There has been ongoing talk and pushback about the proper use of student data within popular ed tech platforms. For example:

Piazza (https://mfeldstein.com/popular-discussion-platform-piazza-getting-pushback-selling-student-data/)

Instructure (https://www.ubyssey.ca/features/double-edged-sword/)

Google (https://www.nationalreview.com/2018/09/google-co-opts-schools-collecting-students-data/)

While there are plenty of arguments about why or why not it is beneficial for ed tech platforms to harvest and analyze large volumes of student data, it would be useful to just get a sense of which companies have the greatest number of student records and how many each holds in either a managed hosting or cloud hosting platform.

To limit the scope of this experiment, I will limit myself to 3 products: Student Information Systems (SIS), Learning Management Systems (LMS), and email. These are the 3 systems that almost all K-12 and higher education institutions use. We are looking at:

Higher education and K-12 institutions in the US and Canada,

Systems used by students, and

Systems hosted by the vendor (managed hosting or cloud hosting).

If an Institution has two products from the same company, for example Google Gmail and Google Classroom, we count this one time to focus on the number of students using a company’s platforms.

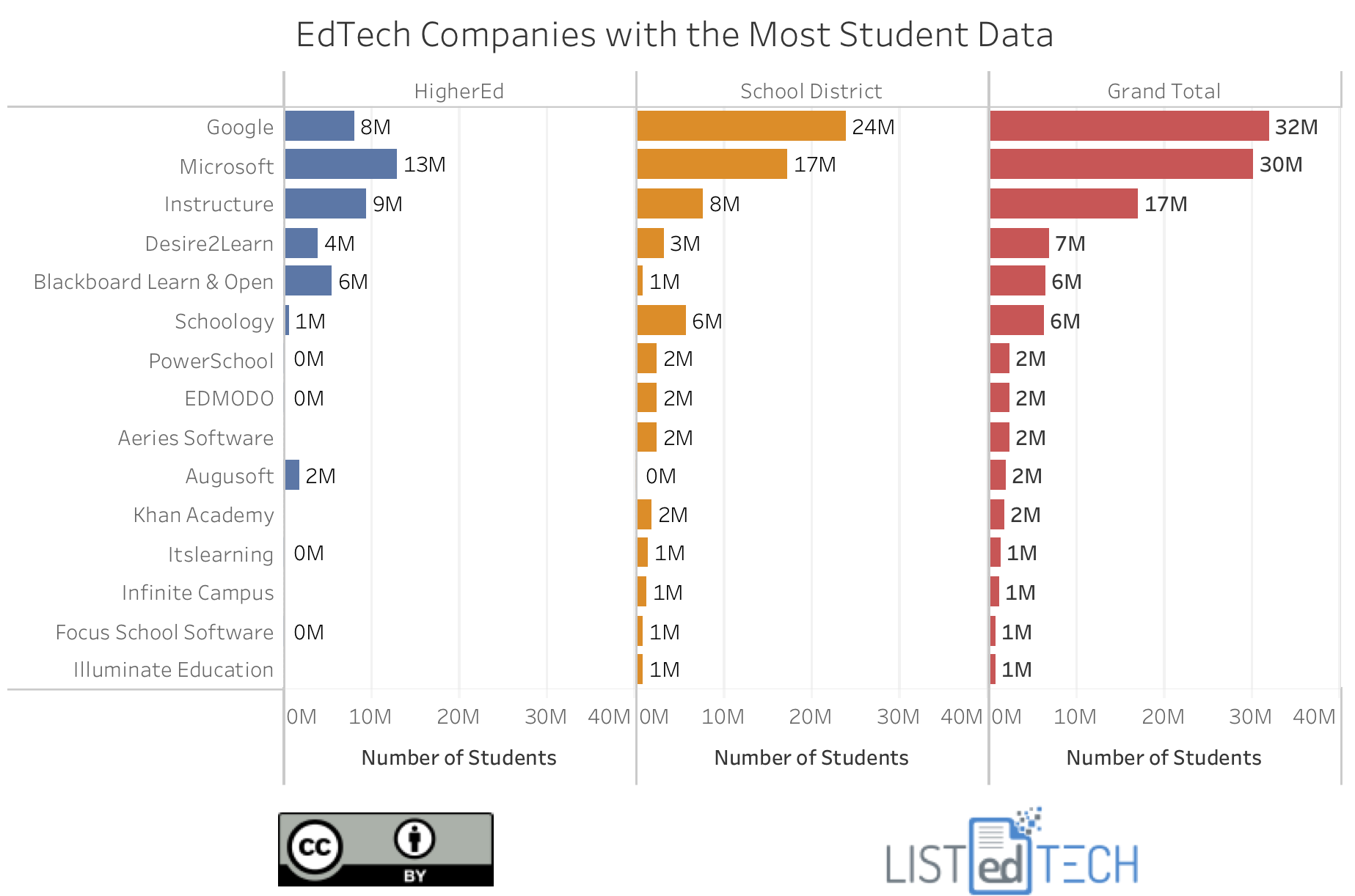

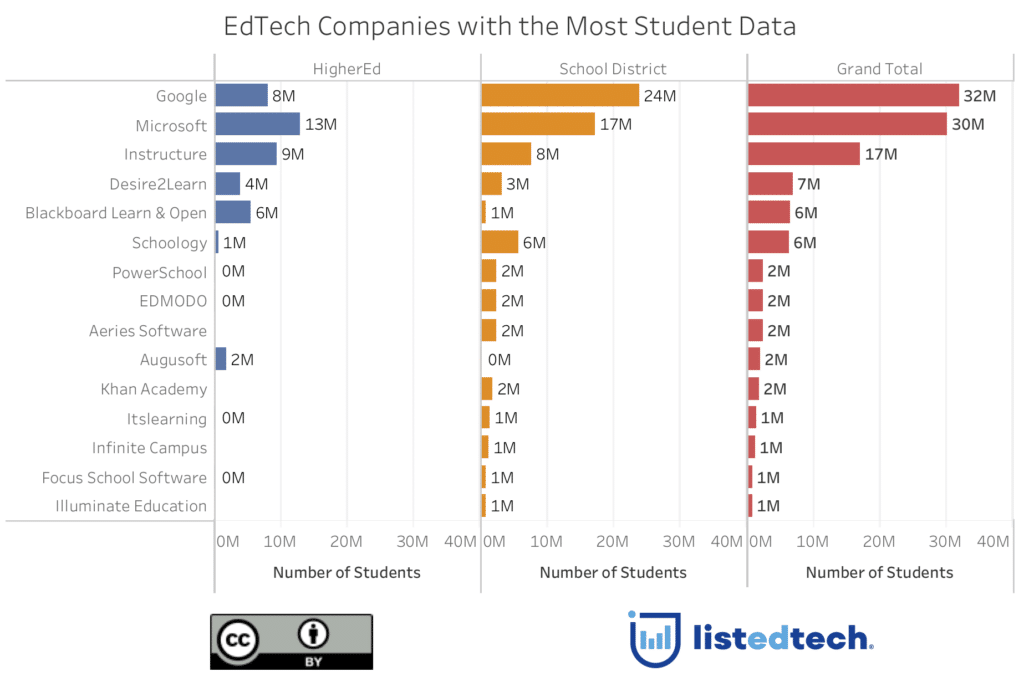

Not surprisingly, Google and Microsoft have the most data largely due to their email systems. Google also has a significant amount of K12 LMS data because of the popular Classroom system.

For the LMS companies, Instructure (with its Canvas system that is native cloud hosted) has by far the most student data. Then we have D2L, Blackboard (Learn as well as Open LMS) and then Schoology.

We list SIS providers (largely K-12, as higher education institutions are more likely to be hosted on premises) such as PowerSchool, Edmodo, Aeries Software and Augusoft

Khan Academy, itslearning, Infinite Campus, Focus School Software and Illuminate Education round out the over 1M group.

Ideally, we would also look at MOOCs and OPMs but this will have to be done in another post.