With the recent news that “TPG and Leonard Green & Partners are gearing up to sell Ellucian Software”, we wanted to have a closer look at its history, its market share and its positioning in the HigherEd market.

Not only is Ellucian a large HigherEd player, but it is also the largest HigherEd technology company in our database. If you have ever talked to anyone working for an EdTech company, it’s not unreasonable to ask them when they worked at Ellucian.

Historical Milestones

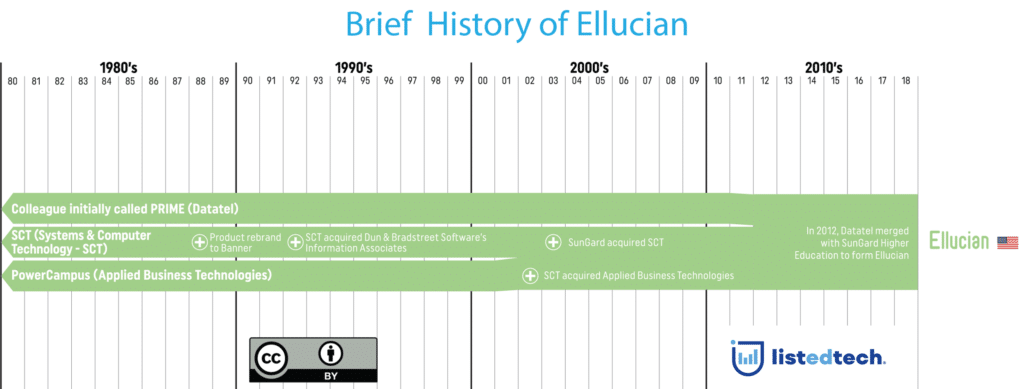

In 2009, JMI Equity and Hellman & Friedman bought Datatel from Thoma Bravo (yes, the firm that has agreed to acquire Instructure).

In 2011, JMI Equity and Hellman & Friedman bought SunGard Higher Education and then merged the two companies to form Ellucian, the new business name for the merger.

In 2015, TPG Capital and Leonard Green bought a majority stake in Ellucian. Reuters reported that the contribution of TPG Capital and Leonard Green was about $3.5 billion.

On December 2, 2019, it was announced that TPG Capital and Leonard Green are getting ready to sell Ellucian in a potential $5 billion-plus sale during the first quarter of 2020.

Ellucian’s website mentions that the company has a history of “50 years of successful partnerships with over 2,500 institutions.” We assume that this headline indicates active clients of the entire line of products. We are confident in this statement since our database includes 2,100 institutions.

Ellucian’s product page lists almost 40 products, divided into three groups:

