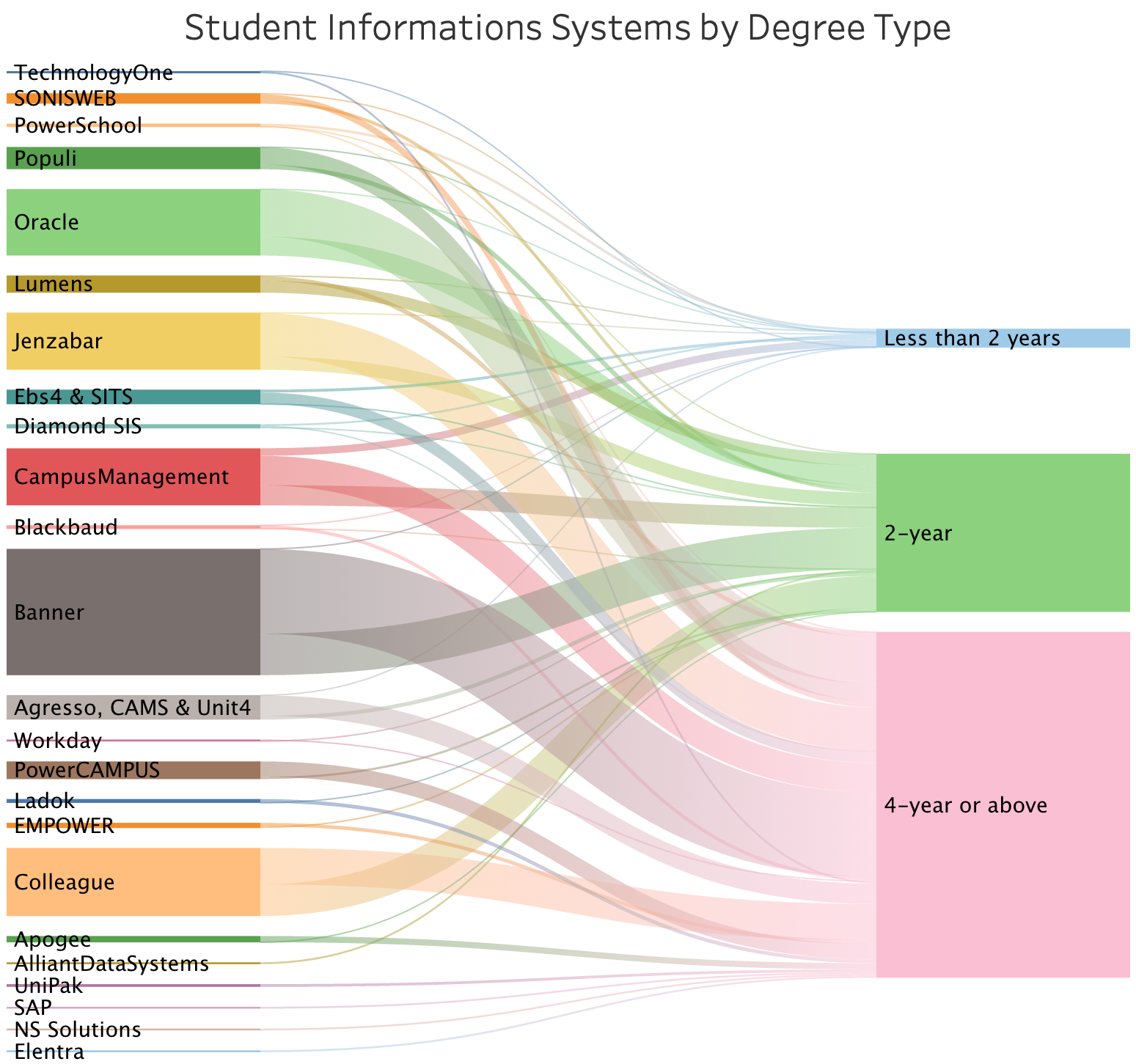

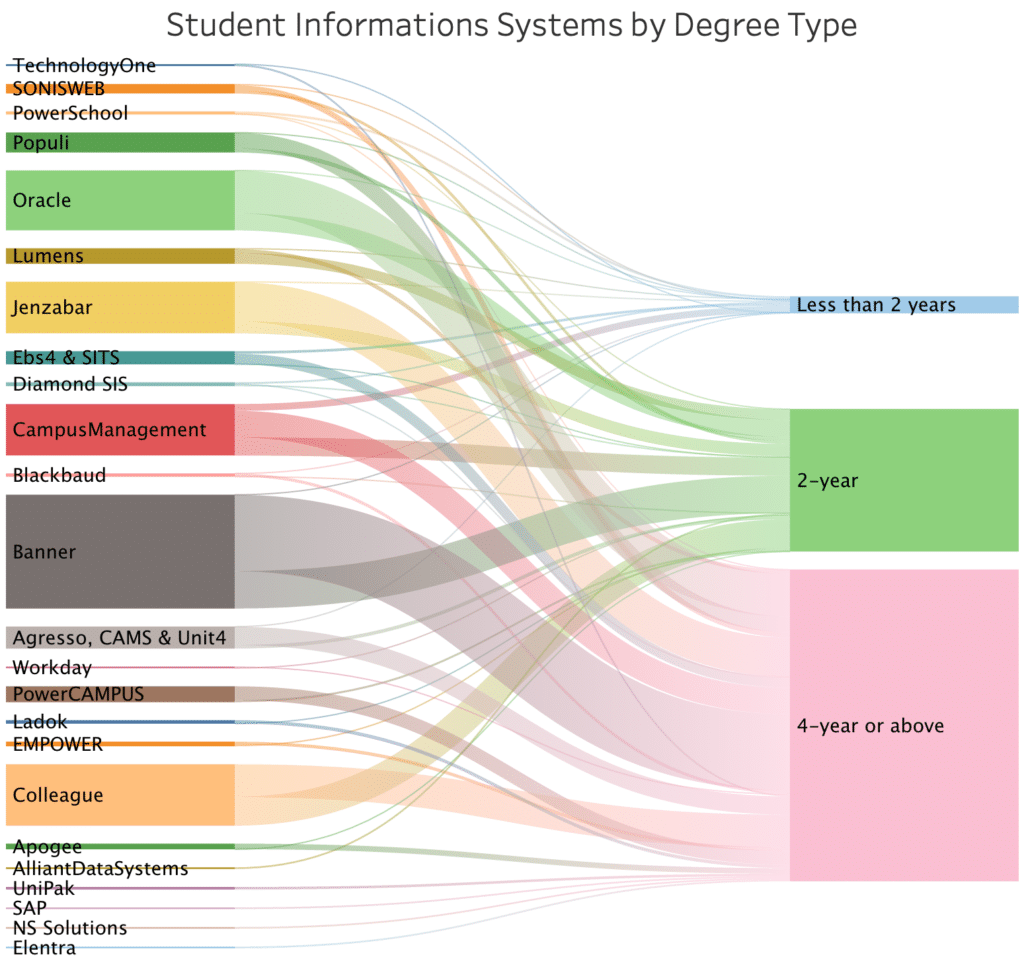

In the past, we look at how enrollment size could be a good indicator of the Student Informations Systems products used. This week’s graph is about SIS and degree types.

We have separated degree types into three main categories:

4-year or above;

2-year;

Less than 2 years (includes Further education and Sixth form colleges)

As you can see, the bulk of products is for the 4-year since that’s also the bulk of the clients.

Some companies/products are mostly concentrated on 4-year or above: UniPak, SAP, NS Solutions, Elentra, Apogee, Ladok, Blackbaud, TechnologyOne, PowerCAMPUS

Other companies/products are concentrated in the 2-year: Alliant Data Systems and Lumens

Less than two year companies/products : PowerSchool and Diamond SIS

The other company/products have a more “balanced portfolio”, meaning that they have a considerable number of clients in all three groups. The two companies with the most “balanced portfolio” are Campus Management and Sonisweb.

Degree type is a good indicator of product selection but not as good an indicator as total enrollment size.

A few notes on the data:

We included the primary and secondary systems. An example of secondary SIS is Lumens systems. It is not usually the main SIS but rather focused on non-credit student’s enrollment.

Smaller products (based on the number of clients we have in our DB) have been excluded from this post.

The graph is based on over 4500 active implementations for whom we know the degree type.

Some of these products are primarily used outside of North America and reflective of the types of degrees offered in those regions (examples include Apogeee, Ebs4 & SITS, Ladok, NS Solution, TechnologyOne, … etc.)

The products/companies in the graph are: Agresso, CAMS & Unit4, Alliant Data Systems, Apogee, Banner, Blackbaud, CAMPUS SQUARE, Campus Management, Colleague, Diamond SIS, EMPOWER, Ebs4 & SITS, Elentra, Jenzabar, Ladok, Lumens, Oracle, Populi, PowerCampus, PowerSchool, SAP, SonisWeb, TechnologyOne, UniPak, Workday.