As you may have noticed, HigherEd evolves in a pendulum motion. At the university level, we can observe movements of centralization of services being depleted over time in favour of a decentralization favouring services in faculties and schools to then return to a central decision-making process a few years later. With IT systems being implemented in universities and colleges the same question arises: can we observe this pendulum trend with IT solutions, more specifically with student information systems? This question was asked by one of our clients.

History of the Student Information Systems

Universities and colleges used to rely on big databases containing student data and academic records to keep track of their student population. Then in the 1970s, the first commercial solutions emerged: EDCTechnology, Datatel, SCT, Applied Business Technology, Campus America, Quodata and Unit4. For a comprehensive look at the evolution of the market, we invite you to have a look at our Historical SIS Market graphs.

Two decades later, in the mid-1990s, companies started building or buying modules to expand their SIS usability and to increase sales. In the first decade of the 21st century, modern SIS contained everything one can imagine.

List of SIS features offered by some vendors:

- Student demographic

- Contact information

- Grades and transcripts

- Enrollment

- Course History

- Scheduling

- Parent Management

- Recruitment

- Admission

- Alumni and Fundraising

- Fees and Debt

- Scholarships and Financial Aid

- Advisor Tracking

- Assessment

- Discipline

- Library Management

- Notification System

- Transport Management

- Reporting

- Health Records

- Sports

- Portal

The Current Trend

Today, the one-stop-shop approach seems to fade away as many small companies have started to focus on only one or two modules. Trying to succeed and excel in all categories resulted, unfortunately, in being average in many aspects.

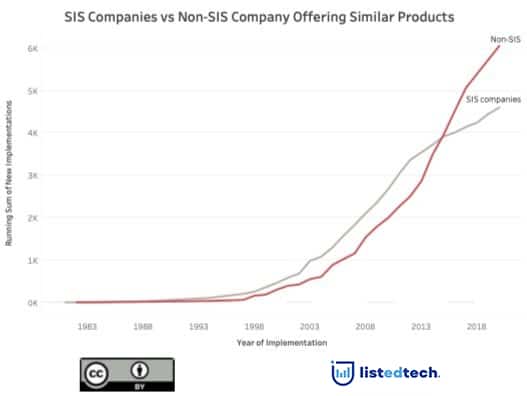

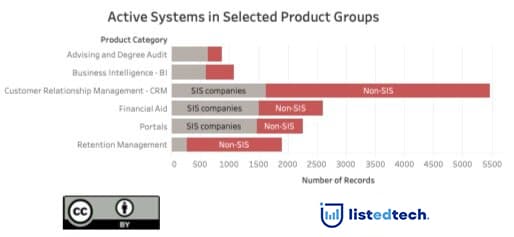

Taking into consideration six product groups that are offered by some of the main SIS companies (Anthology, ComSpec International, Diamond, Ellucian, Jenzabar, Oracle, Populi, Unit4, Workday), we notice that the current implementations for some product categories are being purchased by non-SIS companies.

Looking at the historical implementations, we see a shift: since 2015, the same modules that are not offered by SIS companies now have more implementations.

Clearly, some modules of the student information systems are being replaced by non-SIS companies. Will the SIS return to being a database? Will it simply be part of an application ecosystem like Salesforce?

Data Note: In the Images for this post, we only include datasets for HigherEd.