In January, I was invited to NJEdge’s Conference to be part of a group discussion. It was a fun conference with great people. One of the discussions was surrounding NJEdge’s negotiated contract agreements for educational products. Being curious, I wondered how many members were using these negotiated or preferred pricing?

This got me thinking about all the other COOP/associations/consortiums that offer similar services. To be fair, this type of association offers many different types of services, everything from thought leadership to collaboration with community members, professional development to conferences, solution curation to access to top software executives. My goal is in no way to compare them. I’m simply wondering if the cooperative negotiated contracts are being used by its members?

I limited my analysis to identifying the agreements for LMS and ERP products since almost all institutions are using one of these systems.

I used the following associations:

I mapped almost 1,500 higher education members from the above five selected consortiums with our DB. This would help me see what products they are using and then I could flag for which products each consortium has agreements.

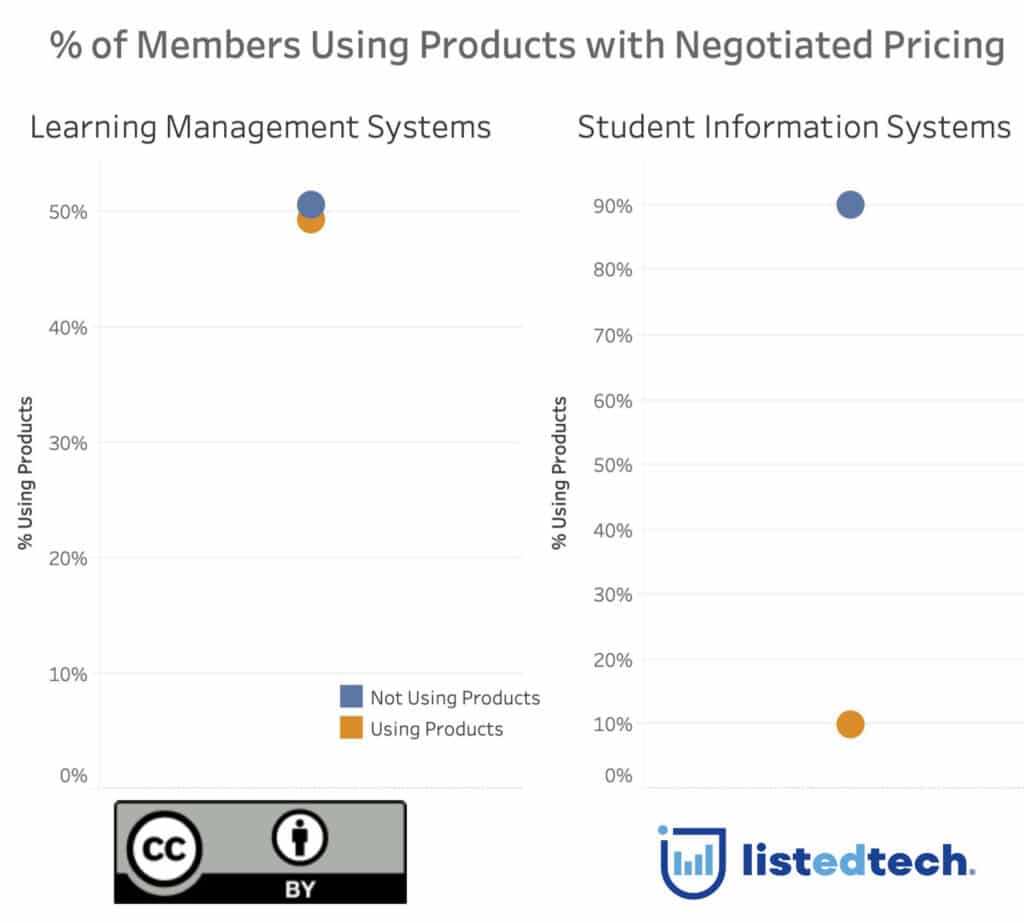

The graph below shows that for the LMS products, 50% of the cooperative members are using the product for which there is an agreement. When it comes to SIS systems, the proportion is only 10%. It is possible, and even probable, that there are schools using the chosen LMS / SIS but have a separate contract or even a pre-existing contract.

Why is there such a difference between LMS and SIS? I think that since LMS has a shorter life span (about 7 yrs), they get changed more frequently and therefore member institutions are able to benefit from negotiated pricing. This is in contrast with SIS (lifespan of about 14 yrs) where members institutions will most probably start using the negotiated pricing at its next purchase. Also, the COOP systems are fairly new in offering price discounts.

