Grant management is at the base of higher education research institutions’ inner workings. It holds a significant role within its ecosystem. It is also made of several systems or products that can function on their own, but which can also hinder the whole process when run as such. HigherEd institutions will often choose a grant management system on the same principles as choosing a student information system or a learning management system, mostly with operational efficiency in mind, but grant management requires more than an administrative outlook.

Understanding each system’s solutions is only one part of the equation. Looking at how these systems have been used in the past and where they have been implemented, whether at institutions of similar size, similar vocation, similar research strategies, or again with similar enterprise resource planning solutions, can facilitate one’s choice and alleviate hesitations.

As many of you know, ListEdTech is a market research firm that tracks systems used in education. Part of our mission is to help colleges and universities, as well as consultants and HigherEd companies, leverage data to better understand the HigherEd market and to target future customers. ListEdTech is writing a report that will come out in March as a way to offer the much-needed data behind the selection of a grant management ecosystem as a whole or divided in the variety of pre- and post-award systems available.

——

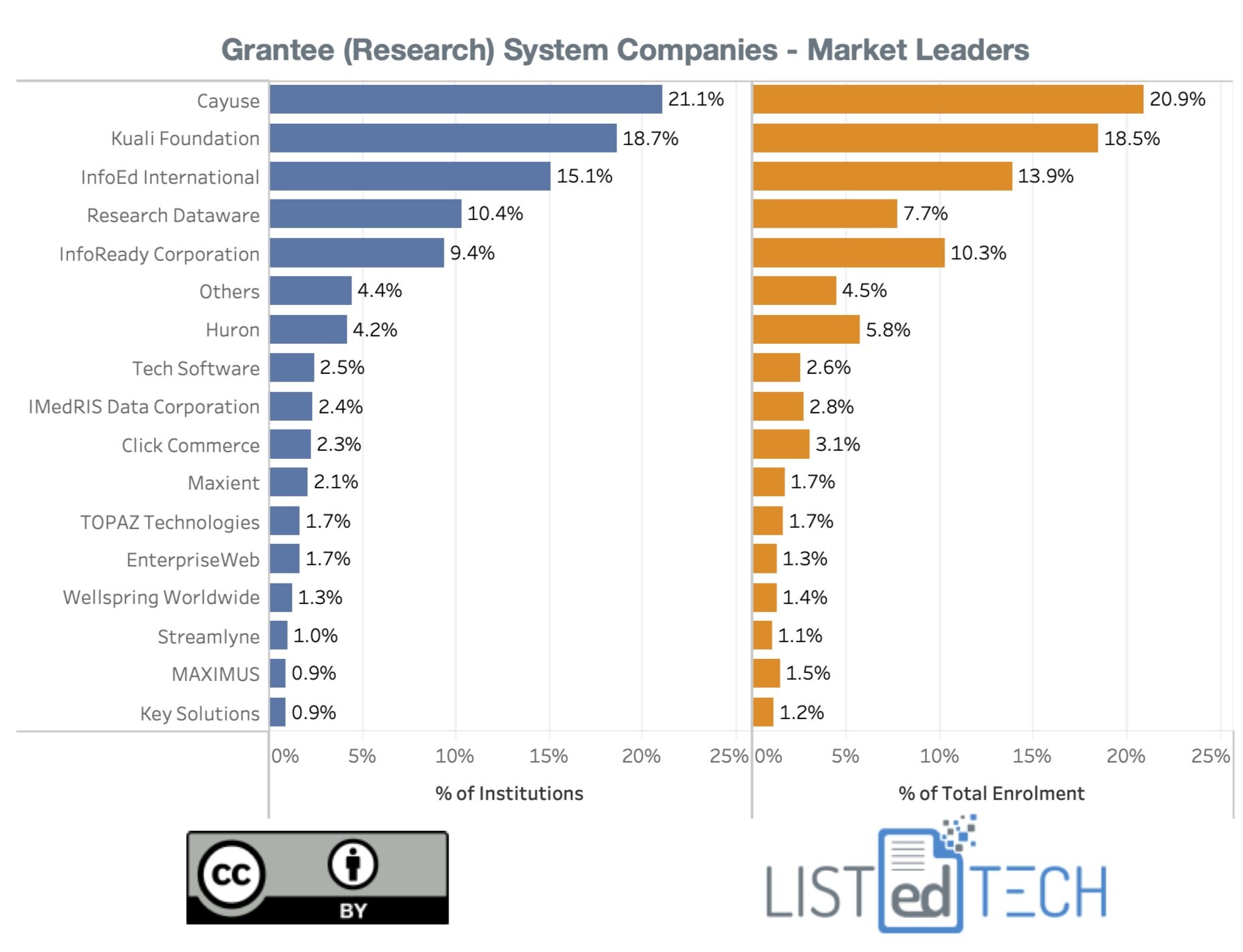

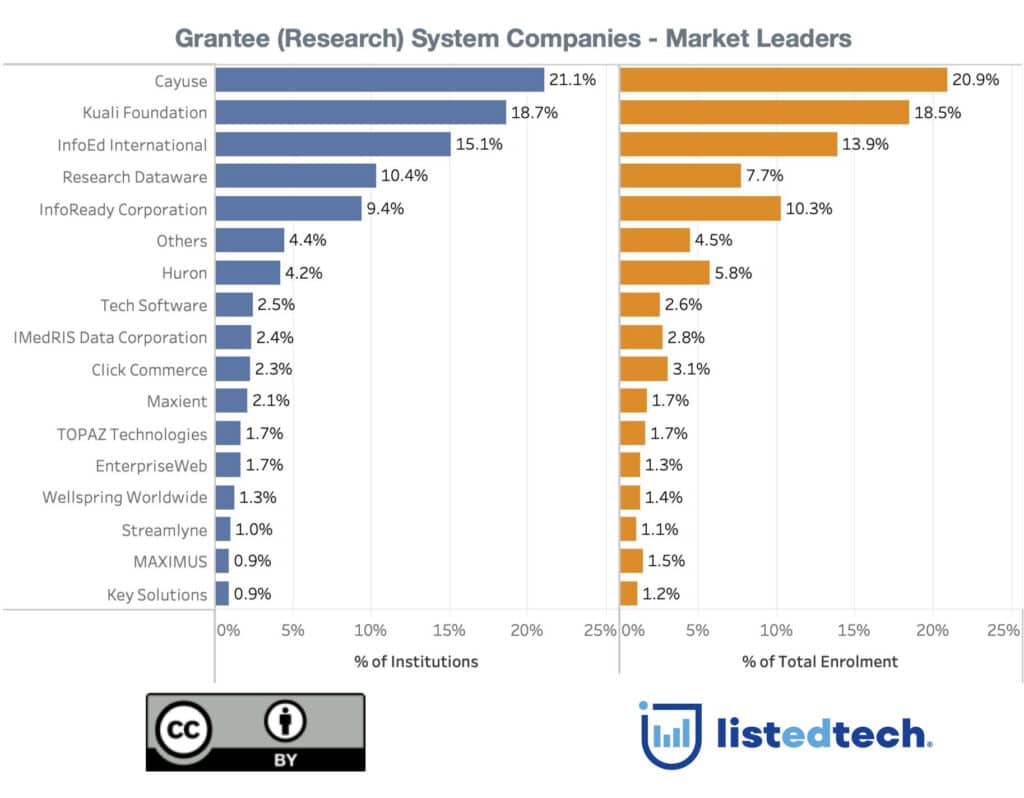

As a first glance into the Grant Systems market, we wanted to look at the overall market. The most active market is the one we have discussed previously as the “Grantee – Research”.

The graph shows two columns, the one on the left side represents the percentage of clients based on unique higher education institutions; meaning that if a company had several products being used at one institution, it will only be counted once. The right column is based on the total institution enrolment (also counted only once).

The leader on all counts is Cayuse.

A few companies have a lower % of users vs enrollment meaning that their clients are often larger institutions (InfoReady Corporation and Huron).

A few companies have a higher % of users vs enrollment meaning that clients are often on average smaller institutions (InfoEd International, Research Dataware).

Note:

We did not include homegrown systems. Homegrown systems still represent 19% of the overall systems used. We are just unable to classify the use of the systems so we just removed them.

Only looking at the North American market.