On August 15, 2022, the learning management system community learned it was about to lose one of its members. As mentioned in the Twitter announcement, Edmodo will sunset its LMS portal (its only product) on September 22, 2022. What led to this decision?

At first, we tried to understand why NetDragon (the owner of Edmodo since 2018) would like to sunset a product appreciated by millions of users. Replies on the Twitter announcement show a great deal of support for the solution.

Who Are Edmodo Clients?

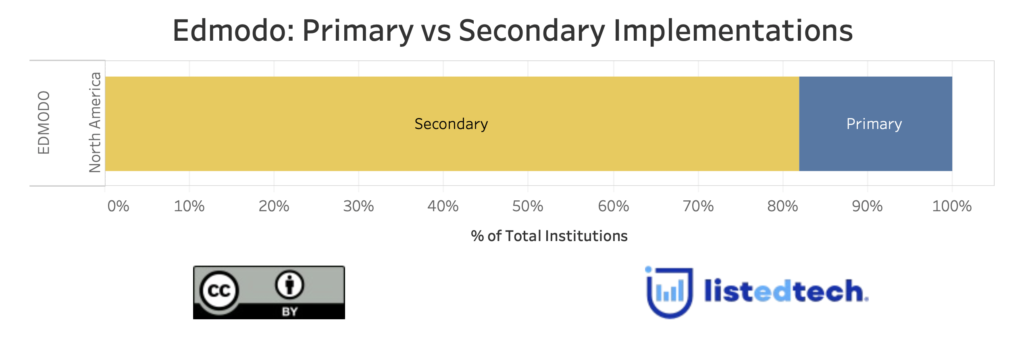

School districts were the most avid users of Edmodo. Because Edmodo offered its solution free of charge, many schools implemented it in addition to another LMS solution. Our data shows that over 80% of Edmodo clients used the portal as a secondary system. When the company shuts down the system on September 22, only about 400 clients will struggle to replace the product. The other institutions and school districts will simply focus their energy on their primary system.

The Edmodo website mentions that the company has served over 100 M users since its inception in 2008. In the ListEdTech database, we only account for about 25 M. Since we concentrate our efforts for K-12 in North America only, we could speculate that about 75% of Edmodo users are school districts worldwide. An announcement made by NetDragon in March 2020 stating that Egypt has selected Edmodo for all its K-12 LMS needs, supports our saying.

