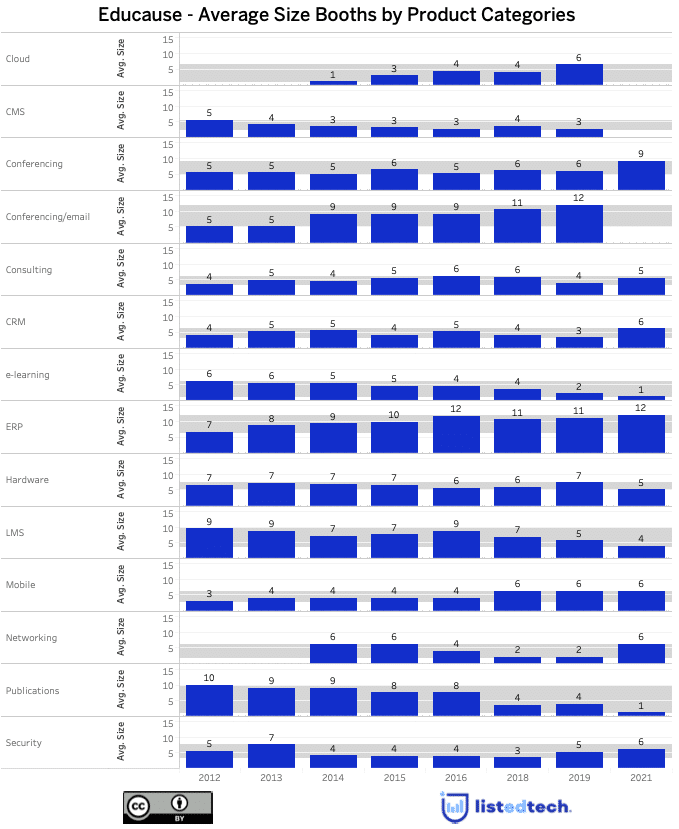

Educause annual conference is around the corner. As its website mentions, “this event showcases the best thinking in higher education IT.” A few weeks back, I questioned myself about the Educause conference and its exhibitor floor plan. More precisely, I wondered if the booths were a good indicator of market trends? I decided to dig into the question.

Methodology

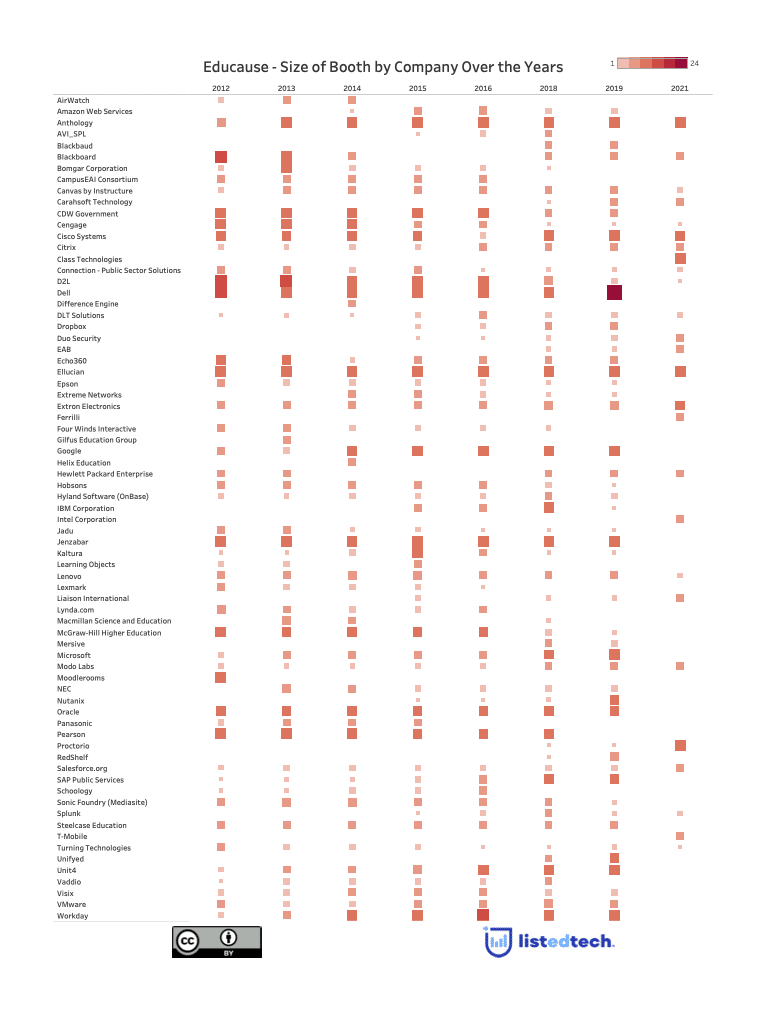

I first retrieved all floor plans and exhibitors’ lists since 2012 (except for 2017 and 2020). I then looked at all the bigger booths and listed them. I consider a big booth covering six squares or more on the floor plan (the smallest possible booth is one square). Refer to the table below to understand the most common area size used on the floor plan. The numbers in italics are the big exhibitors.

