Since the early 2000s, the learning management system market has fast evolved everywhere in the world. When looking at the historical LMS implementations in Canada, we notice that this product category has seen the dominance of a Canadian company (WebCT) for almost the first decade of the century. Despite having several LMS companies from the United Kingdom, the United Kingdom and Ireland did not support one of its own when it came to LMS implementations.

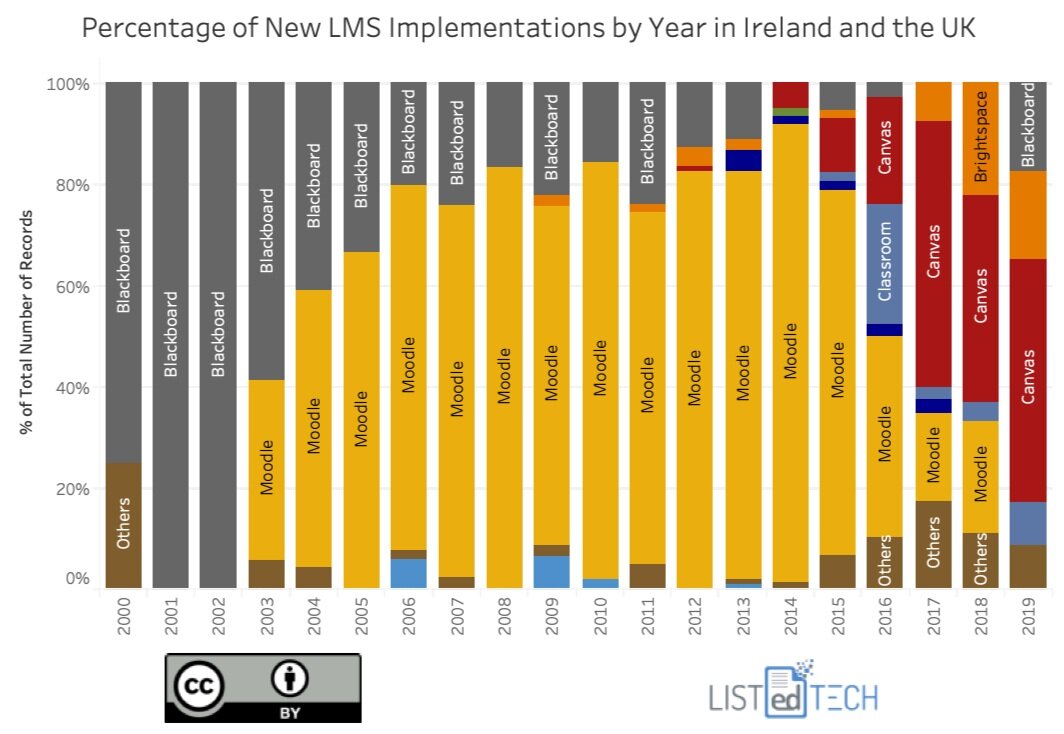

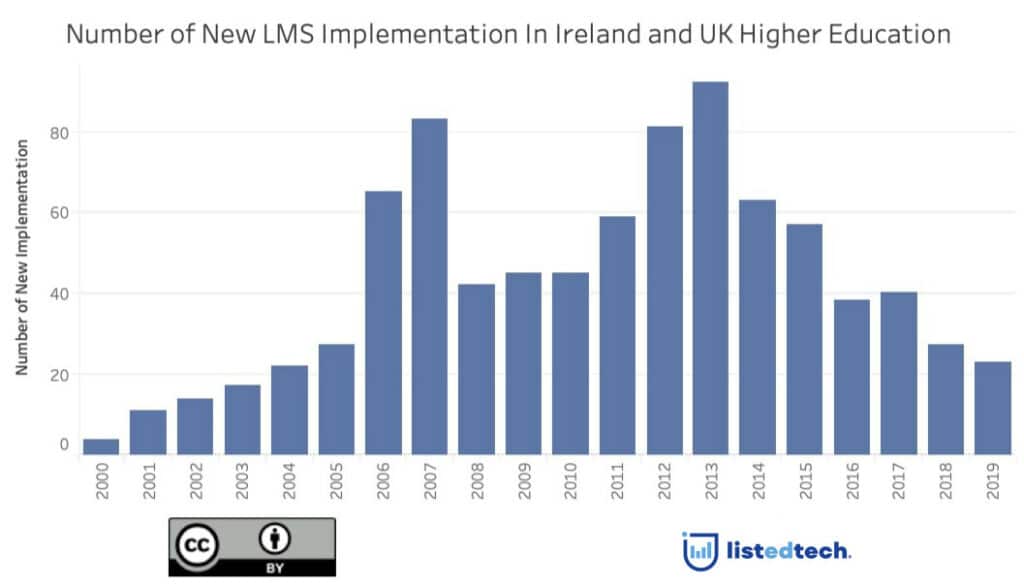

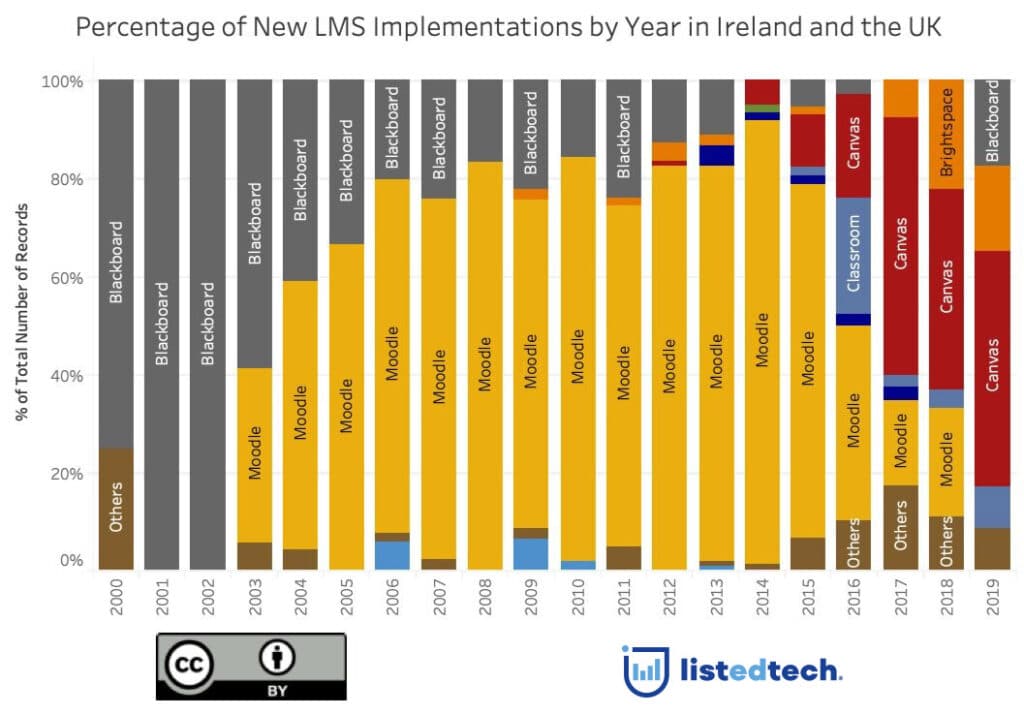

Thanks to the mission of BECTA (British Educational Communications Technology Agency), the United Kingdom has massively invested in technology for its educational sector from 1998 until 2010. These investments are definitely showing in the UK HigherEd LMS Implementations (2000-2019) graph below. We can see that new implementations were abundant, especially in 2006 and 2007.

Are UK and Ireland Moodle fans?

Since the inception of Moodle in late 2002, the United Kingdom was very fond of this product for over a decade. As early as 2003, Moodle took 25% of new implementations in the UK and Ireland. At its peak (in 2014), Moodle represented more than 90% of all new implementations for this market. A surprising fact: the market share of new implementations for Moodle dropped in just a few years. In 2019, it totally disappeared from the radar of new implementations.

Looking at the current trend, we see that Canvas is taking a bigger segment of the UK/Ireland new implementations. Since 2017, its share represents the biggest of all new implementations followed by Brightspace.

We cannot put the finger on why British and Irish universities have decided to slow its Moodle implementations, but we can make an assumption on why more universities decided to select Canvas. In February 2011, Instructure (owner of Canvas) announced it would make its flagship product freely available as open-source software. As the United Kingdom and Ireland seem to prefer open-source products, universities now had an option. Perhaps, in the article “Open source in higher education: how far have we come?” dating back in 2013, The Guardian underlines the two main reasons why universities select open-source software. The obvious reason is to save money on licence fees each year. Richard Maccabee, then director of the University of London Computer Centre, mentioned that it “can reach six figures over the average contract term of 3 years for a typical university”. The second reason is linked to software and business development. By being part of the maintenance of Moodle’s assessment system, the Open University has been able to influence the development of the learning management system and to make sure the solution includes its own needs.

