Key Takeaways:

- Gartner’s SIS quadrant has a limited number of vendors that meet strict inclusion criteria, excluding several players.

- Cloud SIS adoption is progressing faster than Gartner’s 2030 projection, especially among smaller institutions.

- Explore ListEdTech‘s data portal plans for institutions and for industry.

Gartner’s latest Higher Ed SIS Magic Quadrant just dropped last week. It’s been a while since they’ve done one—maybe a decade? If you haven’t seen it yet, some vendors have purchased distribution rights, so you might be able to download it for free.

I always enjoy looking at magic quadrants. They’re iconic—instantly recognizable and always a great conversation starter. But you might be wondering: Why am I talking about Gartner? Aren’t they a competitor?

Not really. We approach things differently. In fact, this is a question we get a lot, so here’s a quick breakdown:

- ListEdTech (Bottom-Up): Actionable insights from 5.2M data points across 81K+ educational institutions.

- Gartner (Top-Down): A strategic, high-level approach focused on a select group of premium clients, primarily outside the education sector.

ListEdTech’s focus is on data-driven decision-making, while Gartner provides strategic IT guidance.

Breaking Down This Year’s Magic Quadrant

Now, back to the quadrant. It’s always fun to analyze:

- Who’s in the leader quadrant?

- Who’s a challenger, a niche player, or a visionary?

No major surprises in vendor placement. But what did surprise me was who’s missing.

Who Was Left Out—And Why?

Since Gartner isn’t a pay-to-play model, vendors must meet strict inclusion criteria to participate. In theory, if a company meets these criteria and has the time and resources, they can be included.

Summary of Gartner’s Inclusion Criteria:

Business Requirements:

✔ Revenue: $2M+ in SIS SaaS revenue & five new customers in the past year

✔ Sales: Must have been actively selling SIS SaaS since December 2023

✔ Go-to-Market: Must explicitly market and position SIS SaaS product

✔ Licensing: Subscription-based or metered pricing

Product Requirements:

✔ Distinct SKU: SIS SaaS must have a clearly identifiable product listing

✔ Core Capabilities: Must support:

- Enrollment Management (student records, registration, grades, degree audits)

- Student Accounts (tuition, billing, payments)

- Composable Architecture (integration with external platforms, modular design, data exchange capabilities)

These criteria explain why some vendors didn’t make the cut—either they didn’t meet all the business/product requirements or simply didn’t have the bandwidth to complete Gartner’s extensive questionnaire. Several vendors told me the time commitment alone was a major deterrent.

Who Made the List?

Included Vendors:

✅ Anthology

✅ Ellucian

✅ Jenzabar Inc.

✅ RIO Education

✅ Thesis

✅ Workday

✅ Apar Technologies

✅ Serosoft

Notable Absences

Potential candidates based on my interpretations of the inclusion criteria:

❌ Campus Café

❌ Drieam

❌ Informatique Education

❌ Jaguar Soft

❌ Oracle

❌ Orbund

❌ Populi

❌ Selma

❌ Silverband

❌ Simovative

❌ Tribal Group

Is Gartner’s Future Prediction Accurate?

One of the more interesting insights from Gartner’s report is their strategic planning assumption:

“By 2030, 25% of higher education institutions will have fully migrated to SaaS student information systems (SISs), with 75% at different stages of deployment.”

This is an important projection, but our data suggests that cloud adoption may already be further along—especially among smaller institutions.

