As you all know, we at ListEdTech collect information on who uses what system in the higher education market. We also collect information on dates and we have recently started to capture information on the implementation partners who help higher education institutions (more on this in the next weeks). Some of the dates we try to collect are the purchase and the implementation dates. Using these data points, we can calculate implementation times.

A few definitions:

We are only looking at new system implementation, not system upgrades;

Purchase date: most often the date at which the institution does a news release stating that they have selected product “A” after a long process that involved many consultations and;

Implementation date: the date when the product goes live – other modules may be implemented after that date, but the main system is live.

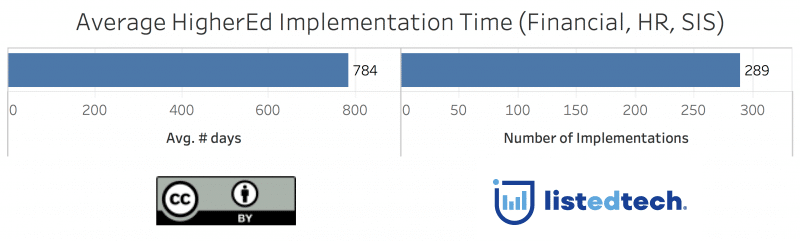

Based on 289 HigherEd implementations, a typical implementation of a new (not an upgrade) system takes about 26 months.

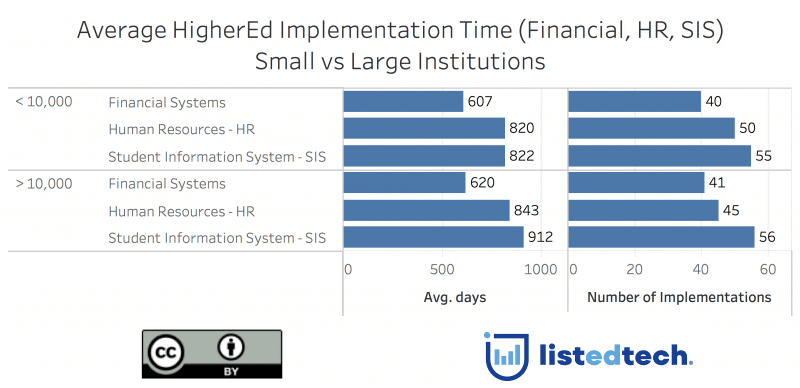

The following view separates the institutions by enrollment size: small (under 10,000) and large (over 10,000). The data shows no real difference in implementation time.

Interested in HigherEd Technology? Sign up to receive our free weekly newsletter! We hand pick the most relevant, interesting and important stories affecting HigherEd IT professionals in product selections, implementations as well as system retirement.

[do_widget id=mc4wp_form_widget-3]

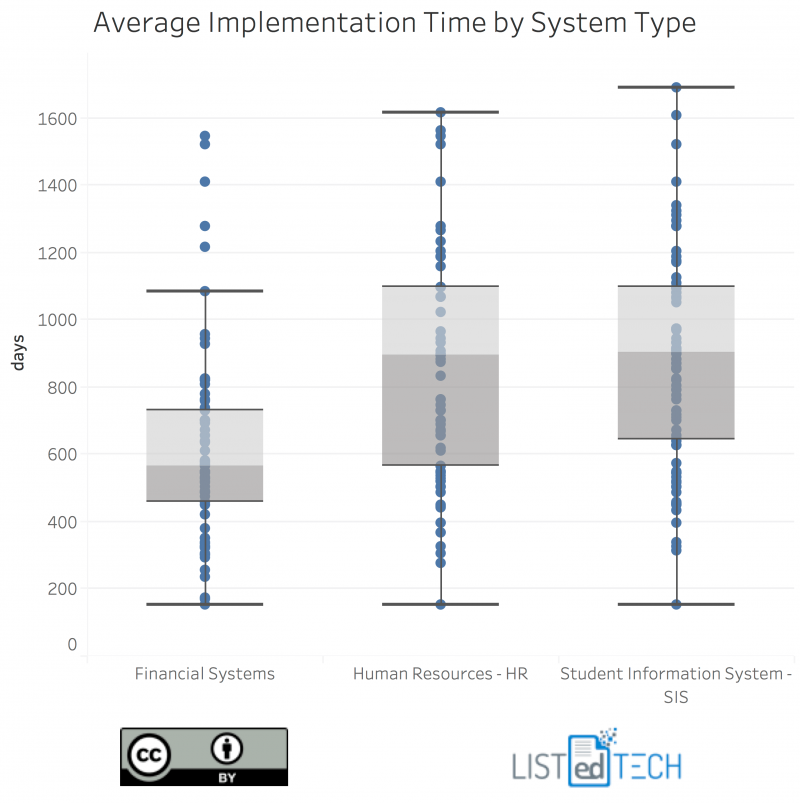

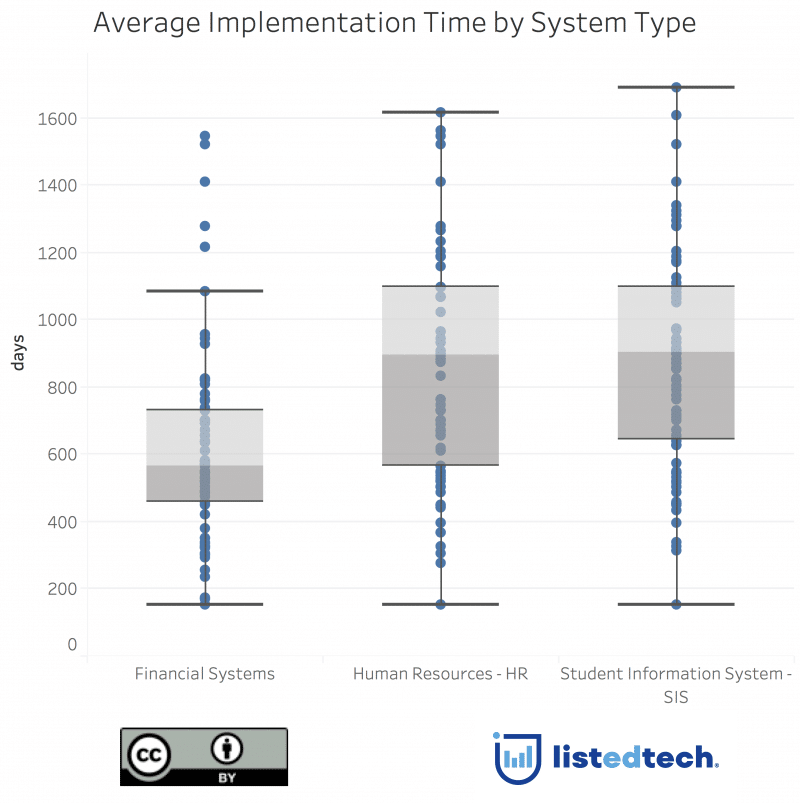

If we split them up by system type: Financial, HR, Student information system, now we see differences in implementation times. You can see that ‘Financial systems’ has the shorter time often being the first system to go live if all three systems are being implemented at once.

In order to understand Box-and-Whisker Plot graphs,