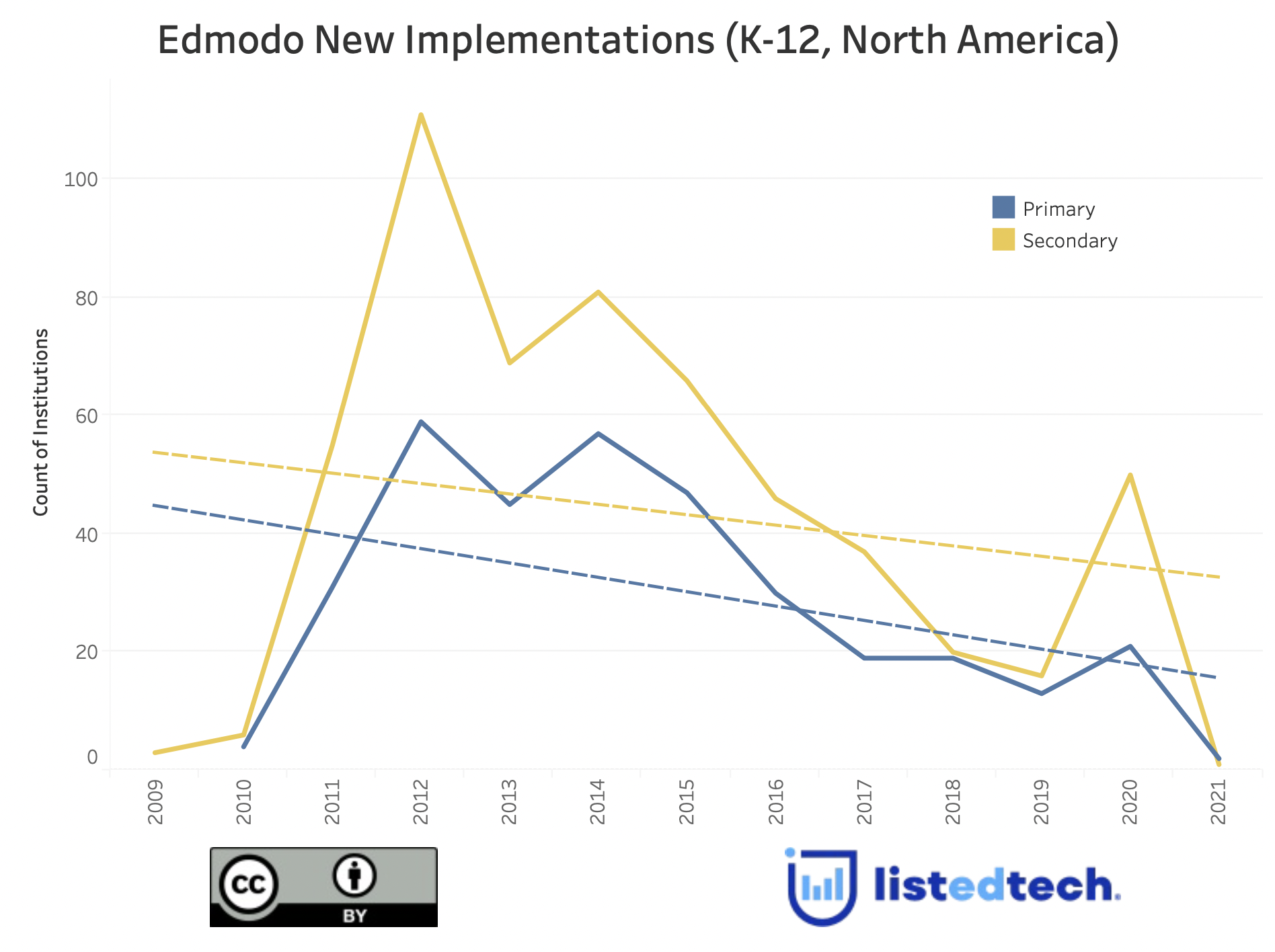

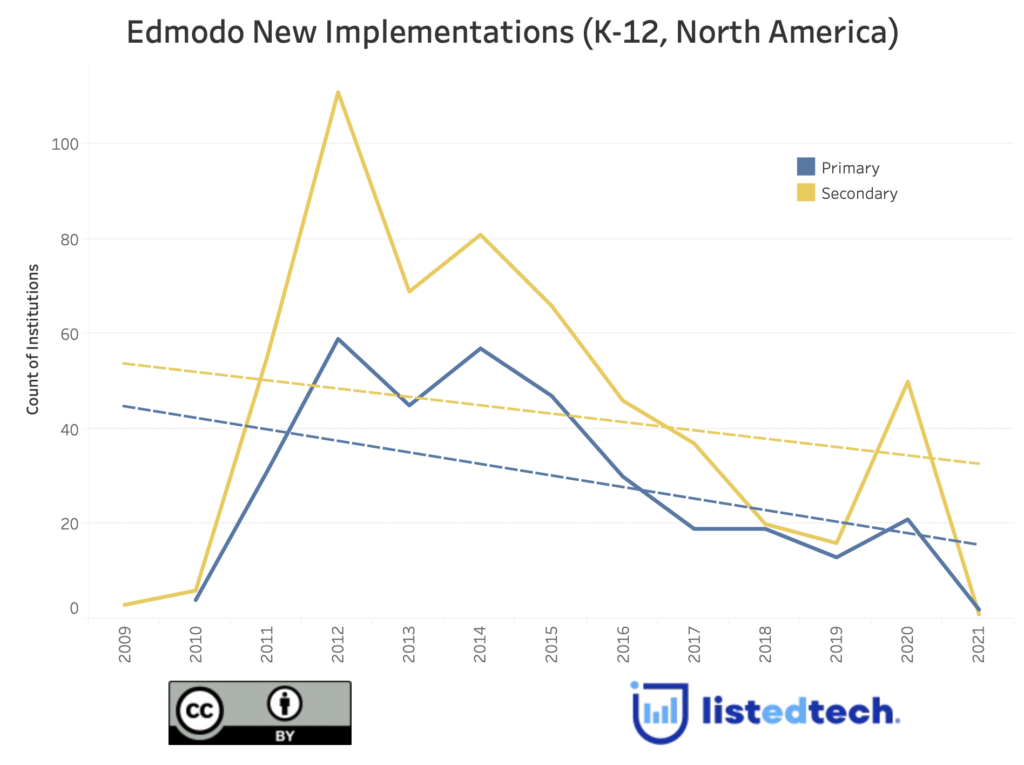

Historical New Implementations

We also looked at Edmodo’s new implementations in North America and noticed that, since its inception, their new implementations had always shrunk. The above graph focuses on the K-12 market (the biggest one for Edmodo). Note that the Y axis of the graph shows the count and not the percentage of implementations. As you can see, implementations as primary systems and secondary systems both show a downward trend.

The new implementations were at their pinnacle three years after the company’s creation, never to be repeated. In 2020, thanks to the COVID-19 pandemic, Edmodo saw a slight increase in new implementations, but that was insufficient to turn the tide.

What Will Happen For the Edmodo Primary Users?

Since the announcement, an important question remains: which solutions will attract Edmodo’s 397 primary clients? Let’s speculate for a few minutes. If the school districts look for a free solution, they could select Moodle or Classroom even though they would have to spend some money on the hosting. Otherwise, institutions will have to choose a paid solution. Based on current trends, we could think that Canvas or Schoology could be the LMS of choice. Since this situation will unfold in the next few month, we will not have to wait very long to see the transfer to other solutions.