As promised in our last post, we will look at the HigherEd institutions that are currently running a Canvas pilot. Pilots are an experimental feature of the ListEdTech wiki so comparisons to other vendors are difficult at this point. Consequently, we will only focus on the Canvas pilots for now. We can however tell you that the pilot data we’ve scraped so far overwhelmingly concerns Canvas…

Overview of our Pilots Data

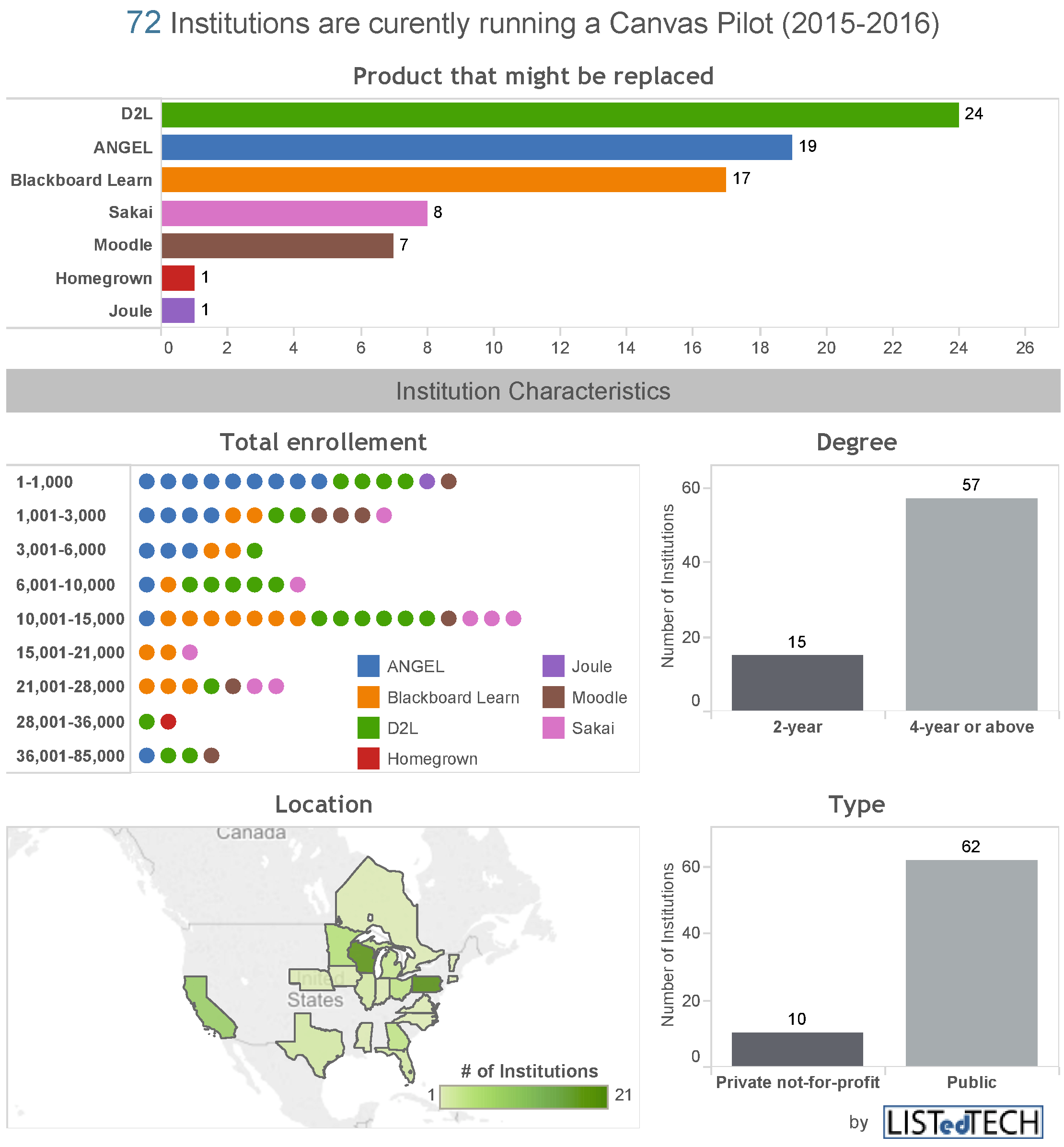

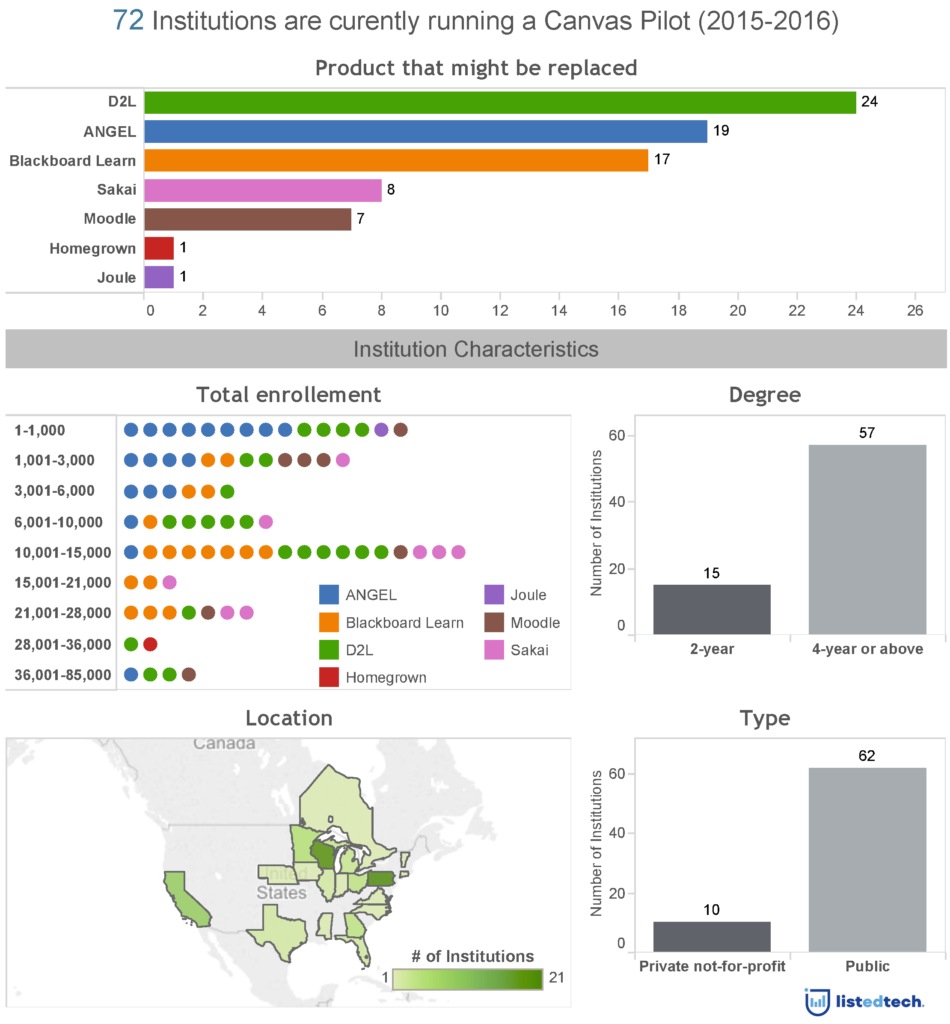

Currently, 72 higher education institutions are listed in the ListEdTech wiki to be piloting Canvas, but its safe to assume that it’s also being piloted by others HigherEd institutions. The 72 pilots have all started in 2015 or will be starting in 2016.

What do we exactly mean by “pilots”? First off, let’s explain what it is not. A pilot is not a sandbox. Some institutions are currently experimenting with a sandbox version of Canvas in order to get some hands-on experience and understanding of the product. We do not consider those to be pilots.

We are talking about a pilot when it is running actual courses with students. For a HigherEd institution to run a pilot, an institution has to pay a certain amount of money. There is therefore a level of investment/commitment. This is probably why over 75% of the institutions that have had a Canvas pilot proceeded to the purchase of the product (this is verified via our data and from a source at Canvas).

