Key Takeaways

- Multiple vendors, one stack: Institutions often rely on multiple payment solutions — most use a layered mix of tools.

- SIS/ERP integration is a challenge: Many vendors excel at front-end and processing, but integration with SIS/ERP is far less common.

- International payments vary widely: Only a small subset of vendors support robust international payment capabilities.

Some contextual notes:

At Ellucian Live earlier this year, I took the opportunity to walk the exhibit hall and ask questions—lots of them. The education payments market is big, complicated, and full of nuance. While we have a wealth of data at ListEdTech, each conversation I have reminds me how much more there is to learn.

One of my longer (and more enlightening) stops was at the TouchNet kiosk. A big thank-you to their team for their patience and willingness to walk me through the layers of this space.

Based on those conversations and our internal research, here are some notes and a functional breakdown of the vendors in this market.

This is a product category we plan to add to our portal this year.

Five Core Sections to Describe Payment Solutions

When it comes to payment systems in education, most people think of a single “tuition payment portal.” But dig deeper, and you’ll find a layered stack of tools and vendors handling everything from the user interface to international money transfers.

At ListEdTech, we’ve mapped thousands of implementations across Higher Ed and K–12, and one trend stands out: institutions rarely rely on just one vendor. Instead, they stitch together multiple tools — often with overlapping functionality — to manage the full payment lifecycle.

To make sense of this ecosystem, we broke the payment stack into five core sections:

1. Student Payment Experience (Front-End Interface)

This is the visible part: where students or parents go to see their bill and make a payment.

Key functions:

- Online portals for tuition, housing, parking, etc.

- Mobile-friendly interfaces

- Payment plan setup

- eBilling and notifications

Common vendors:

- Flywire, Nelnet Campus Commerce and Transact Campus (in HigherEd)

- FACTS, My School Bucks and RevTrak (in K–12)

2. Payment Processing (Gateway & Merchant Services)

Once a student clicks “Pay,” another system takes over to process the transaction securely.

Key functions:

- Handling credit card, ACH, and digital wallet payments

- PCI compliance and fraud protection

- Payment authorization and settlement

- Refunds and chargebacks

Common vendors:

- Campus Commerce, CASHNet’s and Flywire (in HigherEd)

- FACTS, PayPal and RevTrak (in K–12)

3. Back-End Integration with SIS/ERP

Every payment needs to tie back to a student record — and to the institution’s general ledger.

Key functions:

- Posting payments to the correct student account

- Syncing with SIS and ERP platforms

- Reconciling accounts receivable

- Automating financial holds and releases

Common vendors:

- CASHNet, TouchNet and Transact Payments (in HigherEd)

- Blackbaud, FACTS and SchoolCash (in K–12)

4. Billing & Invoicing

Before students pay, they need to know what they owe. This is where billing systems come in.

Key functions:

- Generating and sending tuition and fee statements

- Applying late fees or discounts

- Managing custom payment plans

- Sending payment reminders

Common vendors:

- Campus Commerce, Nelnet Business Solutions and Transact Campus (in HigherEd)

- FACTS, My School Bucks and RevTrak (in K–12)

5. International Payments & Currency Conversion

For global institutions, cross-border payments introduce complexity around currency, regulation, and speed.

Key functions:

- Supporting multiple currencies

- Local banking options for families abroad

- Regulatory compliance (e.g., OFAC, AML)

- Real-time exchange rates

Common vendors:

- Flywire, PayMyTuition and PayPal (in HigherEd)

- Flywire, PayPal and Stripe (in K12)

