When it comes to product selection, a question that is often asked is: what product is implemented in a comparable institution? This is a normal and healthy exercise. To be able to answer this question, we first need to set some criteria to define what is a peer institution.

Criteria to define a “peer institution”

There is no right or wrong way to define a peer institution. Some common elements would be: main competitors in a said market, institutions of the same size, degree type, public or private, research groups (R1 or R2), or again, same overall world ranking. These criteria can work when looking at the socio-demographic point of view, but it doesn’t show the reality of the technology being used.

When it comes to technology, universities and colleges may also want to compare themselves against their technology peers. Instead of using socio-demographic data points, we feel it would be more appropriate for institutions to compare themselves with others using the same technology stack. They might not have the same size or degree type, but they are using the same basic systems (SIS, LMS, HR, CRM, etc.). This could be practical information when they face a specific issue or they want to change one of their systems.

Technology peers at the centre of our institution portal

For the past few weeks, we have been looking specifically at this question. As we are about to launch our institution portal this summer, we aim to provide our users with a technology-based comparison that covers more than 15,000 HigherEd institutions and just as many school districts.

Let’s say that College ABC wants to change its SIS system. In the portal, users will have access to general trends (based on the socio-demographic data), but will also have access to which product their peers have selected in the last few years and even provide some of the name of these institutions. This way, College ABC’s representatives can reach out to other institutions that have implemented a specific product.

For ListEdTech, privacy is at the core of our daily operations. When one of our portal users gain access to the system and do searches to compare itself to competitors, we will not give this information to edtech firms nor will you be added to any mailing lists. We also hate spam 😉

Also, like some of you, we have worked at educational institutions and we know that actual data are hard to obtain. We are trying to change this!

The recipe to compare technology peers

To create the best comparisons between institutions, we have decided to select the seven following systems as the core technology. Basically, out of our 30+ product categories, we created two system groups: the main ones (the group of 7) and the secondary ones (those that connect to the main ones).

Here is the group of 7:

SIS

LMS

HR

Finance

CRM (General)

Library (ILS Integrated Library System)

