grow its market share among smaller institutions, steadily increasing its presence in the overall market.

- Workday (3%): Workday remains a rising star, steadily increasing its market share by capturing clients, in order, from Banner, Colleague, PeopleSoft, Jenzabar, and homegrown systems.

- Smaller Systems (Others: ~2% each): Thesis, PowerCampus, Homegrown and Elevate hold smaller shares, but growth is coming from lesser-known systems like Campus Café, Blackbaud, VISA Campus Management, and Diamond SIS, which cater to niche markets and smaller institutions.

New Implementations and Upgrades

In the past two years, the market has averaged 100 new implementations annually. Including system upgrades, this figure rises to 150 changes per year, led by Ellucian and Jenzabar. This highlights the growing emphasis on modernization and strategic adaptability in a competitive landscape. Note: An upgrade refers to transitioning within the same product line, where an institution switches to another offering from the same company.

To the Cloud: A Dominant Trend for SIS HigherEd Market

Migration to the cloud continues to reshape the SIS landscape. Institutions are increasingly opting for cloud-based solutions, with leading providers like Ellucian, Anthology, and Oracle facilitating these transitions. Notably, most cloud adopters are sticking with their current SIS provider, reflecting a preference for continuity and vendor reliability.

Conclusion

The North American SIS HigherEd market continues to evolve, reflecting a dynamic balance between established leaders and emerging competitors. Institutions are increasingly prioritizing modernization through upgrades and cloud migrations, with providers like Ellucian, Anthology, and Oracle driving this transformation. Meanwhile, rising players such as Workday and niche systems like Campus Café are carving out their space, contributing to a diverse and competitive ecosystem. With an average of 150 system changes annually, the focus on scalability and adaptability ensures that this market will remain a critical area of innovation in higher education.

Note on our Data

Our North American HigherEd SIS market data includes 4,495 implementations across Canada and the USA.

Our portal offers more than just an historical market share. In addition to historical market shares, it showcases eight other charts, information on more than 80,000 institutions, 4,300+ products and 2,000 companies. Book a demo today to discover how ListEdTech’s data can help you make better-informed decisions.