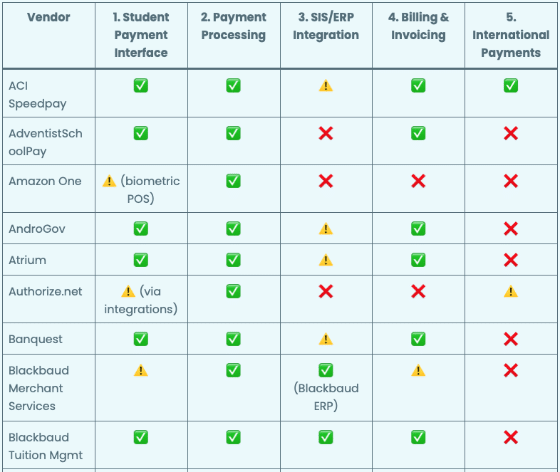

Payment Vendor Functional Matrix

- ✅: Fully supported by the solution

- ⚠️: Functionality is possible, but work/preparation is needed

- ❌: Not supported by the solution

| Vendor | 1. Student Payment Interface | 2. Payment Processing | 3. SIS/ERP Integration | 4. Billing & Invoicing | 5. International Payments |

|---|---|---|---|---|---|

| ACI Speedpay | ✅ | ✅ | ⚠️ | ✅ | ✅ |

| AdventistSchoolPay | ✅ | ✅ | ❌ | ✅ | ❌ |

| Amazon One | ⚠️ (biometric POS) | ✅ | ❌ | ❌ | ❌ |

| AndroGov | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Atrium | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Authorize.net | ⚠️ (via integrations) | ✅ | ❌ | ❌ | ⚠️ |

| Banquest | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Blackbaud Merchant Services | ⚠️ | ✅ | ✅ (Blackbaud ERP) | ⚠️ | ❌ |

| Blackbaud Tuition Mgmt | ✅ | ✅ | ✅ | ✅ | ❌ |

| Bookware | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Campus Commerce (Nelnet) | ✅ | ✅ | ✅ | ✅ | ❌ |

| CardConnect Payment | ⚠️ | ✅ | ⚠️ | ❌ | ❌ |

| CASHNet Dept. Deposits | ❌ (admin focus) | ✅ | ✅ | ❌ | ❌ |

| CeloPay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Clover | ⚠️ (POS focus) | ✅ | ❌ | ❌ | ❌ |

| CollectorSolutions | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Conext Pay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Converge Payments | ✅ | ✅ | ⚠️ | ❌ | ⚠️ |

| CORE Revenue Mgmt | ✅ | ✅ | ✅ | ✅ | ❌ |

| Cornerstone Payment | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Coupa Pay | ❌ | ✅ (AP focus) | ✅ | ❌ | ✅ |

| Diamond Mind | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Dragonpay | ✅ | ✅ | ⚠️ | ✅ | ✅ (Philippines focus) |

| e~Funds for Schools | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Edutrak | ✅ | ✅ | ✅ | ✅ | ❌ |

| ElectPay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Eleyo Platform | ✅ | ✅ | ✅ | ✅ | ❌ |

| EZSchoolPay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| FACTS Tuition Payment | ✅ | ✅ | ✅ | ✅ | ❌ |

| Fine Payment | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| First Data Gateway | ⚠️ | ✅ | ❌ | ❌ | ⚠️ |

| Flywire | ✅ | ✅ | ⚠️ | ❌ | ✅ |

| Heartland Payments+ | ✅ | ✅ | ⚠️ | ✅ | ⚠️ |

| Helcim | ✅ | ✅ | ❌ | ❌ | ⚠️ |

| Homegrown Solution | ⚠️ | ⚠️ | ⚠️ | ⚠️ | ❌ |

| Hubspot Payments | ⚠️ (non-edu focused) | ✅ | ❌ | ❌ | ⚠️ |

| IATS Payments | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Infinite Campus – Campus Payments | ✅ | ✅ | ✅ (native) | ✅ | ❌ |

| IntelleCheck | ❌ | ❌ | ✅ (prints ERP checks) | ❌ | ❌ |

| IntelliPay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| InTouch Receipting Suite | ✅ | ✅ | ✅ | ✅ | ❌ |