It is important to note that our sample of 72 higher education institutions (except 1) that are currently piloting Canvas is US based. The reason why is that we deliberately focus our scraping activities towards the North American market. As a side note, we are currently expanding our reach to other markets, in the hope of eventually providing our readers with other geographical market analysis.

Lead Indicators of Market Movement

Why is it important to look at pilot programs? We consider them as important lead indicators into how the market will evolve in the near future.

For example, from our sample of 72 institutions that are currently piloting Canvas, it is therefore interesting to see what LMS they are potentially transitioning from. Below is a high-level view of that market movement, with further detail as to how that translates within sub-segments of the North American market.

While keeping in mind that our analysis is based on preliminary data of pilot programs in North America, we can still formulate a few noteworthy observations. Of the institutions that are running a Canvas pilot…

The top 3 LMS they are currently using are D2L, Angel and Blackboard.

They are of all enrollment sizes. It’s also worth noting how it seems like a high percentage of small institutions are currently using Angel.

They are from 18 different states and 1 province. Note that Wisconsin and Pennsylvania currently have a State-wide pilot.

They is a 20/80 split between colleges and universities.

They is also a 20/80 split between private and public.

What do you think of this possible shift towards Canvas? Is it something you are observing when talking to your peers? We’d love to get your feedback via info@listedtech.com, the comments section or social medias.