| Numbers of squares | Area Size | Number of squares | Area Size |

| 1 | 100 sq. ft. | 8 | 800 sq. ft. |

| 2 | 200 sq. ft. | 9 | 900 sq. ft. |

| 4 | 400 sq. ft. | 12 | 1,200 sq. ft. |

| 6 | 600 sq. ft. | 15 | 1,500 sq. ft. |

As previously mentioned, the year 2017 was not retrievable, and I decided not to include 2020 in this analysis because the conference was 100% virtual, making things harder to compare. After adding each company as a big exhibitor during the analysis period, I checked all editions of the annual conference to see if it also had smaller booths. These additions explain why you will see smaller numbers for some companies. However, if a company had only bought small kiosks (1, 2 or 4 squares) over the years, it would not appear in our graphs and tables.

Let’s add an important note before going into the analysis. Although the in-person sessions and the exhibitors’ hall are back, the conference’s virtual component will still represent the majority of the attendees. Also, some companies have put corporate policies related to COVID-19 and have decided to refrain from participating in face-to-face conferences and fairs. For these reasons, the usual in-person attendance of 5,000 participants may be as low as 1,000 for the 2021 annual conference. This potential low attendance and the pandemic that continues to impact us may explain why the floor plan for this year is a bit off compared to the other years.

General Findings

- Between 2012 and 2021, 73 different companies selected a big booth to promote their products or services. The year with the most considerable number of big booths was 2018, with 34 booths. In 2021, the floor layout only showcases 18 booths with six squares or more, the smallest number of big exhibitors since 2012.

- The higher education IT sector is very volatile when it comes to selecting big booths at the Educause annual conference. Between 2012 and 2021, 30 exhibitors bought a bigger booth (6-square and more) only once. We can name AVI_SPL, Difference Engine, Gilfus Education Group, Helix Education, Learning Objects, Mersive, Nutanix, Perceptive Software and Vaddio. Most of these companies are not the top vendors of their product categories and probably did not have the breakthrough expected from attending Educause annual conference.

- Over the years, Educause hosted some gigantic booths for special occasions. In 2019, Dell had an e-sports booth of 12 squares in addition to its regular 12-square booth. Workday, in 2016, offered a 4-square golf course on top of the 12-square standard booth. These oversized representations remain anecdotal.

- Except for 2021, the average size of big booths varies between 8.1 and 8.9. For this year’s event, the average booth size is 6.6.

- Since 2012, very few companies have been present as big exhibitors each year. We only count three: Anthology (avg size of 11.5), Ellucian (avg size of 12) and Extron Electronics (avg size of 6.9). For instance, other companies (Lenovo, for example) were present for the whole period of our analysis but selected at some point a smaller booth. Keeping Lenovo as an example, it only has a 2-square booth for the 2021 event.

The Presence of Specific Product Categories

Looking at the graph, we can see that some product categories disappeared over the years while others took bigger booths. Please note that a product category must have more than one company selecting a big kiosk during the analysis period to be included in this graph. For this reason, you won’t see Business Intelligence, Furniture or Proctoring in the product category graph.

- The publishing industry, once vital to higher education, no longer appears as big booths. McGraw-Hill Higher Education, Pearson and Cengage Learning were all 12-square booths or 9-square booths in 2012, 2013, 2014. In 2021, Cengage Learning is a 1-square kiosk, and the two other companies completely vanished from the floor plan.

- The hardware industry is another example of the transformation of the higher education IT sector. When comparing the floor plans from 2012 to 2021, we know that computer labs take less and less space on higher education campuses as students bring their laptops. Universities and colleges no longer need to invest massive chunks of their budget in server rooms as cloud solutions are evolving into the preferred implementation choice. In 2012 and 2013, five hardware companies were among the big booths. In 2014 and 2015, their numbers dropped to four. In 2021, only two hardware companies are still part of the prominent exhibitors: Hewlett Packard Enterprise and Intel. Lenovo, which was a major exhibitor since 2012, opted for a 2-square booth this year. Dell, with two 12-square booths in 2019, completely disappears for the 2021 edition.