| Jaggaer AP Director | ❌ | ✅ (AP focus) | ✅ | ❌ | ❌ |

| Laserfiche Cloud | ❌ | ❌ | ⚠️ (records only) | ❌ | ❌ |

| LINQ Connect | ✅ | ✅ | ✅ | ✅ | ❌ |

| My School Bucks | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| MyPaymentsPlus | ✅ | ✅ | ✅ | ✅ | ❌ |

| MySchoolApps | ✅ (meal apps only) | ❌ | ✅ | ⚠️ | ❌ |

| MySchoolWallet | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| NatPay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Nelnet Quickpay | ✅ | ✅ | ✅ | ✅ | ❌ |

| NMI Payments (USAePay) | ⚠️ | ✅ | ❌ | ❌ | ⚠️ |

| Nutrislice | ✅ (meal ordering) | ⚠️ | ⚠️ | ✅ | ❌ |

| OSP by Edlio | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| ParentSquare Pay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Paycom Solution | ❌ | ✅ (HR/payroll) | ✅ | ❌ | ❌ |

| Paymentus | ✅ | ✅ | ⚠️ | ✅ | ✅ |

| PayMyTuition | ✅ | ✅ | ⚠️ | ❌ | ✅ |

| PayPal | ⚠️ (via plugins) | ✅ | ❌ | ❌ | ✅ |

| PaySchools Central | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| PaySimple Solutions | ✅ | ✅ | ⚠️ | ✅ | ⚠️ |

| PayTrace | ⚠️ | ✅ | ❌ | ❌ | ⚠️ |

| Procare Billing | ✅ | ✅ | ✅ (childcare SIS) | ✅ | ❌ |

| ProfitStars | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| PushCoin | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| RevoPay ePayments | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| RevTrak | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| RYCOR Solutions | ✅ | ✅ | ✅ | ✅ | ❌ |

| SchoolCash | ✅ | ✅ | ✅ | ✅ | ❌ |

| SchoolPay | ✅ | ✅ | ✅ | ✅ | ❌ |

| Simple Tuition Solutions | ✅ | ✅ | ✅ | ✅ | ❌ |

| SPS EZpay | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Square | ⚠️ | ✅ | ❌ | ❌ | ⚠️ |

| Stripe | ⚠️ | ✅ | ❌ | ❌ | ✅ |

| TechnologyOne ERP Cash Receipting | ✅ | ✅ | ✅ (TechOne ERP) | ✅ | ❌ |

| ThryvPay | ✅ | ✅ | ❌ | ❌ | ❌ |

| TITAN by LINQ | ✅ | ✅ | ✅ | ✅ | ❌ |

| TouchNet | ✅ | ✅ | ✅ | ✅ | ⚠️ (via Flywire etc.) |

| Transact Payments | ✅ | ✅ | ✅ | ✅ | ⚠️ |

| UP Bill Payment | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Vanco Payment Solutions | ✅ | ✅ | ⚠️ | ✅ | ❌ |

| Visa Spend Clarity | ❌ | ✅ | ❌ | ❌ | ⚠️ |

| WisePay | ✅ | ✅ | ⚠️ | ✅ | ✅ (UK/international) |

| WPM Education Platform | ✅ | ✅ | ⚠️ | ✅ | ✅ (UK focus) |

| Xpress-pay | ✅ | ✅ | ⚠️ | ✅ | ⚠️ |

Bonus Insight from Our Data

In our portal, you’ll find detailed market share insights by region, sector, and institution size. For example:

- Flywire is implemented in more than 30% institutions globally.

- In the North American K–12 space, FACTS and PayPal each have over 20% of market share.

Conclusion

Understanding the education payment stack isn’t just about knowing who handles tuition. It’s about recognizing how different tools — often from different vendors — come together to support both institutional operations and the student experience.

Want to explore who’s using what? Access our portal or get in touch for a custom data pull.