When a post-secondary institution wishes to change its Student Information System software, what is the first question they ask? It’s usually either What system is my neighbour using? or What system is used by institutions of my size?

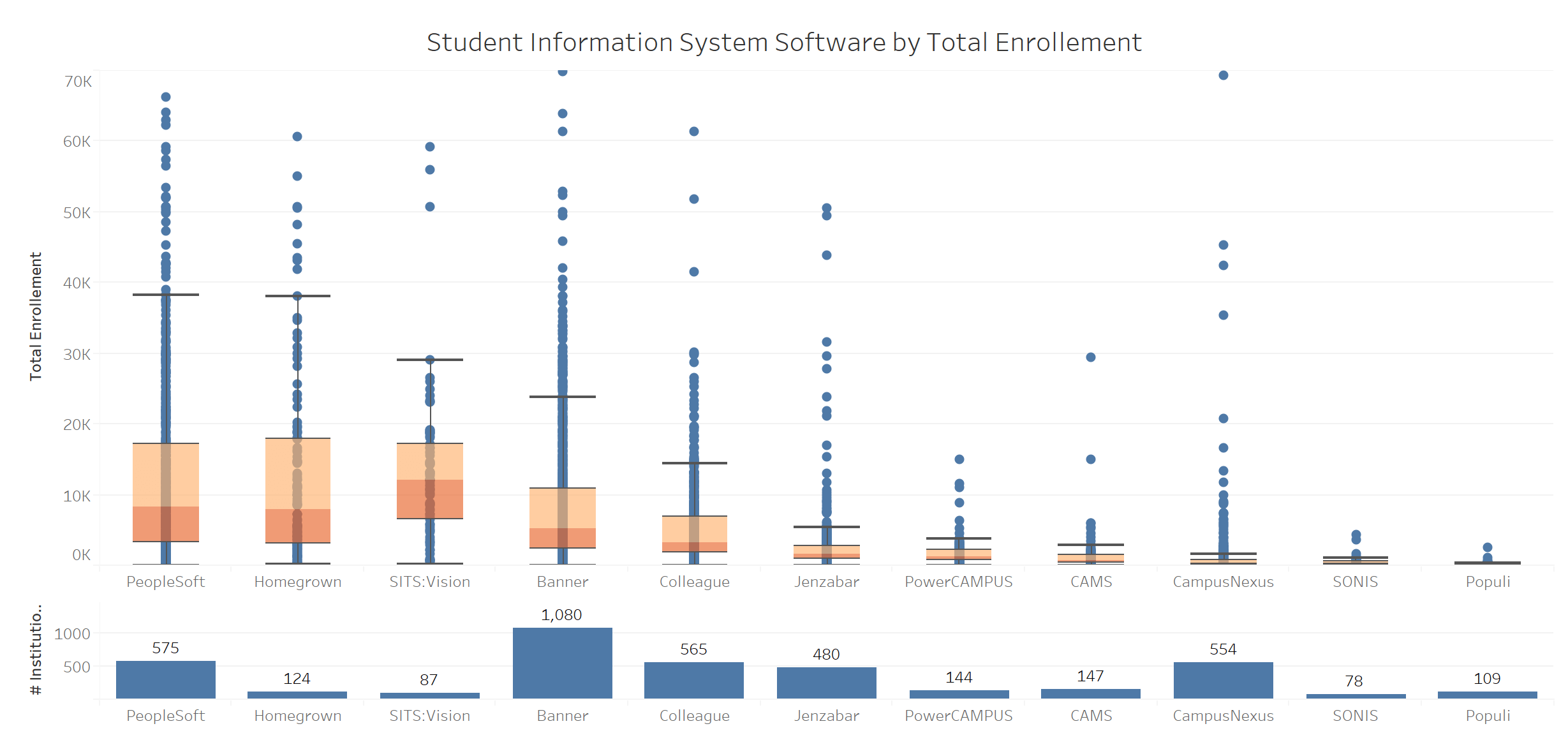

About five years ago when my university (University of Ottawa) started looking for a new Student Information System software to replace our homegrown system, I wish we would have had access to this information, particularly in a graph such as the one below.

Interested in HigherEd Technology? Sign up to receive our free weekly newsletter! We hand pick the most relevant, interesting and important stories affecting HigherEd IT professionals in product selections, implementations as well as system retirement.

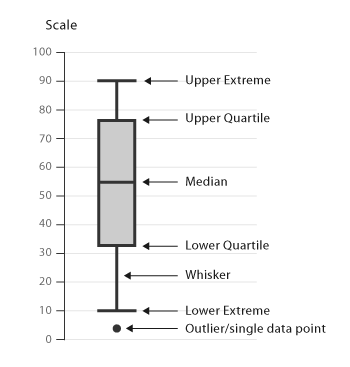

In order to understand Box-and-Whisker Plot graphs, here are a few explanations.

First, you determine the median (value separating the higher half of a data sample from the lower half), then the upper and lower quartiles. Together, these form the “box” which is represented in orange. The upper and lower quartiles are the medians of the upper and lower half of the data set (light and dark orange).

Now the ‘whiskers’ are the minimum and maximum of the “standard” data set, represented by dark black lines in the graph.

Over and below these whiskers are the outliers; the data-points that are considered out of norm and which are outside the box plot.

Observations:

Peoplesoft by Oracle (median 8,315) has the largest spread. It has a client base consisting of mostly large institutions.

Homegrown (median 7,855) has an almost mirror profile to Peoplesoft.

SITS:Vision by Tribal Group (median 12,105) has the highest median.

Banner by Ellucian (median 5,256) has a large volume of clients in the 2,000 to 10, 500 range.

Colleague by Ellucian (median 3,247) has a concentration of midrange institutions.

Jenzabar’s (CX, EX) (median 1,562),PowerCampus by Ellucian (median 1,178) and CAMS by Unit4 (median 636) have almost mirror profile.

CampusNexus by Campus Management (median 371) and SONIS by Jenzabar (median 283) have narrow grouping of institutions if we base it on total enrollment.

Populi (median 128) has the smallest range toping at around 400. They are clearly focused on very small institutions.

ListEdTech tracks over 75 SIS products used in HigherEd; about a dozen of them are what we would consider having wide market appeal. For this graph, we only kept the SIS products for which we had at least 75 active implementations.

The Y axis was cut at 70,000. Very few outliers appear above that number but only for Banner and SITS:Vision systems. Since we are only looking at a subset of institutions for whom we had enrollment, the numbers don’t necessarily represent the total marketshare.