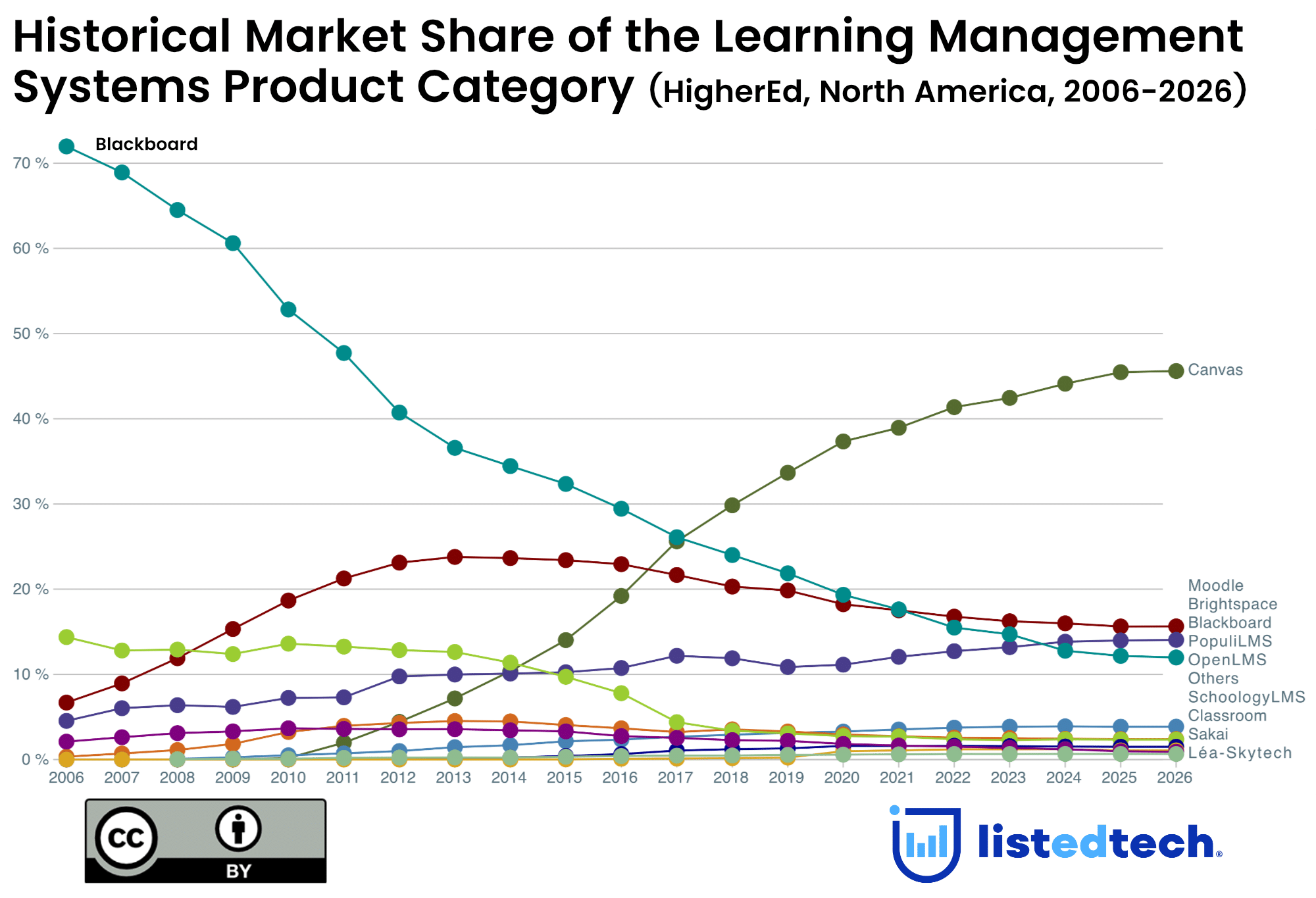

- Like the SIS market, the LMS market is almost saturated, especially in the Higher Education submarket. Therefore, the business approach has evolved since the early 2010s. The most probing proof of this situation is the presence of Desire2Learn/D2L at the Educause annual conference. In 2012 and 2013, the company spread its booth across 15 squares (the biggest available at the time). Since these editions, D2L reduced its booth size: 15 to 12 to 8 to only 1 in 2021.

- The ERP product category is the most stable. Anthology (previously advertised as Campus Management at Educause) and Ellucian have had two oversized booths since 2012. Jenzabar, which used to have a 12-square booth until 2019, decided not to be an exhibitor this year. The same goes for Unit4, which bought 6-square in 2013 and 2014, 8-square in 2015 and 12-square in 2016, 2018 and 2019, but is absent in 2021. The reason for the disappearance of Unit4 from the 2021 floor plan is probably related to the separating of the SIS business and the launch of Thesis.

