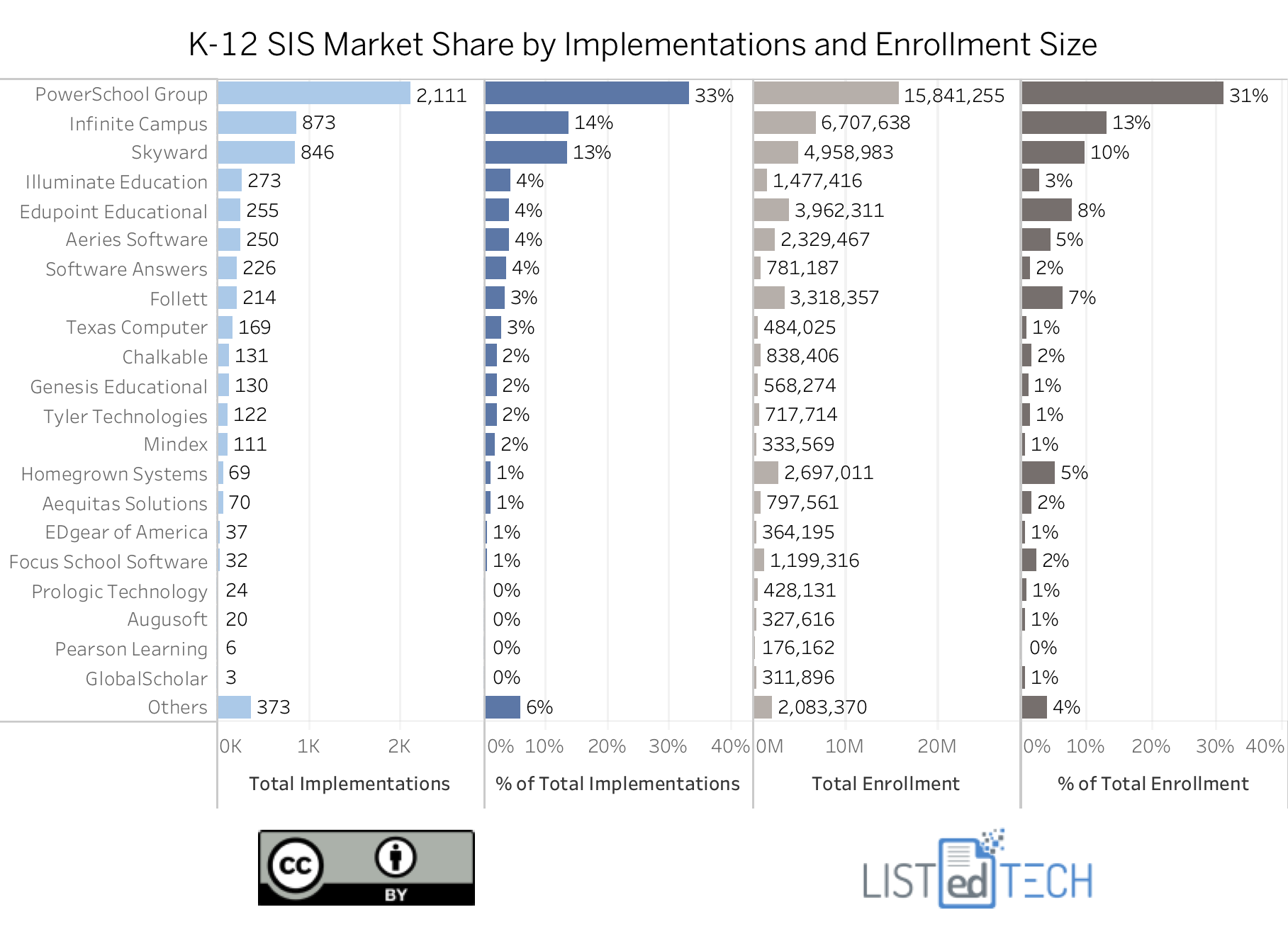

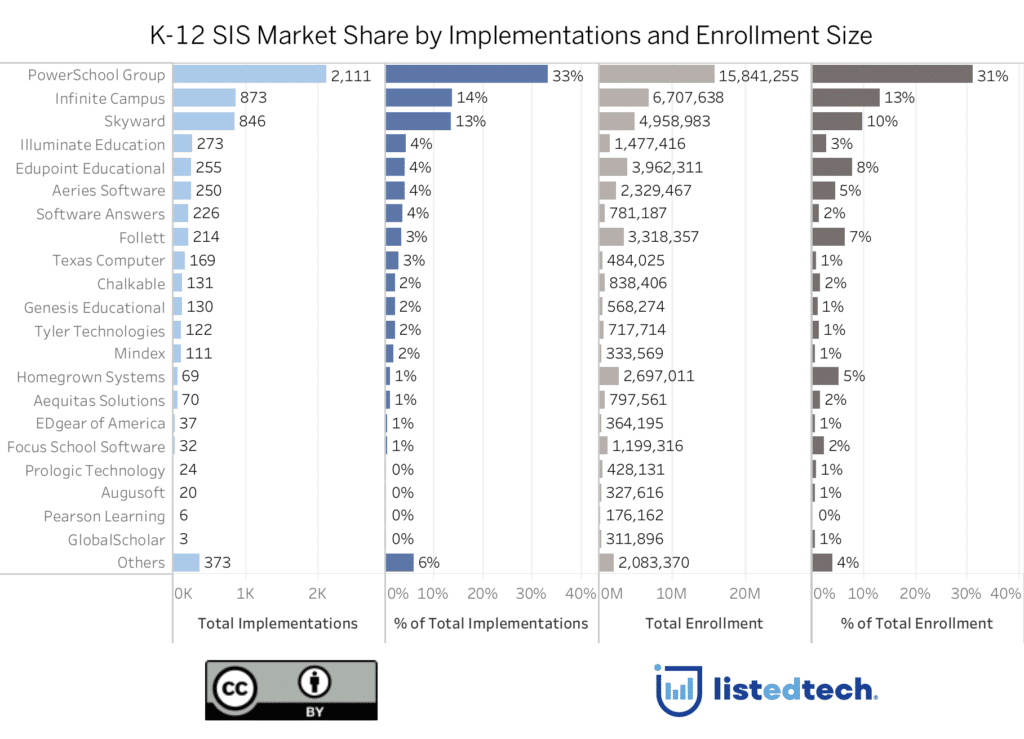

Last week, Wade Tyler Millward wrote an article on EdSurge, “Illuminate to Sunset Student Information System in 2021“, in which he presented one of our graphs to show the relative market share in the K-12 SIS market. His goal was to show the impact of such an action from Illuminate. According to our data, this will impact under 300 school boards.

Since our post in June, where we showed the reference data, we added about 1,000 Canadian and American school boards to our database. So, we wanted to give an update on the numbers.

An important note here is that the graph now shows enrollment size and number of implementations.

Also, it is worth mentioning that our methodology was to add the biggest school districts first to reduce the impact on the market share the further we go down the list.

As of October 1, 2019, we can state that our data represents more than 85% of the estimated 56.6 million students in the USA and 5 million students in Canada. We are still working to add more school boards (those with a total enrollment of under 2,000 students).

A few points to look at on the graph:

Homegrown systems have very few implementations but are installed in big school boards; they represent only 1% of school boards but 5% of students.

Other discrepancies:

Follett: used by 3% of school boards but 7% of students

- Edupoint Educational: used by 4% of school boards but 8% of students

Skyward: used by 13% of school boards but 10% of students

Note on data: to create this graph, we used total enrollment numbers available in the IPEDS 2016 database for American school boards. Canadian school boards enrollment sizes were added using the numbers available on the province’s website.