At ListEdTech, our goal is to help institutions and companies have access to more data to make better decisions. In mid-August of 2022, we made the Portals product category available for HigherEd. Today, we are happy to announce that the K-12 Portal subgroup is now accessible on our portal.

Even though we are still working on the data (getting more implementation dates and contract information), we wanted to make this category available to you, our portal users, as early as possible. You don’t have an account yet? Institution employees get access for free and we have great deals for edtech companies and firms.

What Are the Market Leaders?

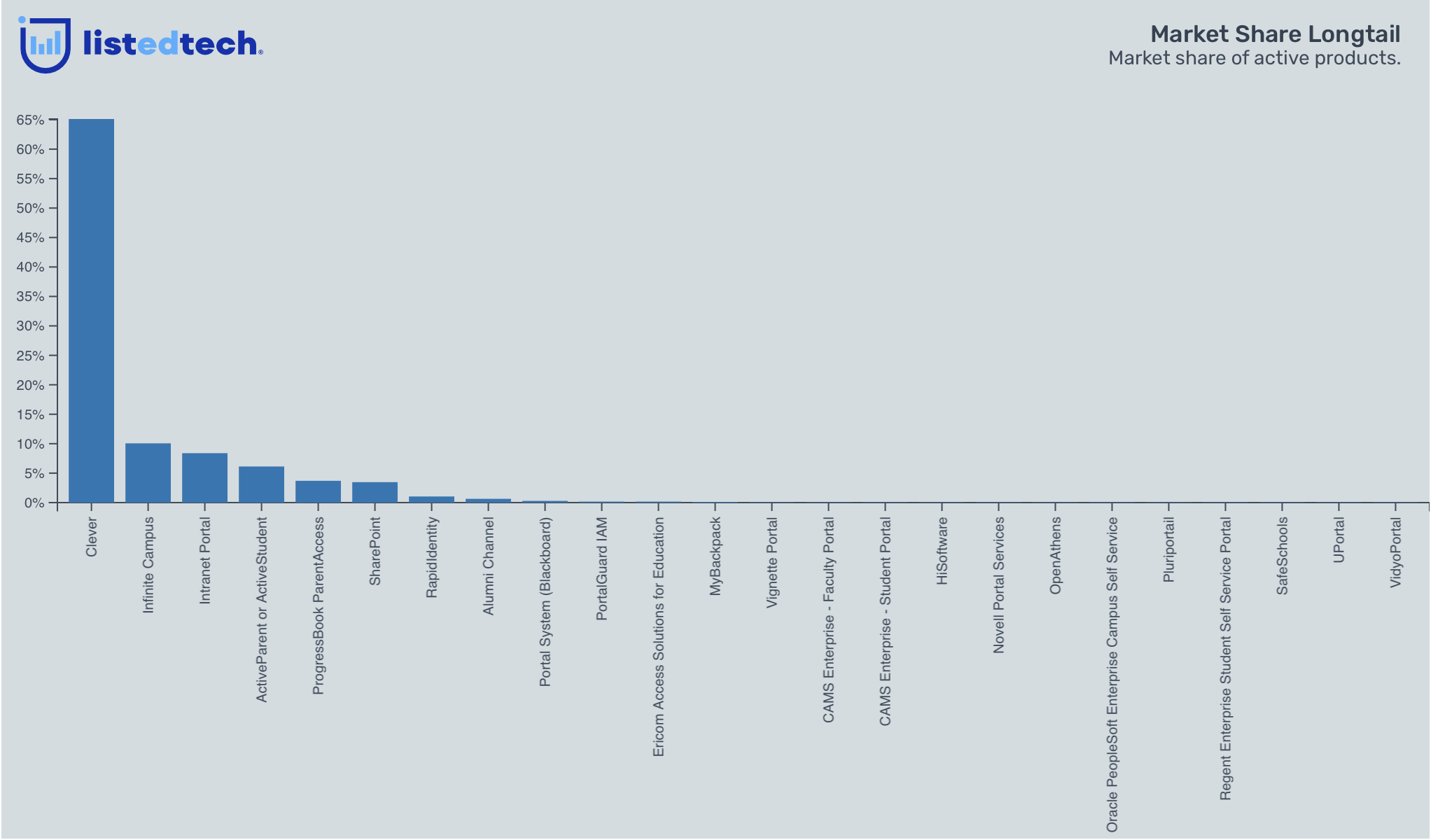

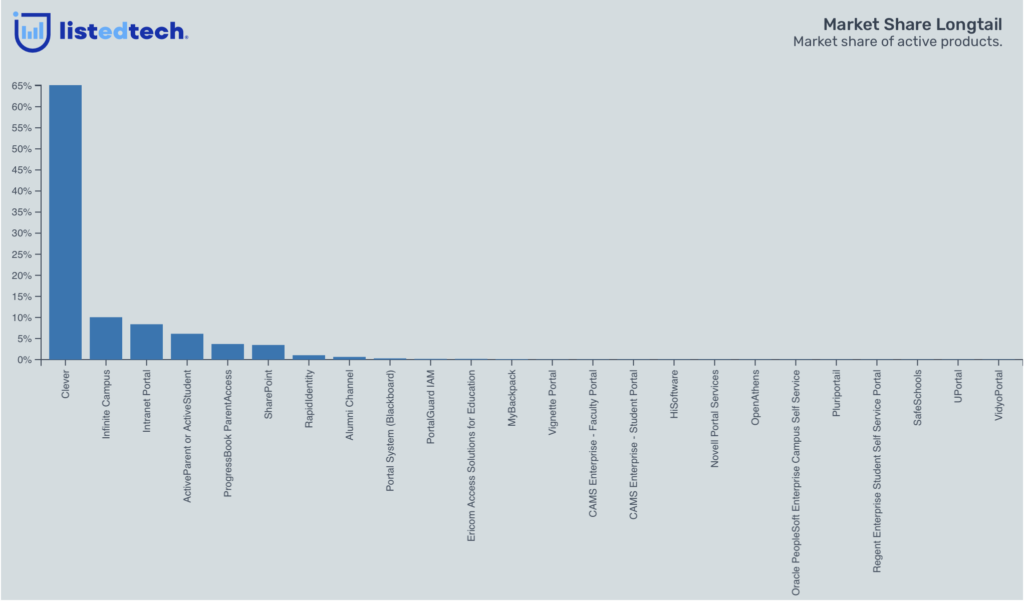

The portal category is very different between K-12 and HigherEd. For K-12, here are the current market leaders:

As you can see, the product category is dominated by Clever. Since its inception in 2012, the company has gained exponential market shares. This prolific growth attracted the attention of Kahoot!, who decided to acquire the portal company in the summer of 2021.

