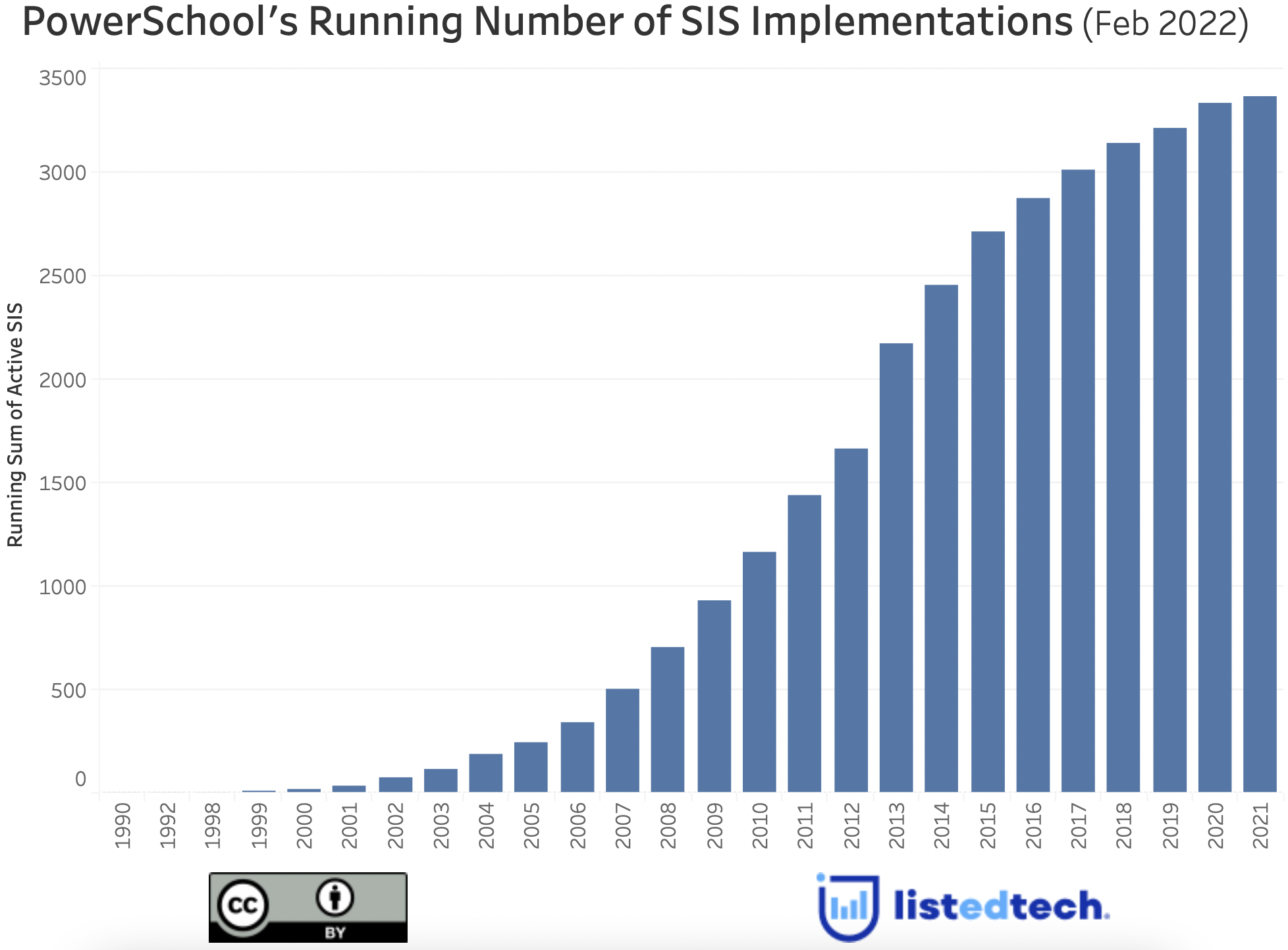

Like many IT stories in the 1980s and 1990s, the creation of PowerSchool initiated from one specific need: getting attendance tracking (as well as other information) to be sent through the school district’s network. From this initial class project, Greg Porter (founder of PowerSchool) worked on his project to build the first version of PowerSchool Student Information System in 1997.

Contrary to many companies at the time, Porter focused the development of PowerSchool on one core element: a web-based platform. In the times of Macintosh versus Microsoft, Porter’s vision added a third (and stronger) player to the battlefield. To gain more clients, he also attended competitors’ presentations the day before he was scheduled to present, noted all the missing components of these systems, and added functions to his PowerSchool system that same night. The business model attracted the attention of Apple, to which he sold his company for $62 million in stocks in 2001.