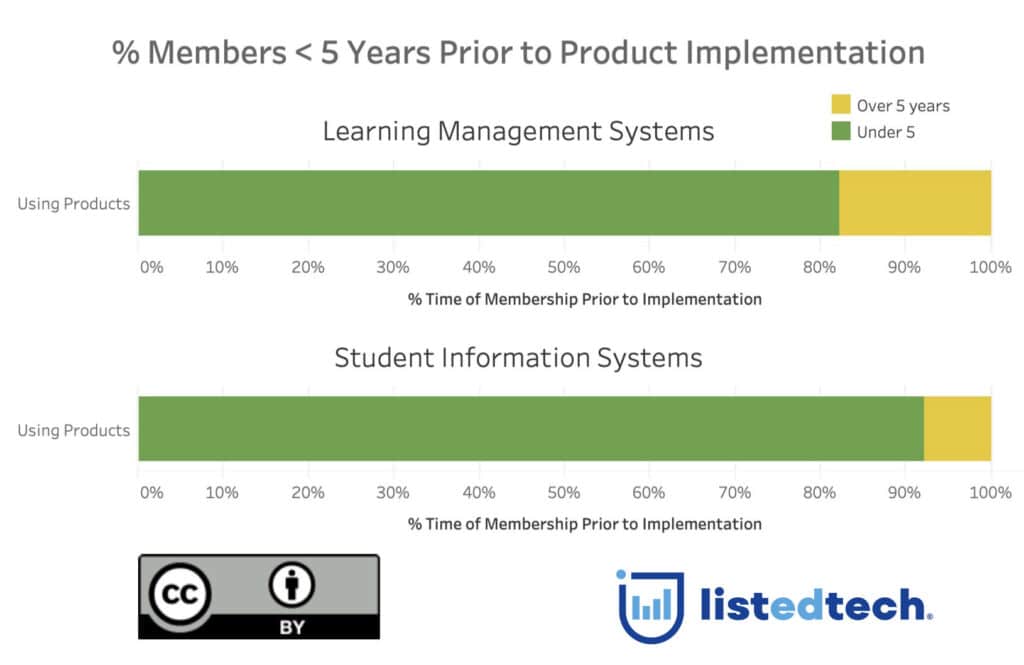

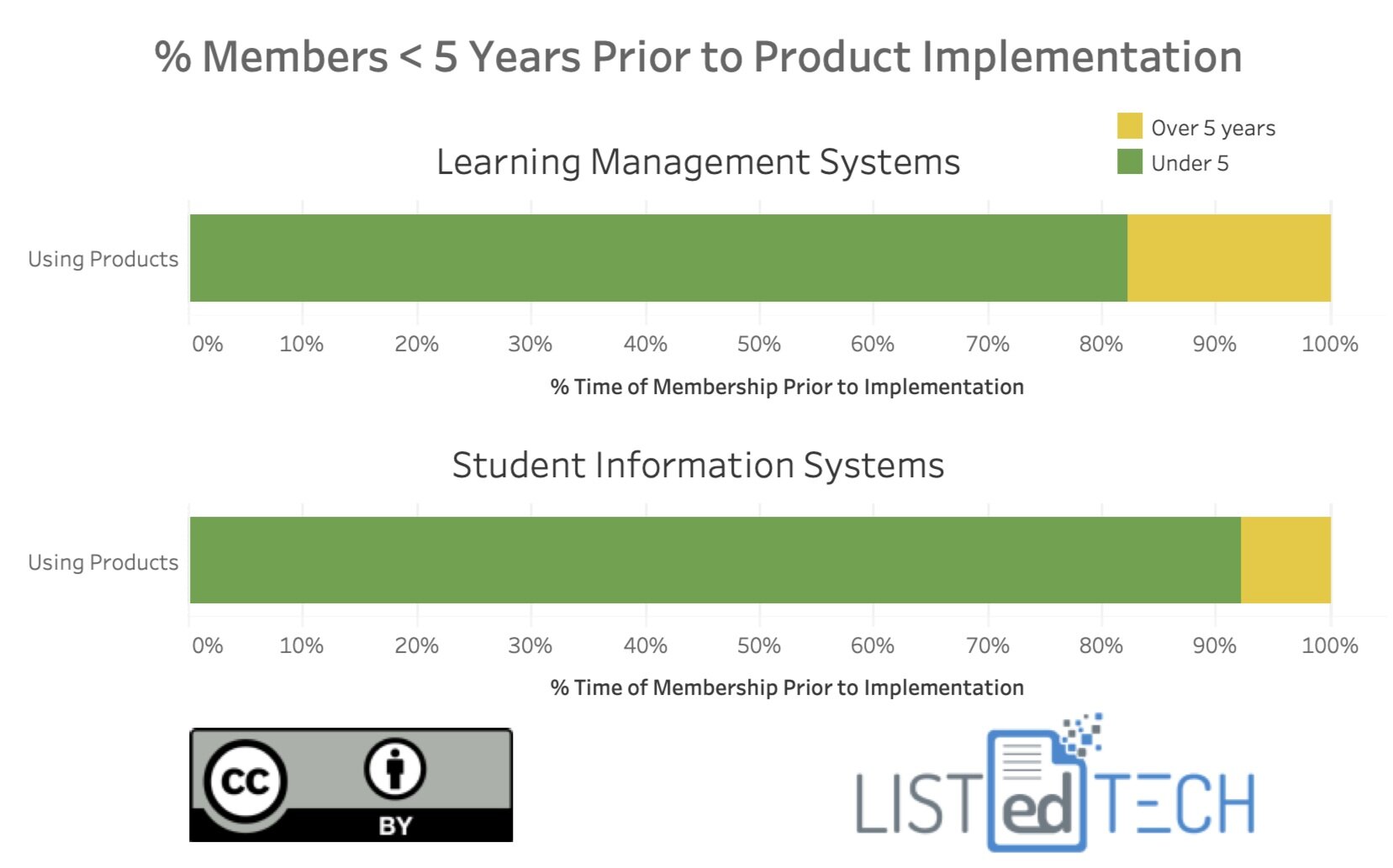

As mentioned above, only 50% of member institutions are using the negotiated contracts for LMS and 10% for SIS. But an interesting point is that for the institutions that are using the products, over 85% became members 5 years or less before implementing their product. With this high ratio, we can assume that the negotiated agreement was probably an incentive for them to become members.