At ListEdTech, with spring comes our second report on grant management systems. After last year’s interest in our report, we are working hard on the updated version for 2021. Should you be interested in reading the report, we aim to have it available in early June.

Like last year, we have contacted the companies in this product category to build on our knowledge. In terms of numbers, we have added more than 200 institutions to our dataset for a total of just under 1,400 North American institutions and more than 3,500 records (an increase of 800 from last year).

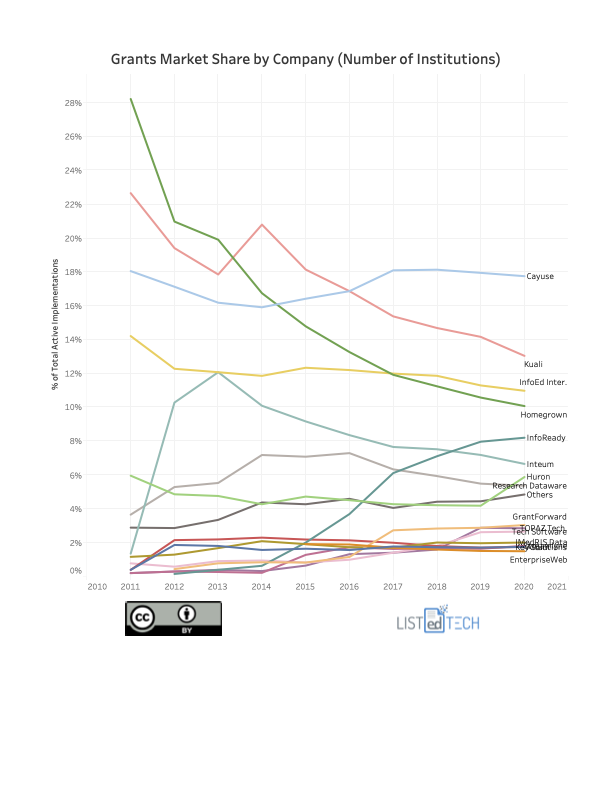

As you can see in the market share graph below, the year 2020 hasn’t seen much change compared to 2019, the main points of interest are :

- With the sale of all its product suite to the “State University of New York’ systems and 28 of its campuses, Huron increased its market share.

- Kuali decreased its market share.

- Homegrown systems continue their steady decline to commercial solutions.

We calculate the market share by counting each product used by an institution. If an institution uses multiple instances of one product, we only count it once using the earliest implementation year in our database and the last decommission date. Therefore, if multiple faculties use the same product, we only count it once. If multiple campuses use the same product and we know that they all use it, we count it multiple times (for example SUNY, Colorado State University or other university systems).

Again, as with all our data, we focus our efforts on educational institutions. We don’t look at associated medical or health groups.

We cannot wait to present you with our updated report on grant management systems. If you are interested in purchasing a copy, please contact us.