From an SIS Company to a K-12 Solution Provider

Since this announcement, PowerSchool has been acquired twice. It was first sold to Pearson Education in 2006 for an undisclosed amount and then to Vista Private Equity in June 2015 for $350 million. Three years later, in June 2018, Onex Corporation decided to join Vista Equity Partners to support PowerSchool’s growth. Since this agreement, Onex and Vista are equal partners in this enterprise. What is intriguing about PowerSchool is not really its owners, but the several acquisitions they have made over the years.

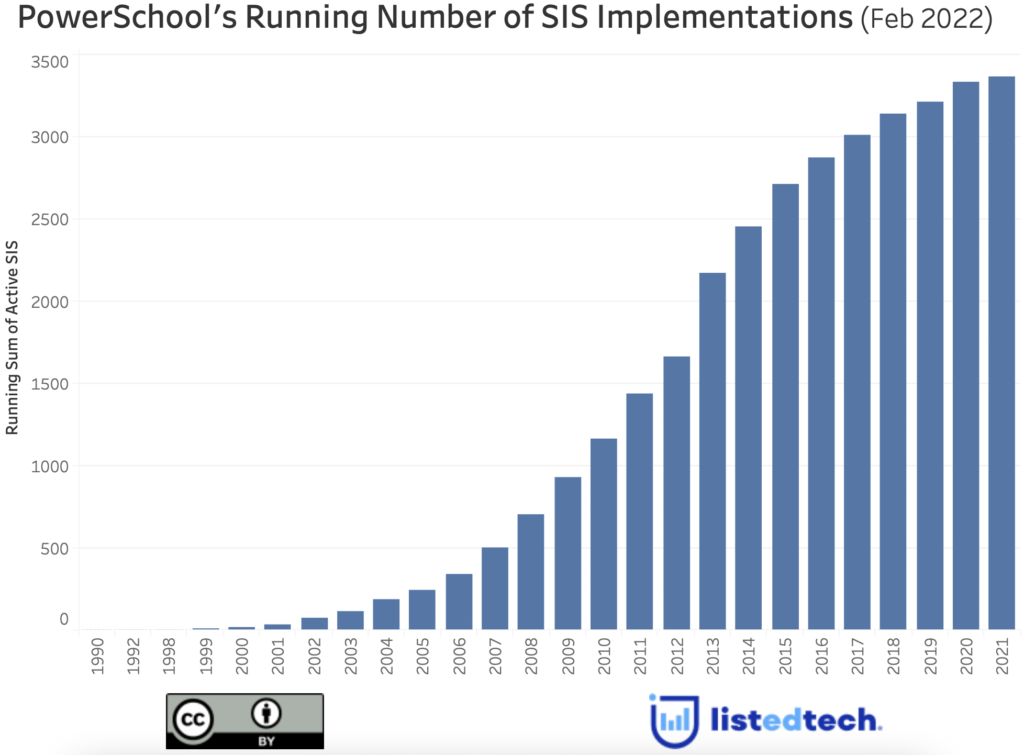

With Porter’s method of gaining clients, the company became well known in the SIS market in the early 2000s. In recent years, it acquired 14 companies. Here is a table of these acquisitions, sorted chronologically:

| Date | Company | Products | Supplemental information at acquisition |

|---|---|---|---|

| November 2015 | Infosnap | Cloud-based online registration management for public K-12 schools | A client base of 10,000 K-12 schools |

| February 2016 | Interactive Achievement | Award-winning standards-based instructional assessment and analytical solutions for school districts | Used in 12 states and is piloted in the United Kingdom. |

| May 2016 | Tienet Solutions | Part of MAXIMUS, a solution that helps educators manage instruction, intervention, and special education. | Maximus has more than 16,000 employees worldwide and partners with six government bodies. |

| June 2016 | Haiku Learning | Innovative cloud-based learning management and classroom collaboration solution designed to meet the needs of K-12 educators. | From November 2015 to June 2016, PowerSchool has invested $100 million to build its unified classroom platform. Haiku has 3 million users worldwide. |

| August 2016 | SRB Education Solutions | Provider of complementary administrative and ERP solutions for K-12 school boards and districts in Ontario and throughout the Canadian provinces: Trillium, atrieveERP, SchoolLogic, and L4U Library management systems | First acquisition in Canada. |

| October 2016 | Chalkable | Student achievement and regional education data management solution | A client base of 5,000 schools in 50 states. |

| December 2016 | SunGard K-12 | Finance, HR and payroll solutions for school districts and K-12 schools. | FIS (Sungard K-12 previous owner) has 20,000 clients in 130 countries. It employs more than 55,000 people. |

| April 2018 | PeopleAdmin | Talent solutions, including TalentEd and Performance Matters | The combined entity will reach over 45 million students and 13,000 school and district organizations including 88 of the top 100 districts in North America. |

| October 2019 | Schoology | K-12 learning management system to be part of Unified Classroom | With this transaction, PowerSchool offers its services in more than 80 countries. |

