Back in November, I got the chance to meet Joshua Perry, writer of the “Bring more data” blog. Joshua has been following the Management Information System (MIS) used in the UK K12 market. Have a look at some of his posts http://bringmoredata.blogspot.com.

After discussing our mutual interests in educational systems’ market trends, we thought it could be interesting for the two of us to swap data and write a post using the other’s data. So this is my attempt.

Joshua’s data is very granular. ListEdTech looks at K12 data from the school district level, while he looks at it from the school level (using governmental data).

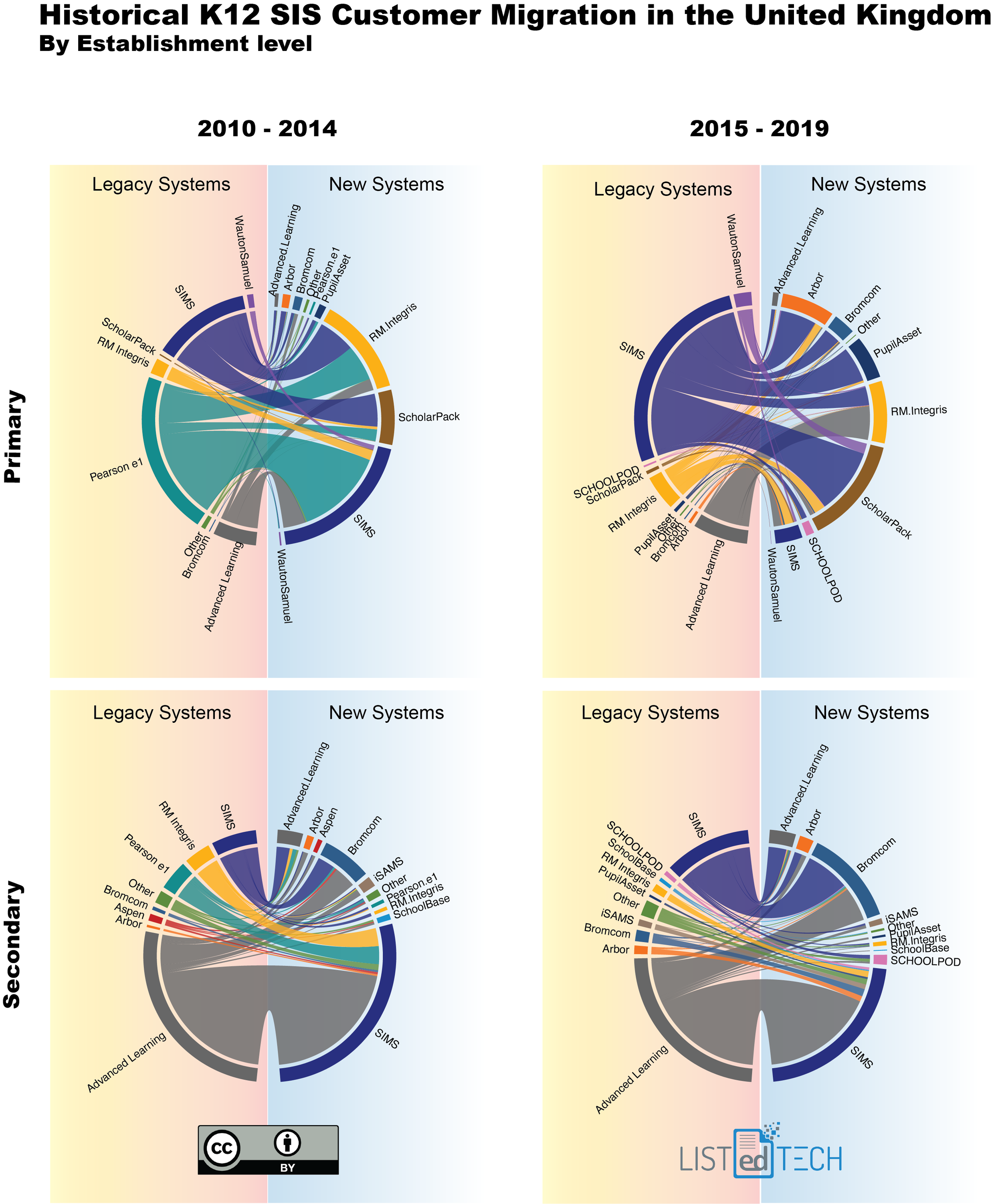

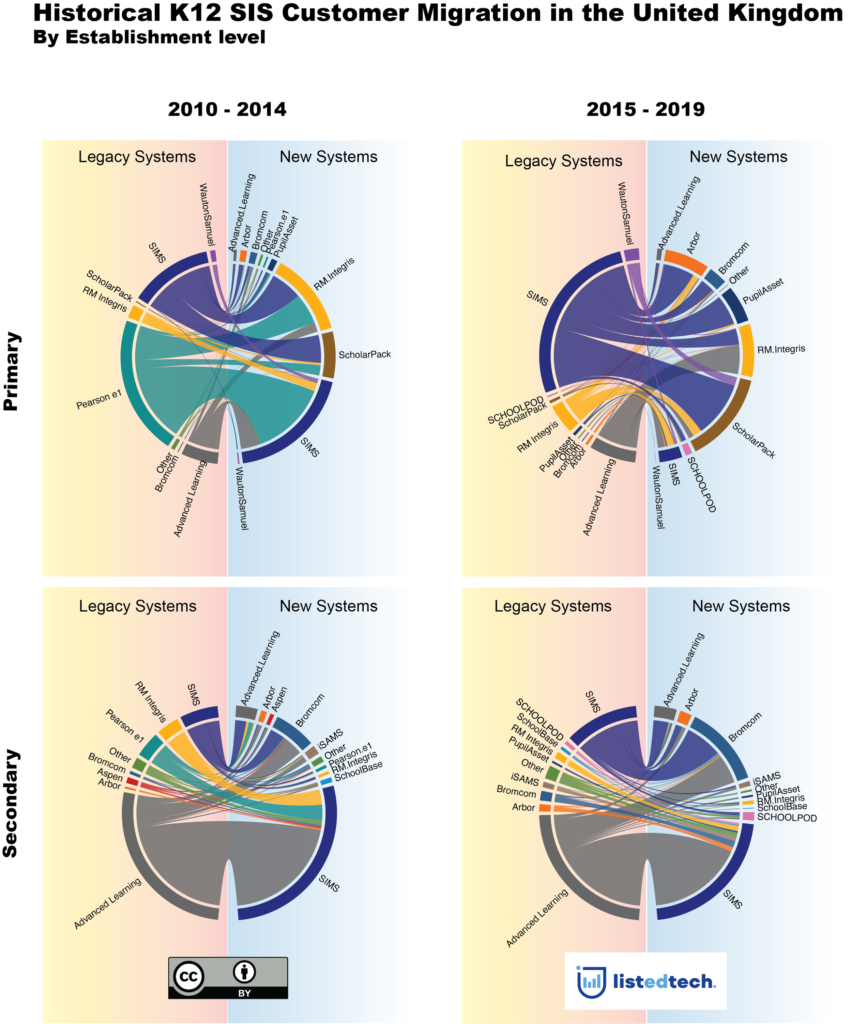

I created four historical graphs (2010-2014 to 2015-2019) of primary vs secondary level trends where every line represents a school. The left side shows the previous campus Student Informations System (SIS), measured by the number of institutions, and the right side shows the new SIS.

A few observations:

Primary level

Pearson e1, followed by SIMS, lost the most customers in the 2010-14 timeline.

SIMS, followed by Advanced Learning, lost the most customers in the 2015-19 timeline.

SIMS had the biggest customer increase in the 2010-14 timeline. However, they not only lost this advantage in the 2015-19 timeline, they actually came last as uptake in customers.

Overall, ScholarPack, RM Integris, and Arbor are the three companies with the most new customers within the 2015-19 time frame.

Secondary level

SIMS and RM Integris had the biggest customer increase in the 2010-14 timeline.

Advance Learning, followed by SIMS, lost the most customers in the 2010-14 and 2015-19 timelines.

Overall, SIMS and Bromcom are the two companies with the most new customers within the 2015-19 time frame.

Another interesting tidbit is that the systems used in the UK are completely different – as in I don’t recognize a single system used in the UK that would be used in North America.

A PDF version is available to help you zoom into the graphs.

For any questions about the data used for the graphs in this post, please contact Joshua Perry, writer of the “Bring more data”.