Active Implementations of LMS in UK and Ireland

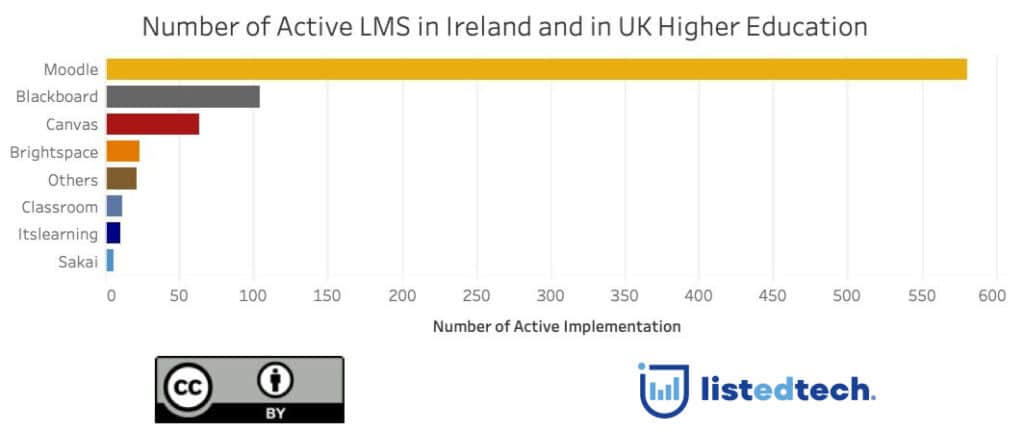

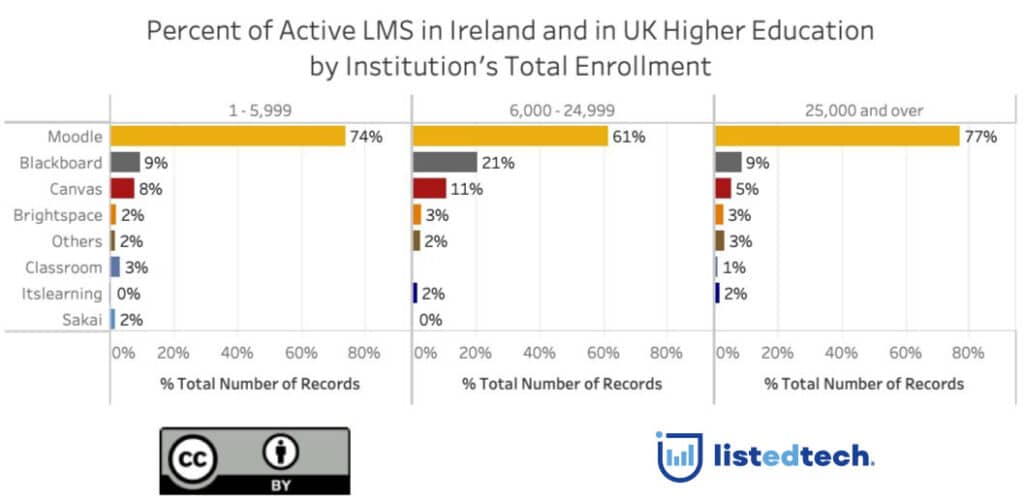

Even if new implementations of Moodle have halted for about two years, Moodle is still a strong contender in British universities. With its comeback in 2019 (after two years of no new implementations), Blackboard is in the second position and Canvas is in third. With the actual pace of new implementations for Canvas, we can predict that Instructure will soon be in second place, passing Blackboard. Classroom, ItsLearning and Sakai and all of the other products do not represent a real competition in the British-Irish market.

When we look at the market share of active implementations based on the institution size, we can see that Moodle has its lowest market share in middle-size institutions but Canvas is at its highest.

We have a lot to monitor in the LMS market in the United Kingdom and Ireland:

Will the current trend of the absence of new implementations for Moodle continue?

Is the year 2019 a bubble for Blackboard or are they really coming back?

Will Canvas and Brightspace continue its domination of new implementations?

Data Note:

The data only represents higher education institutions.

Graphs are based on 721 United Kingdom implementations and 96 Irish implementations.