| October 2019 | AccelaSchool | K-12 Solution to seamlessly integrate paperless systems into their schools to help efficiency, data collection, and costs | |

| October 2020 | Hoonuit | K-12 education analytics and data management solutions | Hoonuit’s clients represent more than 14.5 million students, including 12 state and territory-wide deployments. |

| February 2021 | Hobson’s Naviance & Intersect | A solution that helps students and counsellors explore and plan for life after high school, which includes aiding students through the college application process. | Over 40% of US High Schoolers have access to Naviance. |

| November 2021 | Kickboard | Provider of K-12 Education Behavior Management Solutions | |

| January 2022 | Kinvolved | K-12 communications, attendance, and engagement solutions | A client base of 250,000 students |

PowerSchool focuses on several objectives to stay on top of its game:

It empowers teachers to help them in their classrooms.

It gives educators a comprehensive view of performance at every level.

It enables administrators to do more with existing budget resources.

It nurtures an environment to engage and attract teachers.

It builds bridges between parents, students, and educators.

Top Products

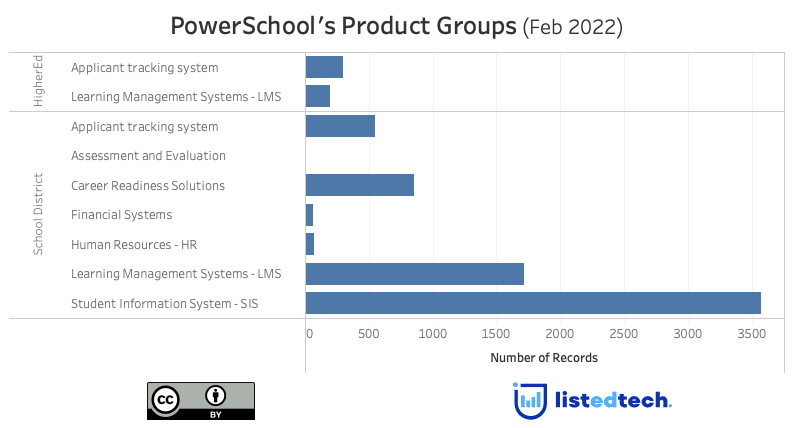

PowerSchool divides its product offerings into seven categories:

Student Information Systems: PowerSchool SIS, eSchoolPlus SIS, Trillium SIS, iNow SIS, Chalkable SIS, Chancery SMS. Some of these SIS are region-specific showing PowerSchool attacking the market on two ends: local and national.

Unified Classroom: Performance Matters, Schoology Learning, and Special Programs.

Unified Administration: eFinancePlus, BusinessPlus, Business Analytics, Atrieve HR, Atrieve Finance, and Atrieve Payroll

Unified Talent: School Spring Job Board, SmartFind Express, Candidate Assessment, Applicant Tracking, Employee Records, Perform, and Professional Learning.

- Unified Communities: Naviance

- Unified Insights: Hoonuit Analytics

- Unified Home: Kinvolved

While PowerSchool is primarily focused on the K-12 market, its PeopleAdmin and Intersect products do specifically serve universities and colleges.

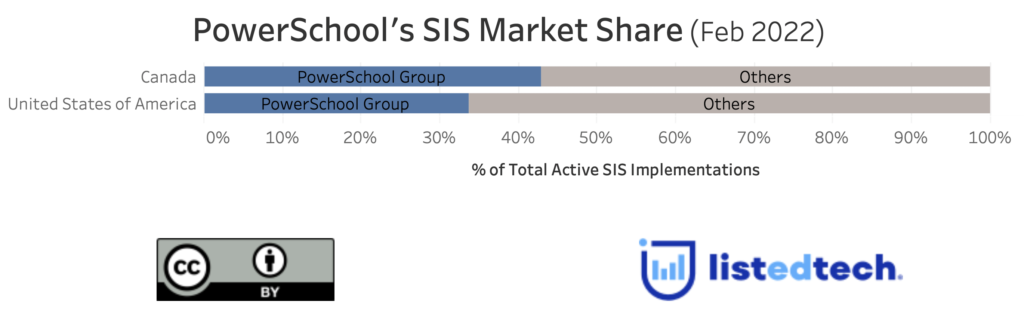

With its current product line and acquisition model, PowerSchool has been dominating the K-12 market, not only in the SIS product category. Under the ownership of Vista Private Equity and Onex, PowerSchool has expanded its product line to include leaders in K-12 education technology and well-known career readiness solutions. Since the first version of this post, we saw that PowerSchool, under the management of its CEO Hardeep Gulati, continues to buy more to become the K-12 education technology company.

This article includes information obtained from PowerSchool after its initial release in an email sent to our subscribers on February 24th, 2022.