We think it’s time for another update on the student information systems used in the K-12 submarket. We published our initial post on K-12 student information system historical implementations in April 2020 and did an update in July 2021, then in October 2022. Let’s dig once again into the SIS used in K-12 to ensure you (subscribers and portal users) have access to the most recent data.

Since our last update in October 2022, we have added SIS data on almost 2,500 school districts. The majority of these school districts are smaller private school districts with total enrolments under 500. When we launched our coverage of K-12 in 2018, we aimed to get the most accurate portrayal of the public school districts. Over time, we knew we had to look at the private school districts to better represent the current market. Combining the public and private school boards, we now have SIS data on over 17,000 school districts in the USA and Canada.

Current K-12 SIS Market Share

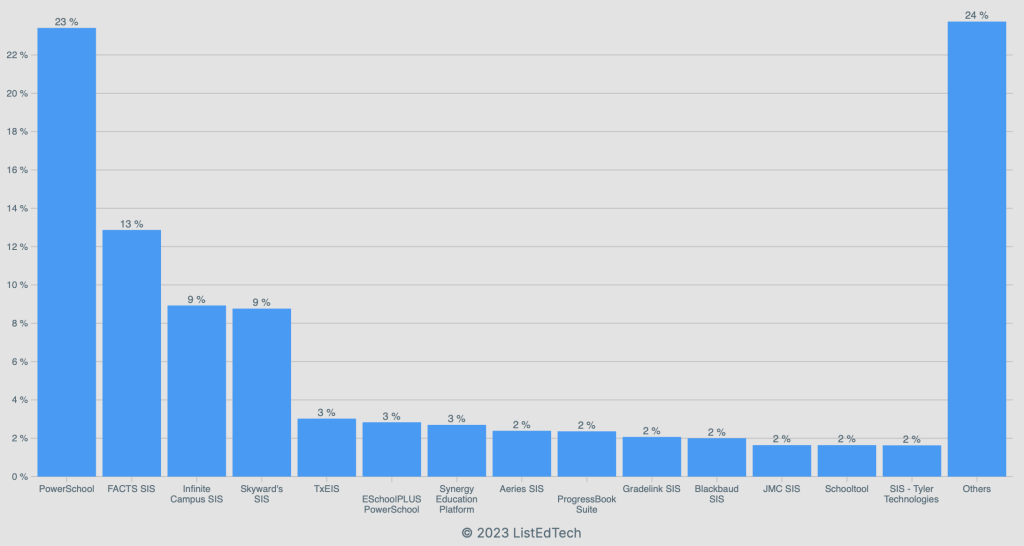

Adding more school districts means having a greater range of SIS solutions. As of October 2023, PowerSchool led the product category with 23%, followed by FACTS SIS (13%), and Infinite Campus (9%). This year, we see that the longtail of solutions is even longer. Since October 2022, FACTS SIS gained 3%, becoming the second most implemented SIS for school districts.

This solution was under the radar for a few years. As mentioned earlier, we explain this situation because of the clientele that use FACTS: private school districts. Within this group, institutions choose FACTS SIS over 40% of the time. Please note that we are still adding data daily. Therefore, the market share may fluctuate.

