When Finalsite purchased Blackboard K-12’s product suite in mid-September, we finally got the answer to the question from September 2021: what is the fate of Blackboard’s non-LMS products? At the time of the purchase last year, we said that “[b]y merging with Blackboard, [Anthology] gains a robust LMS to complete its product offering.” But we also evoked that Blackboard was more than just an LMS company. With its recent acquisition, Finalsite has become a strong player in two product groups: alert notifications and content management systems.

Many will confirm that Finalsite stays under the radar despite its presence in several product categories. On its website, Finalsite lists solutions in content management systems (CMS), mass notifications, email marketing, enrollment management and marketing services, among others. From its solution list, we can say that Finalsite focuses on content, communication and marketing.

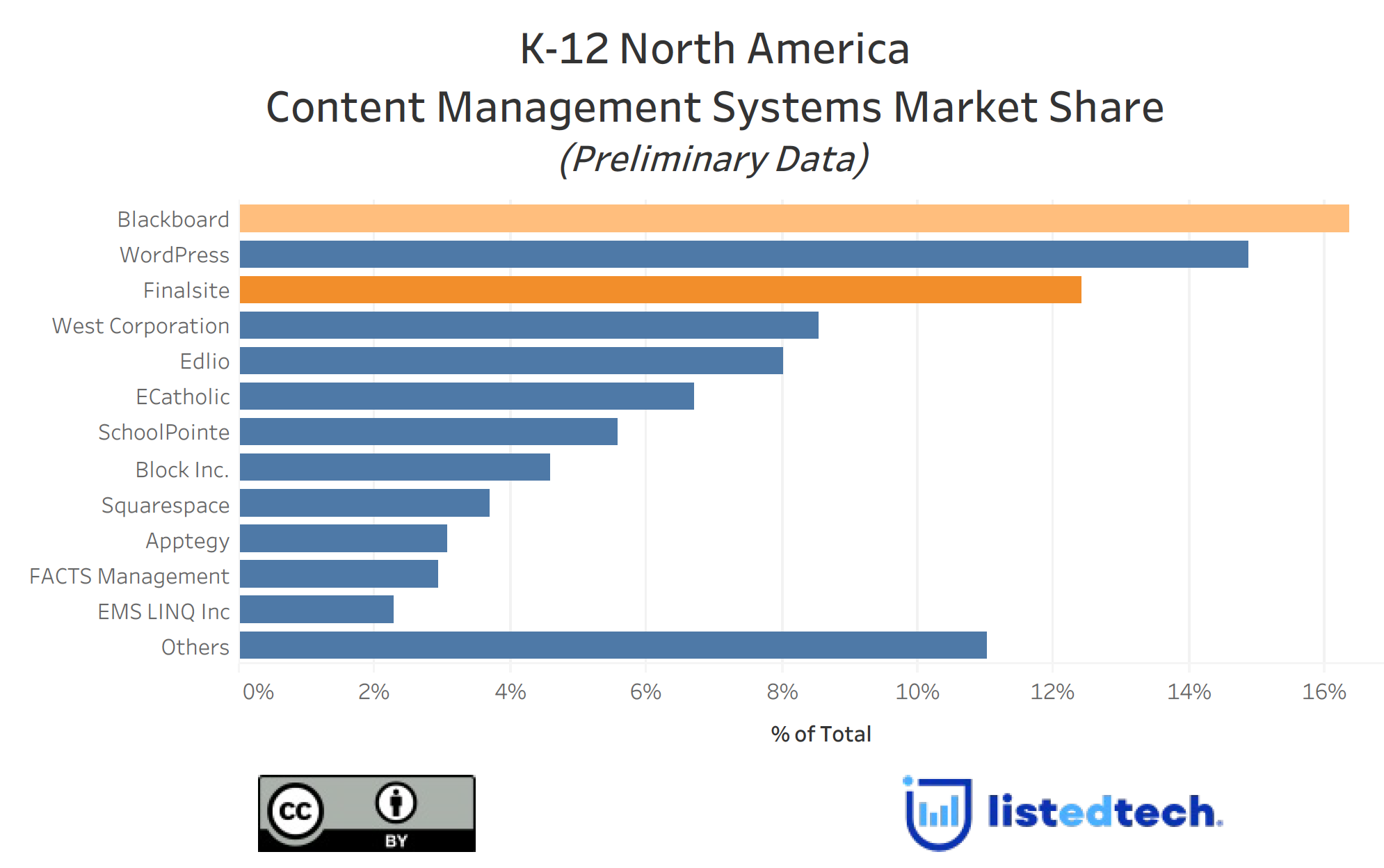

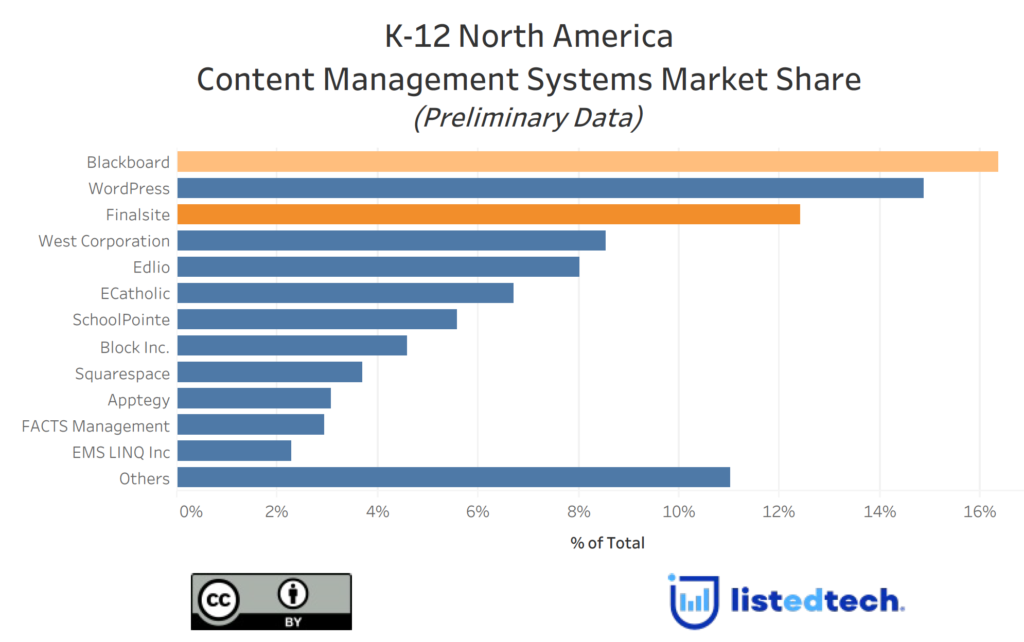

One of the important solutions for Finalsite is its content management system: Finalsite CMS. At ListEdTech, we consider our CMS data to be preliminary as we are not showcasing this product category on our portal. Although our data is preliminary, we are confident that the 4,500 implementations we gathered provide solid trends. Previously the third player in the CMS group, Finalsite now leads the product category thanks to Blackboard CMS’ implementations. Finalsite CMS and Blackboard CMS represent roughly 30% of the market share. WordPress is in second position with 15% of all CMS implementations.

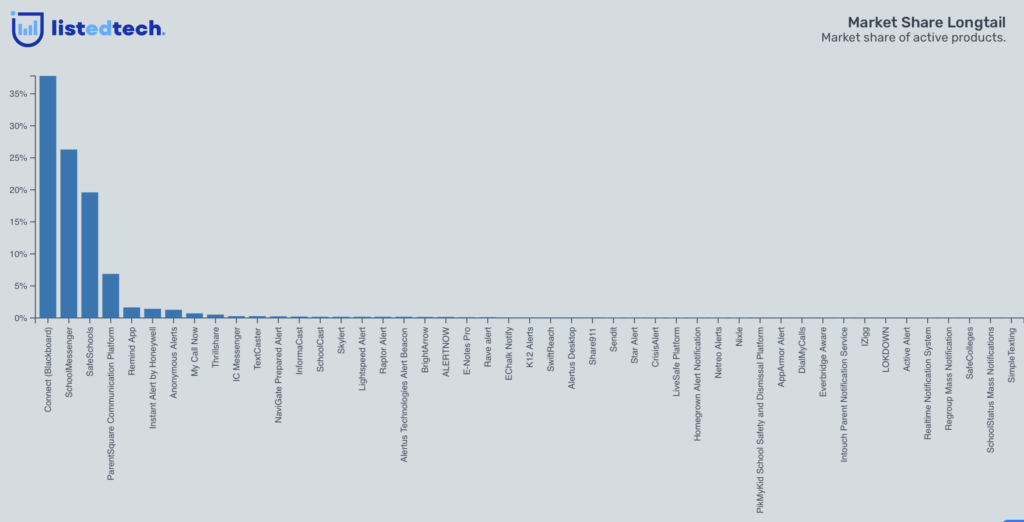