Enterprise Resource Planning & Student Information Systems

Constituent Relationship Management

Integration & Analytics

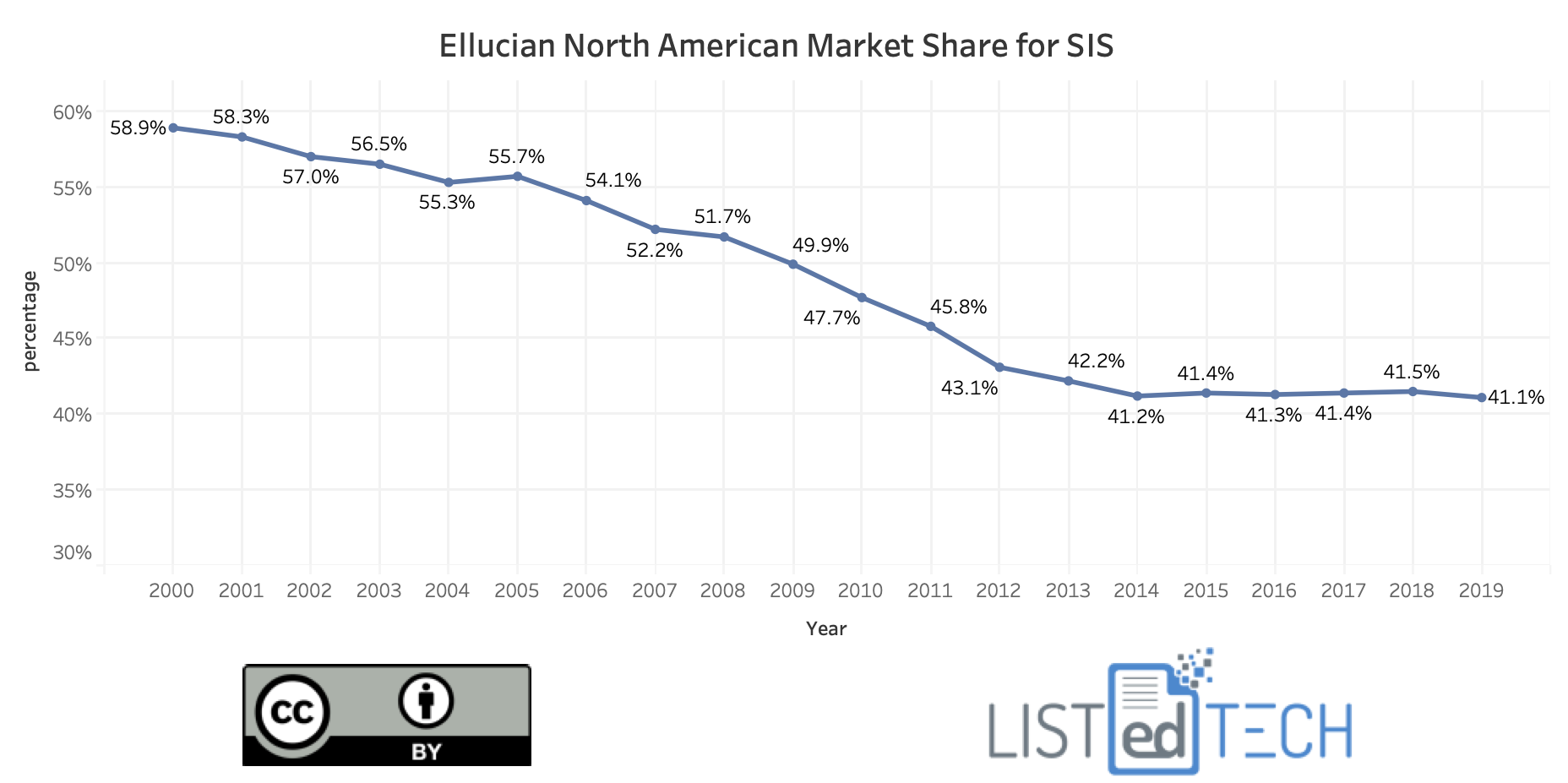

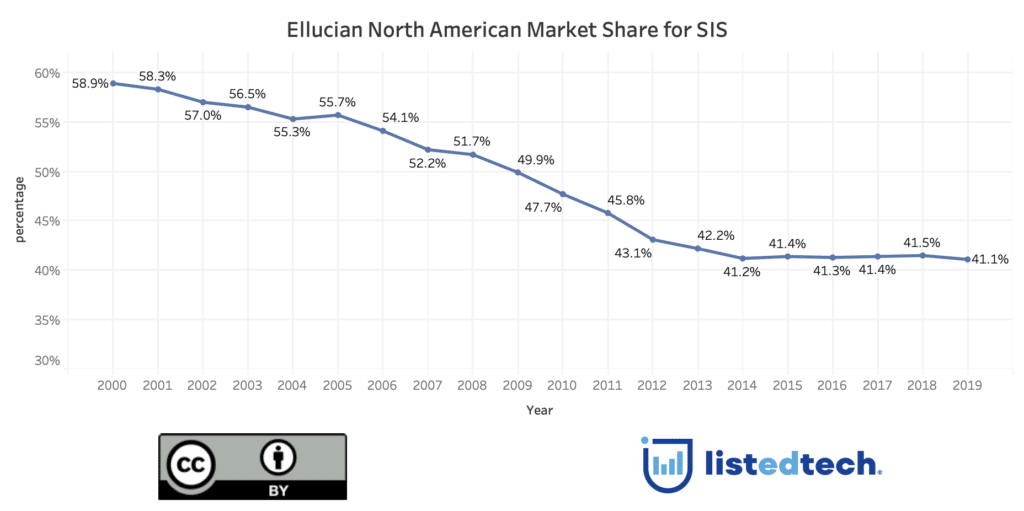

The following graph represents Ellucian’s market share for Student Information Systems by combining their three products (Banner, PowerCampus, and Colleague).

Some thoughts

Even with sevral acquisitions and mergers over the last two decades, the SIS market share of Ellucian has either been in decline or flat. This is particularly obvious between 2008 and 2012, where the company lost 8.6% in market shares to the likes of Campus Management and Oracle.

Since 2014, the situation seems to have stabilized.

The purchase of a majority stake by TPG Capital and Leonard Green in August 2015 is correlated with Ellucian’s market share stabilization, but we have yet to see an increase.