Email

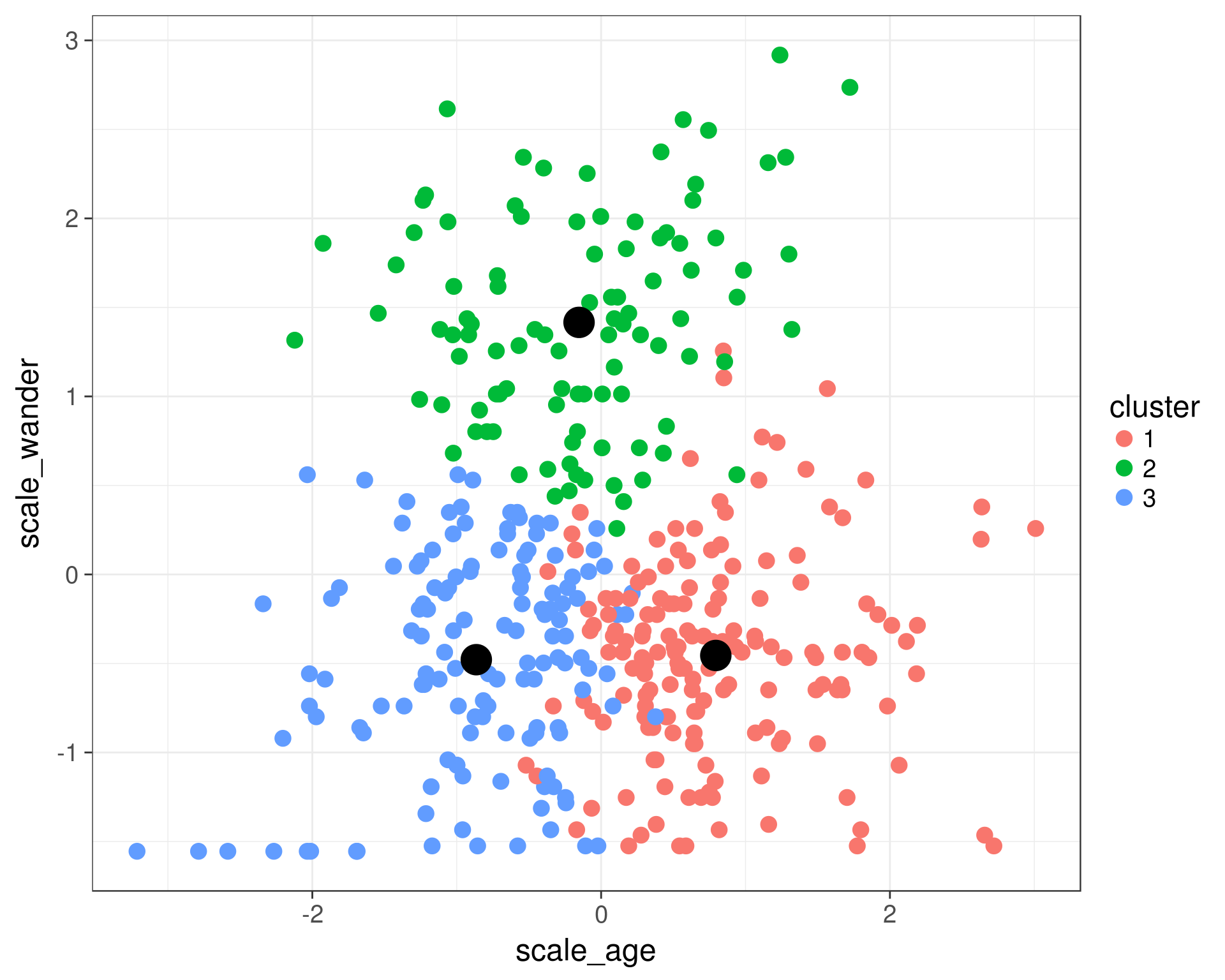

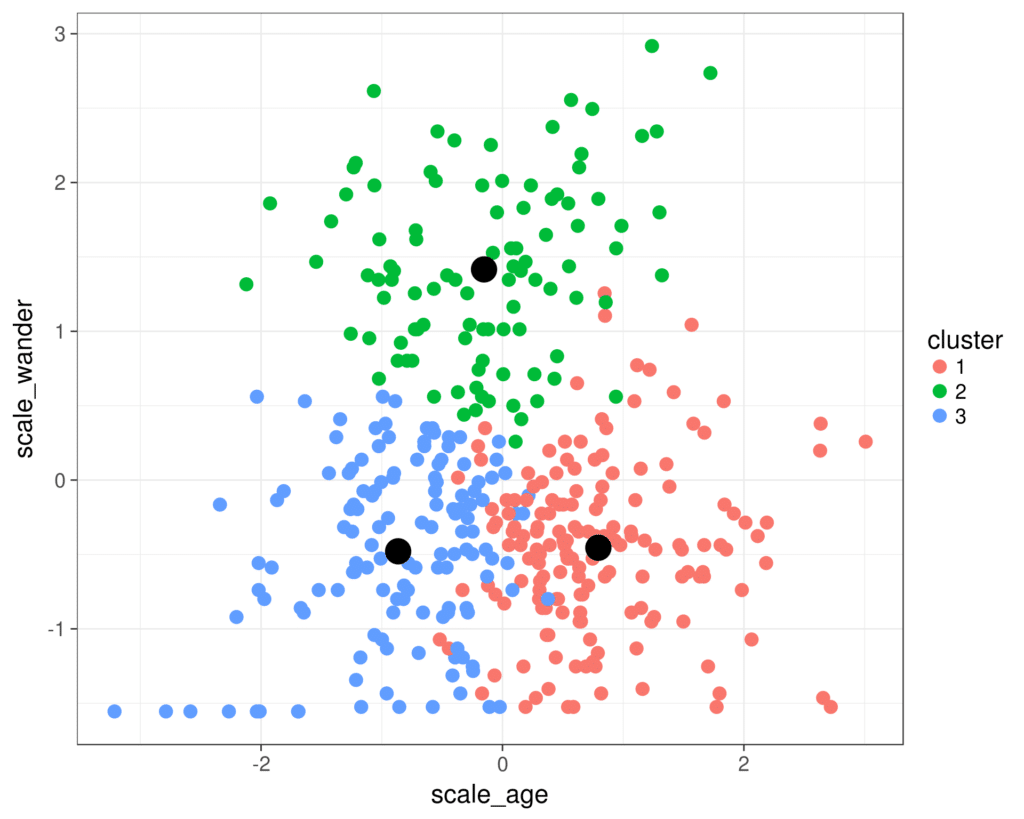

The technology peer comparison is always used in addition to the socio-demographic data because we need to contextualize the institution data. Using this information, we used a type of machine learning called K-modes to create clusters.

As we are still working on our algorithm, we test it constantly. For our first series of tests, we focused on North American institutions. We have a total of 5,209 HigherEd institutions and 10,540 K-12 school districts for which we have product usage.

Our initial results created 50 clusters of peers, varying from one institution (cluster 46) to 1,496 institutions (cluster 14). We still need to refine our machine learning algorithm, but we like digging into this. Let’s go over two clusters as examples:

| Cluster | # Institutions | Average enrolment | Institution Type | Degree Type | LMS | CRM | SIS | |

|---|---|---|---|---|---|---|---|---|

| #30 | 208 | 4,065 | 206 are public schools; | 202 are school districts | 135 use Schoology | 179 use Gmail | 122 use PowerSchool; | |

| #41 | 562 | 15,435 | 424 are public institutions; 137 are private not-for-profit | 498 are 4-year; 62 are 2-year | 232 use Canvas; 131 use Blackboard | 169 use Salesforce; 74 use Hobsons; 70 use Ellucian | 245 use Gmail; 177 Microsoft Exchange | 212 use Banner Student; 183 use PeopleSoft |

Why are we doing this?

Our institution portal will be going live in August. Our goal is to offer institutions data and visualizations to help them identify systems used by peer institutions and to show any system changes that have been performed in the past few years. Instead of having an institution ask on a listserv and hope that someone answers, we will help institutions find the needed information presented in a thoughtful way.

On our institutional portal, users will have access to a plethora of information. Let’s say your institution wants to change its SIS system:

The portal will present the general market;

The portal will also showcase the market that is the most aligned with your institution’s reality (size, degree type, etc.);

The portal will list a short list of peer institutions that have changed or are in the process of changing their SIS.

We know that some of you are wondering who else is using Product A, B or C. With the institution portal, the answers will be readily available. We are looking forward to August and the launch of our new institutional portal, we hope you are as well.