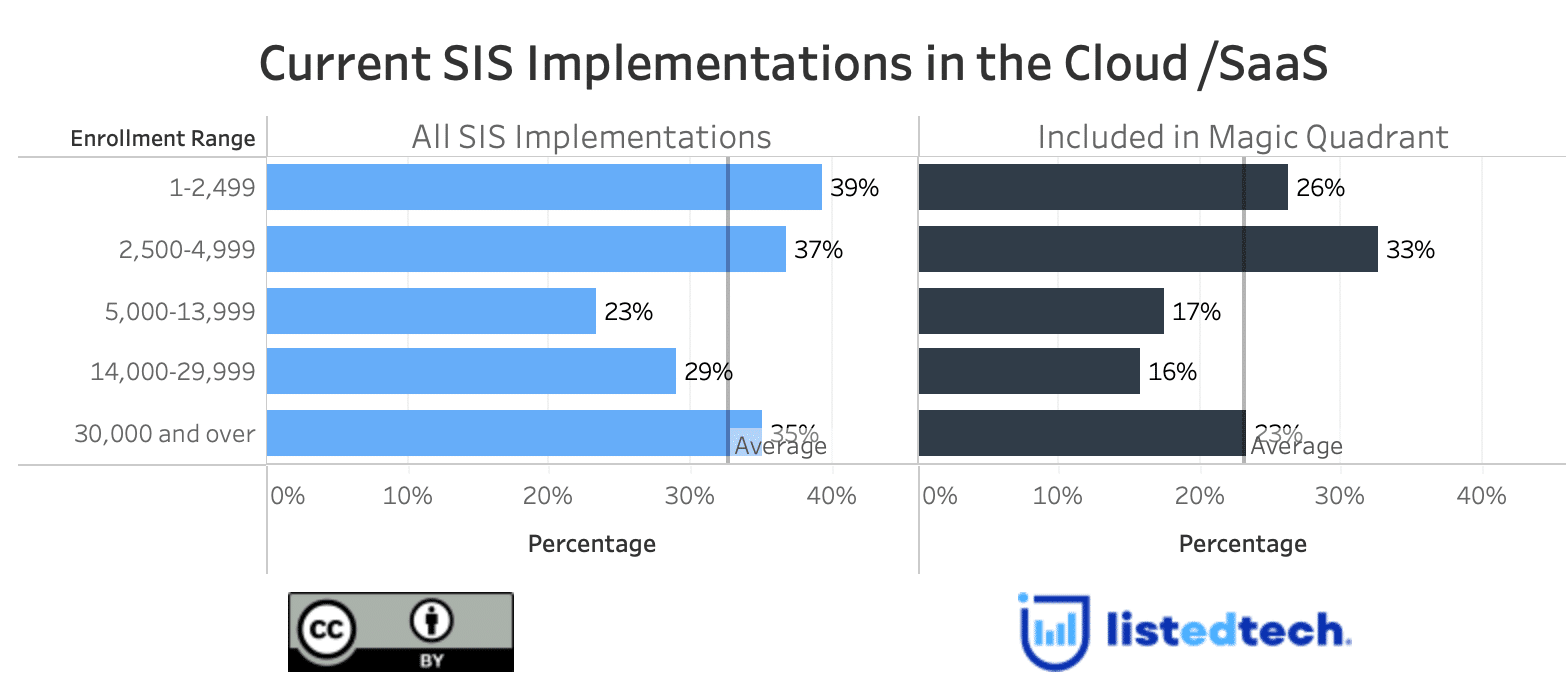

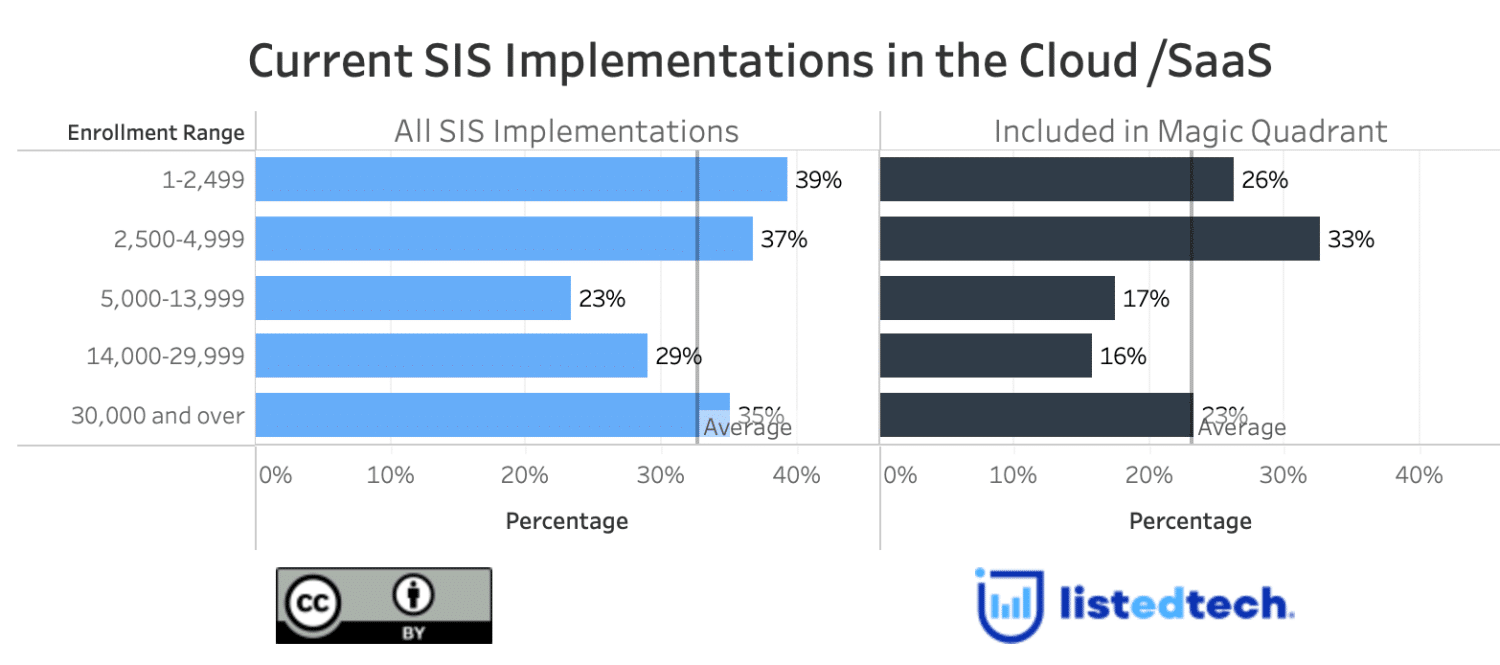

Take a look at the chart above:

- Across all institutions, 33% have already implemented a cloud-based SIS.

- Smaller institutions (under 5,000 students) are leading the shift, with adoption rates nearing 40%.

- Even larger institutions (30,000+ students) are moving to the cloud at a 35% rate.

However, when we look specifically at the vendors included in Gartner’s Magic Quadrant, the numbers are lower:

- The average cloud adoption rate among included vendors is 23%.

- This suggests that, while the quadrant focuses on key market players, it may not fully reflect the broader SIS landscape, where smaller and more agile providers are driving cloud adoption at a faster pace.

📌 Important Note:

There is a key distinction between cloud-based SIS and SaaS SIS. Gartner’s report specifically refers to full SaaS migration, meaning multi-tenant solutions where institutions no longer manage infrastructure. Our data reflects broader cloud adoption, which can include single-tenant hosted solutions, hybrid models, and full SaaS offerings. While these numbers don’t align perfectly, they still indicate that institutions are moving to the cloud faster than the quadrant’s SaaS-only lens might suggest.

What This Means for Institutions

Gartner’s insights remain valuable, especially for understanding larger, well-established vendors and industry trends at a high level. At the same time, our data highlights how many institutions—particularly smaller ones—are adopting cloud solutions at a faster pace than the quadrant might indicate.