Seven months after Urkund bought PlagScan to form Ouriginal, Turnitin is clear on its position: this new competition has to be part of the Turnitin family. Let’s see what the biggest plagiarism company to exist will look like.

Client base

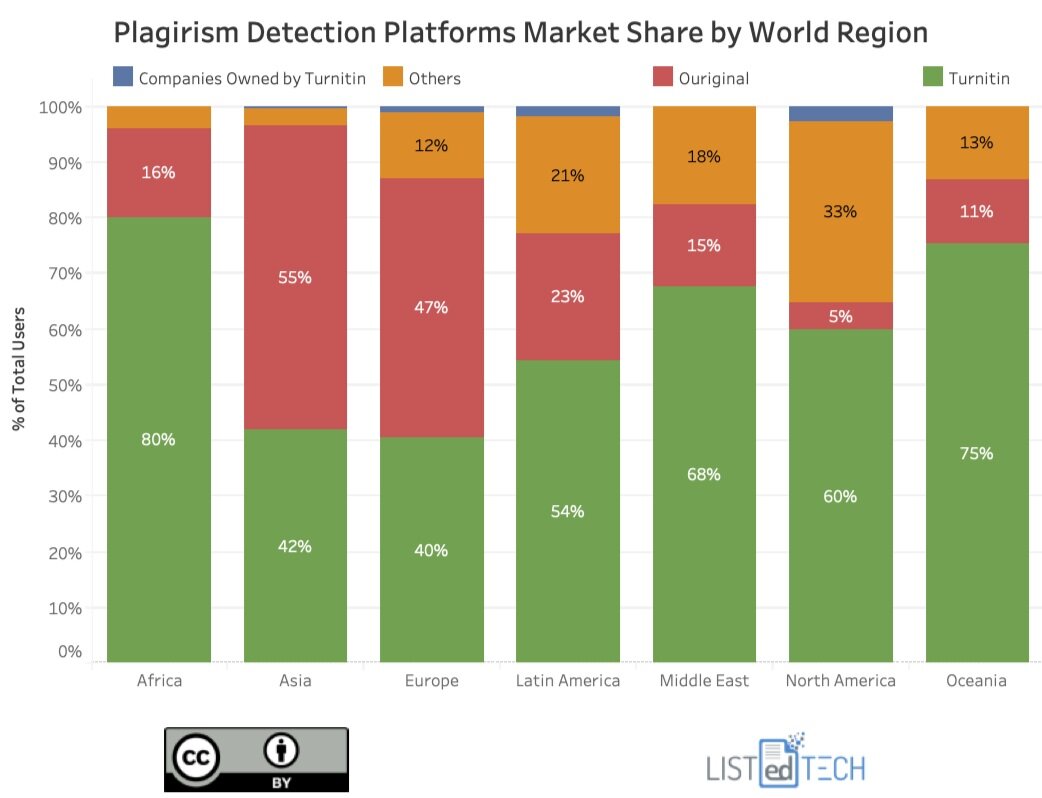

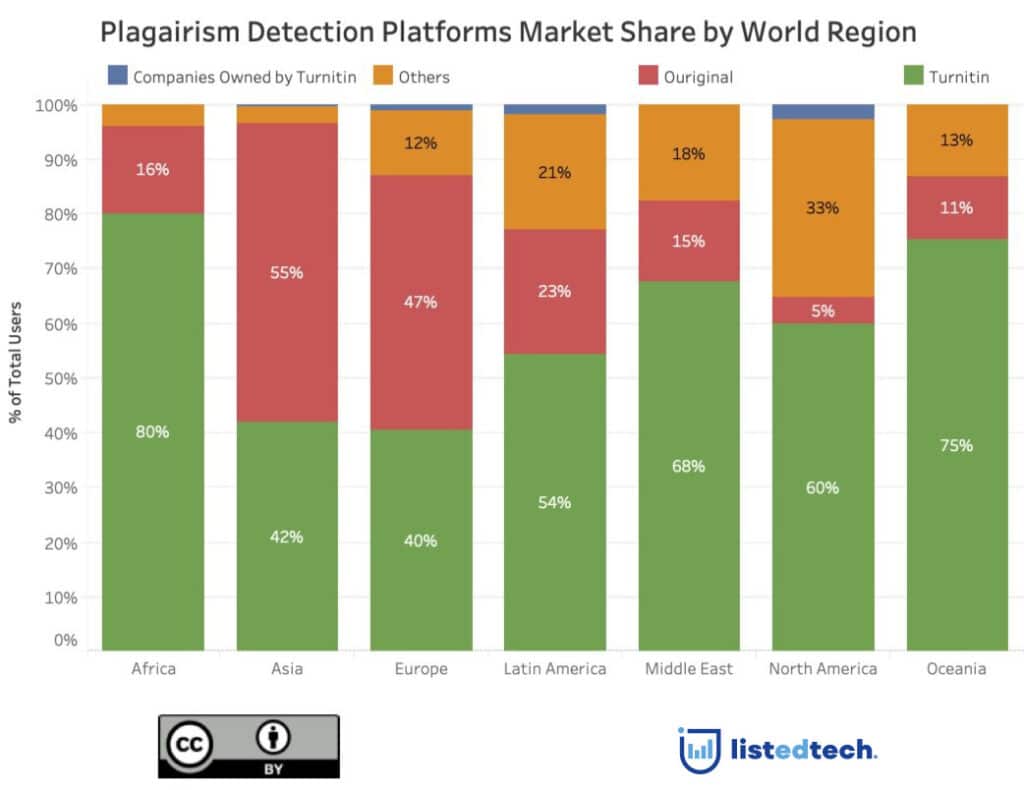

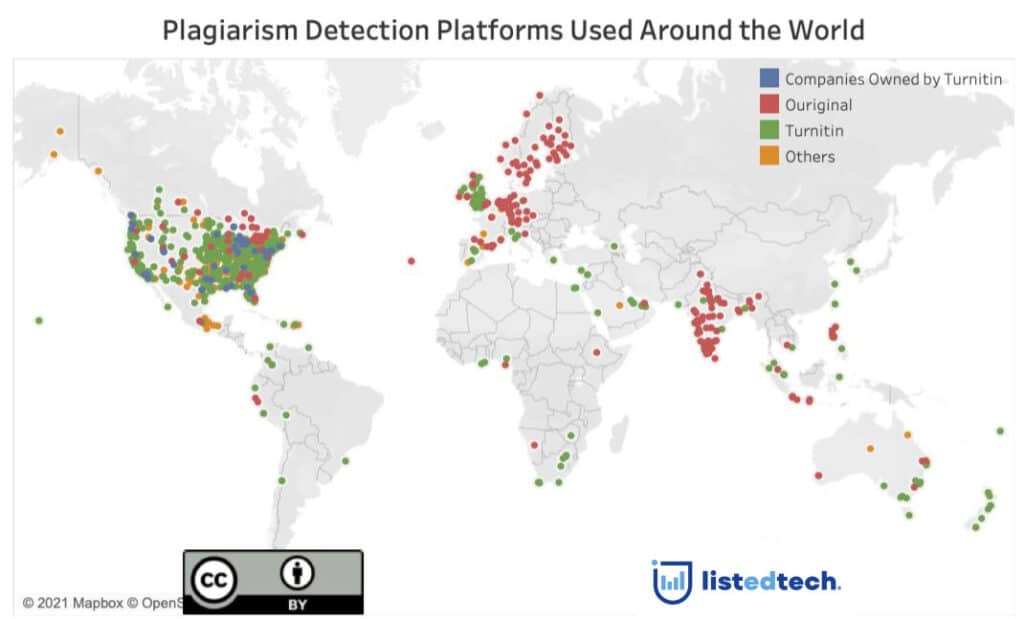

Because Urkund was located in Sweden and Plagscan was based out of Germany, Ouriginal was well established in Europe. Turnitin has clients in the rest of Europe as well as all over the world. Therefore, this potential merger will greatly expand Turnitin’s geographical reach. This is especially true in Europe and Asia. See graph below.

Service offering

Turnitin has always been strong in its capability to analyze the originality of a text submission. It has an integration of several databases online, working in conjunction with its own textual database. In addition to this main feature, the company developed over the years several products to support academic integrity in general: a tool for helping instructors grade assignments faster and easier; another one to ensure academic submissions to scientific journals are exempt of plagiarism; and the integration of its detection services to multiple LMS.

Ouriginal focuses on its seamless integration to several LMS systems, on the prevention of ghostwriting through powerful metrics, as well as its capacity to identify plagiarized text even if it has been translated. The company will search through regular content available online as well as licensed content; it even compares submissions from other participating institutions and publishers.

The plagiarism detection market after the merger

This purchase will create a company with over 18,000 clients in 150+ countries. It’s not the first acquisition for Turnitin. Over the past decade, Turnitin acquired the following companies (listed anti-chronologically):

ProctorExam (February 2021) – proctor system

ExamSoft (October 2020) – assessment platform

Unicheck (June 2020) – plagiarism detection

Gradescope (October 2018) – assessment platform

VERICITE (February 2018) – plagiarism detection

LightSide Labs (2014) – tutoring solution

This list does not include several partnerships with other companies to better serve specific populations, institutions or companies.

As shown in the list of acquisitions, we believe that Advance (the owner of Turnitin since March 2019) has created the biggest player in the plagiarism detection market. Not only does it have more clients than any other company, but it also has offices across the globe and supports its users everywhere.

So what’s left on the market?

What could be the next target for Turnitin? In the Plagiarism category, the only major player that is left is Blackboard’s SafeAssign…