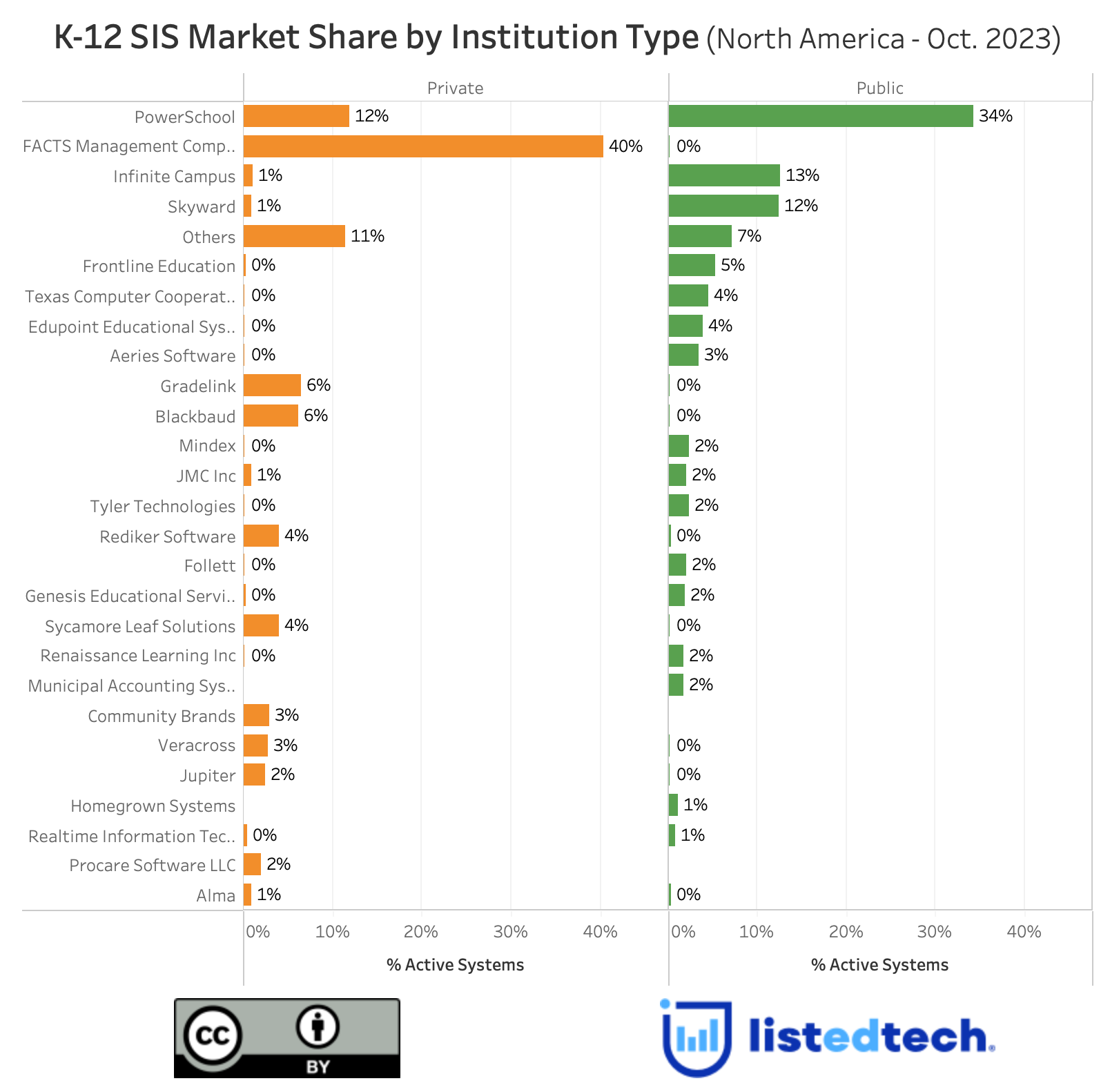

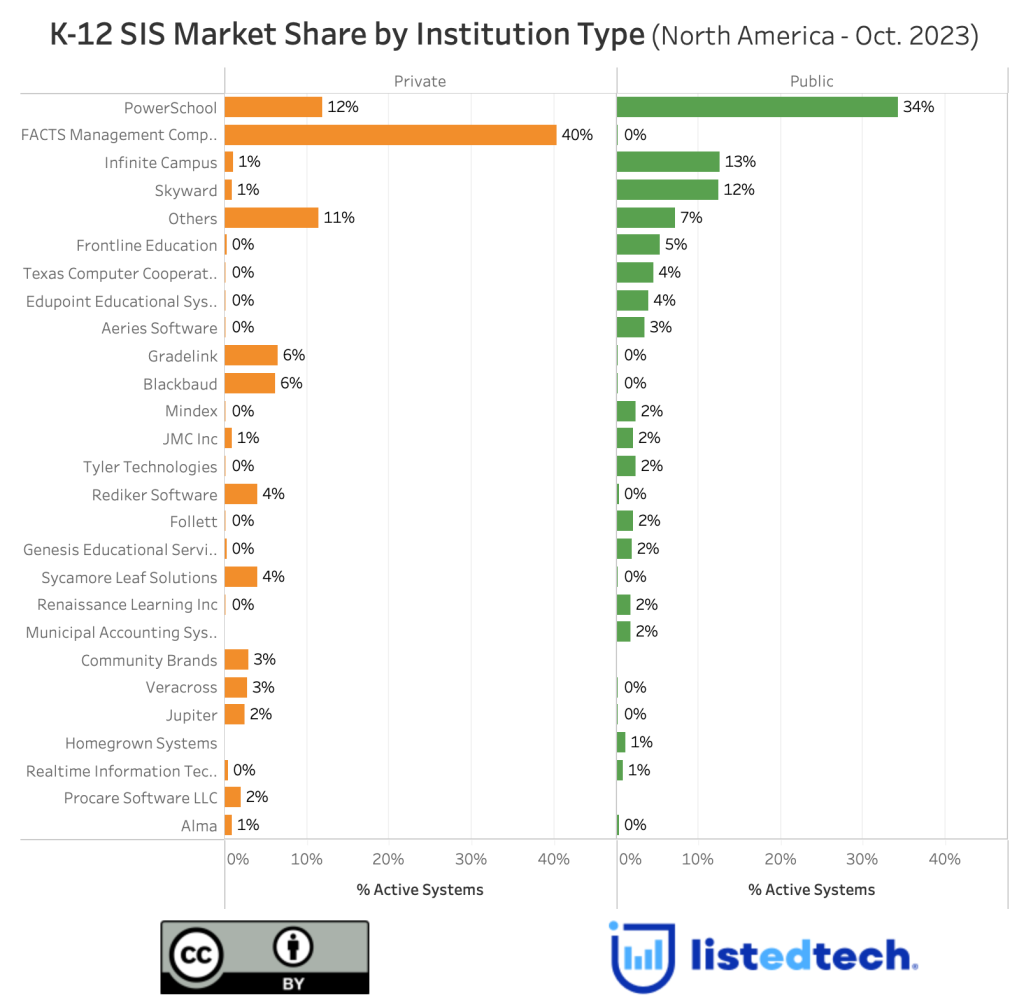

The difference in product selection between private and public school districts is astonishing. Except for a few products, the only system with a considerable market share that is used in both school district types is PowerSchool.

Historical Market Share (2014-2023)

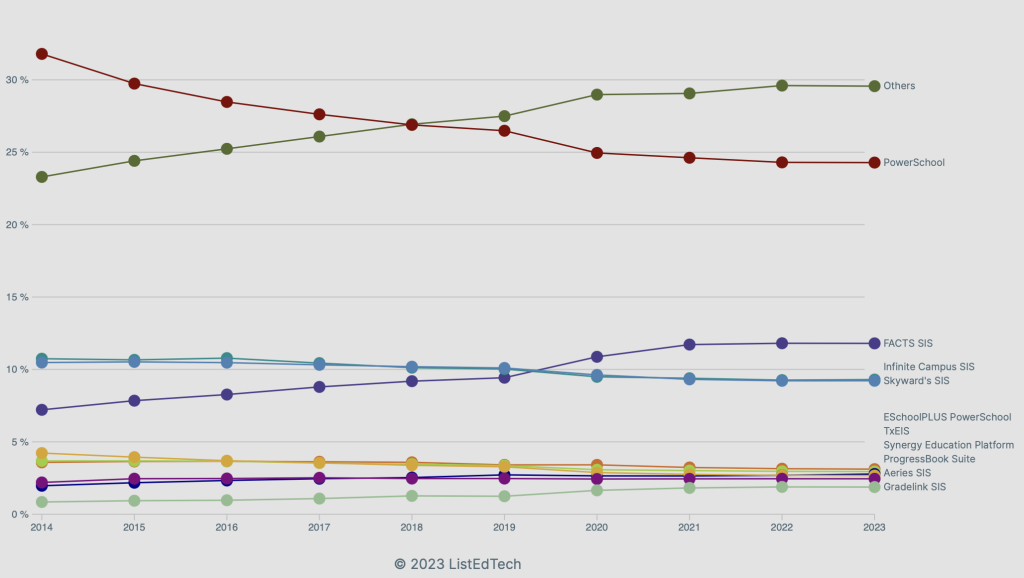

The historical implementations graph shows that PowerSchool’s new implementations have slowed down in the past ten years. It is not the only solution however that has seen fewer new implementations. Since 2014, most solutions have seen a slow but steady decrease in new implementations except for FACTS, Aspen (an impact of the Government of Ontario announcement), and Gradelink SIS. When we look at the number of new implementations yearly, the K-12 market slowed down from 2015 until 2019. If it weren’t for the COVID-19 effect, we would see little to no variation.

The K-12 SIS market is historically considered a very stable market due to market shares being roughly the same over the years. However, in the past 2-3 years, we noticed a shift in some solutions, as previously mentioned. We will continue to monitor the implemented solutions in public versus private schools as this may be a trend.

Note: Every week, we continue to add new school districts and SIS implementations to our database. We continue to work towards having the most representative market shares. As of October 2023, we are still missing several thousand school districts, mostly private, with very small enrollment.