Blackboard is the leader in the alert notification product category. Available on our portal, this product group is key to school district operations. Finalsite mentions on its website the novelty of its mass notification solution. For this reason, Finalsite is absent from the alert notification product group prior to the Blackboard K-12 acquisition. Blackboard dominates the alert notification category with 38%, ahead of SchoolMessenger (26%) and SafeSchools (just under 20%). In school districts with 5,000+ students, Blackboard Connect is used by almost half of them and proves to be successful.

So Why Did Finalsite Buy Blackboard K-12?

It is clear that Finalsite wanted to strengthen its position of choice in the CMS category while establishing a solid reputation in the alert notification group. Without Blackboard K-12, the ascent would have been difficult. Finalsite’s Founder and CEO Jon Moser explains: “This acquisition brings together the brightest minds in K-12 edtech, accelerating transformative improvements in everything from our product development to our customer service.” On the Blackboard K-12 team, the enthusiasm is contagious. “With Finalsite’s comprehensive portfolio [explains Blackboard K-12 President Lee Blackmore], our K-12 clients will be positioned to continue to deliver critical communications at scale while continuing to receive the comprehensive and dedicated support for which we are known.”

Going from 1,000 clients to over 7,000 clients and doubling its workforce to 500 employees, Finalsite now has the challenge of meeting the expectations of its many new customers and continue to offer innovative products to stay on top of its game.