Although it is the preferred solution in all enrollment bands, it performs better in smaller school districts, reaching almost 70%. In larger school districts (14,000+ enrolled students), its competitor is Infinite Campus (with approximately 27% of the market), while Intranet Portal and Active Parent/Active Student compete for their slice of the pie in smaller institutions. Both solutions have a market share between 7 and 10%.

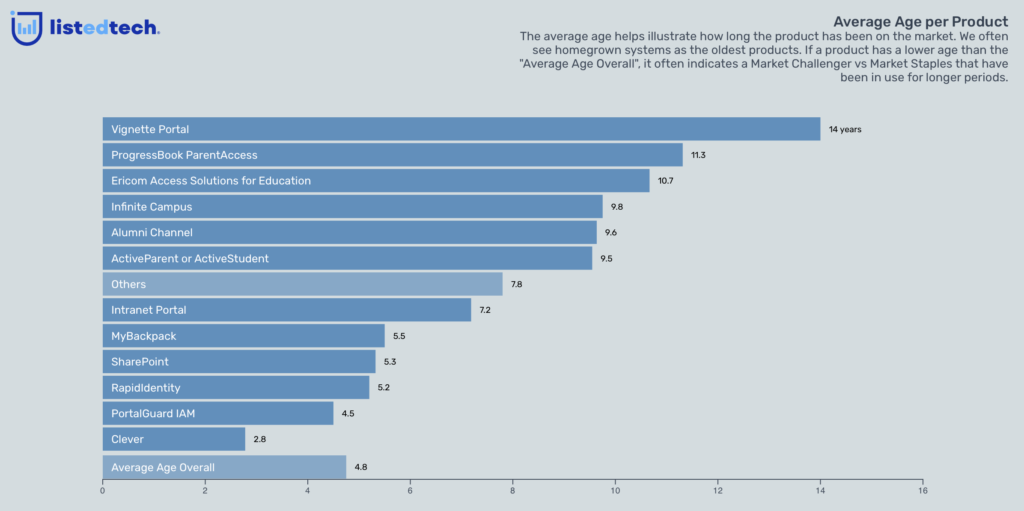

Clever has the smallest average age per product, clocking at 2.8 years. Infinite Campus and Active Parent/Active Student have an average implementation span of 9+ years, and Intranet Portal has 7 years. Clever’s massive growth continues and is accelerated by the Covid-19 pandemic.

The Future of Portals

As our previous post on portals mentioned, the current bubble in the portal category might only be ephemeral. On the other hand, when we see a domination of a new product like Clever, we tend to believe that the portal category is here to stay and that it just needs to renew its functionality offering.