| Group | Company | ||

|---|---|---|---|

| Cloud | Amazon Web Services | Dropbox | Nutanix |

| CMS | Hyland Software (OnBase) | Jadu | |

| Conferencing | AVI_SPL | Cisco Systems | Citrix |

| Class Technologies | Echo360 | Kaltura | |

| Mersive | |||

| Conferencing/email | Microsoft | ||

| Consulting | CampusEAI Consortium | Carahsoft Technology | Difference Engine |

| DLT Solutions | Ferrilli | Gilfus Education Group | |

| IBM Corporation | |||

| CRM | Blackbaud | Helix Education | Hobsons |

| Liaison International | Salesforce.org | ||

| e-learning | Learning Objects | Lynda.com | Sonic Foundry (Mediasite) |

| Turning Technologies | |||

| ERP | Anthology | Ellucian | Jenzabar |

| Oracle | SAP Public Services | Unifyed | |

| Unit4 | Workday | ||

| Hardware | CDW Government | Connection – Public Sector Solutions | Dell |

| Epson | Extron Electronics | Hewlett Packard Enterprise | |

| Intel Corporation | Lenovo | Lexmark (Perceptive before 2015) | |

| NEC | Panasonic | Vaddio | |

| LMS | Blackboard | Instructure | D2L |

| Moodlerooms | Schoology | ||

| Mobile | AirWatch | Modo Labs | |

| Networking | Extreme Networks | T-Mobile | |

| Publications | Cengage | Macmillan Science and Education | McGraw-Hill Higher Education |

| Pearson | RedShelf | Visix | |

| Security | Bomgar Corporation | Duo Security | Four Winds Interactive |

| VMware | |||

How Acquisitions and Financial Struggles Impact the Floor Plan

The more I examine the Educause floor plan data, the more I notice that the company economic cycle impacts the annual conference. Some companies appear or disappear following a merger or an acquisition.

- AirWatch, after its acquisition by VMware in 2014, disappeared from the floor plan. VMware continued to be a prominent exhibitor until 2019.

- The significant drop in sizes (from 12-squares in 2012 to 1-square in 2021) for Cengage booths can be explained by two events. In 2013, the company filed for Chapter 11 bankruptcy. Following its restructuring in 2014 and 2015, the company now focuses more on online learning solutions.

- Dropbox was present in 2018 and 2019 with a 6-square booth each year. In 2021, the company is not part of the exhibitors’ list. We could explain this situation by the workforce reduction that occurred in January 2021.

- With the recent purchase of some of Hobsons’ products, EAB entered the big exhibitors’ group in 2021 with a 6-square booth. In 2019 and 2018, it occupied a 2-square kiosk and was absent in 2016.

- Since 2012, Echo360 has always been a prominent exhibitor, except in 2014 when the company selected a small 2-square booth. Nothing can explain this situation, especially since the company announced in November 2014 an $18M venture capital investment. Note that for the 2021 edition, the company has not returned to the Educause floor.

- Except for 2021, Hobsons has been on the exhibitors’ floor of Educause since 2012. Between 2012 and 2016, it bought a 6-square kiosk. In 2018, it decided to downsize to a 4-square and a 1-square in 2019. With its recent purchase by PowerSchool and EAB, the company is no longer active.

- Hewlett Packard Enterprise has been present on and off on the Educause exhibitors’ floor plan. From 2012 to 2021, when it decided to buy a booth, it always went with the 6-square kiosk. Between the years 2014 and 2016, HP did not purchase any booths at the Educause annual conference. I have found that HP proceeded with massive job cuts between 2012 and 2014 that followed critical security vulnerability and hacking attacks.

- Microsoft, with its many products targeting the higher education sector, has been at Educause since 2012. While it offered its Office suite, including Outlook, it was rather timid with a 6-square kiosk. More recently, it has grown its kiosk to reach 12 squares in 2019. It’s surprising that Microsoft is not an exhibitor in 2021 despite its major success with Teams during the pandemic. It was even a bigger shock as Educause advertised Microsoft as a primary sponsor and exhibitor until September 2021.

- A positive impact of the pandemic is the presence of Proctorio, a proctor platform that helps keep integrity while teaching at a distance. For the 2021 edition, the company has bought a 12-square kiosk. Before the current edition, it purchased a 1-square stall in 2019 and was part of the start-up alley in 2018.

Based on these eight years of data, I can say that the Educause floor plan is unsurprisingly linked with the market trends. We have noticed that when misfortune hits a company, the following Educause annual conference is somewhat impacted. The only edition that does not strictly follow this rule is the current edition. Conferencing systems were essential to distance education in the past 18-month. However, companies in this category have limited their investments in the Educause annual conference and did not increase their kiosk’s area size. The only exception to this awkward year is Class Technologies. This company is a newcomer and was founded during the pandemic.

I would like to hear what you think about this post. Tag us on Twitter with the hashtag #listedtech or comment on other social media platforms via our ListEdTech accounts.