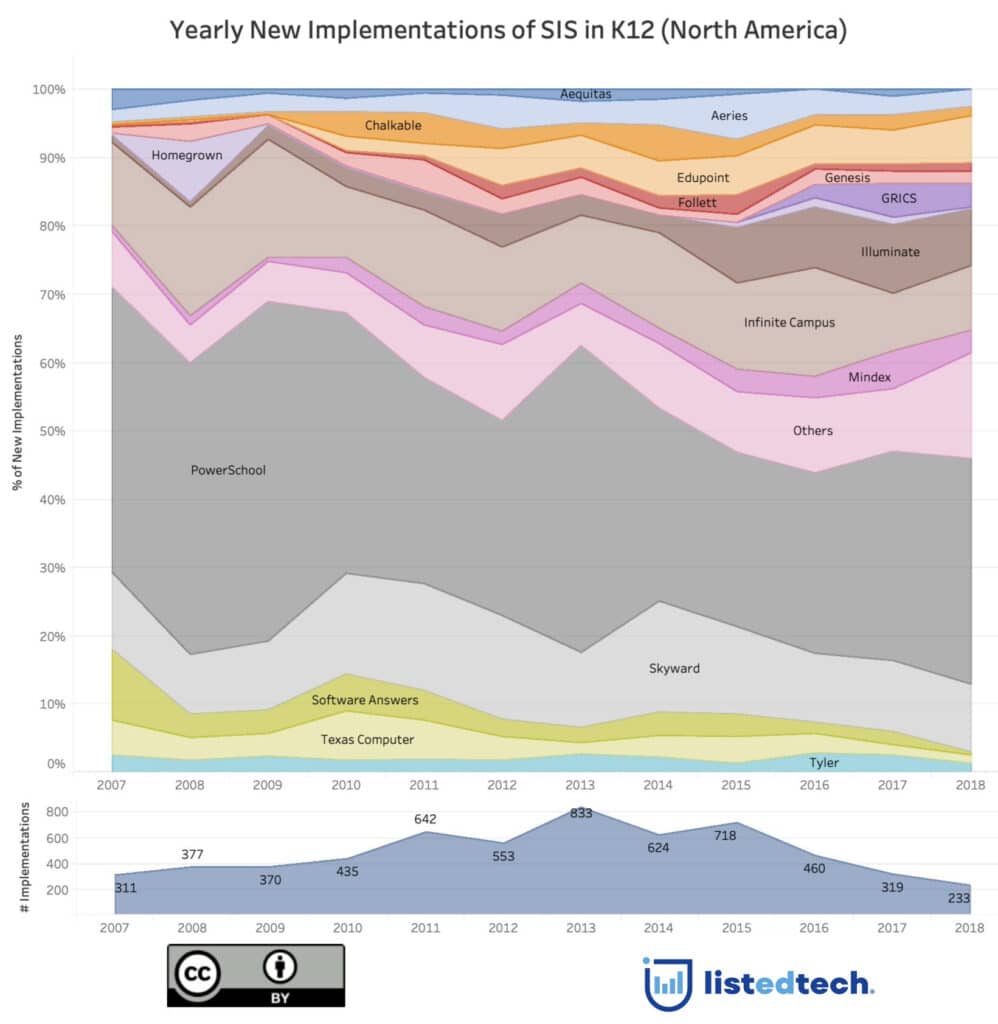

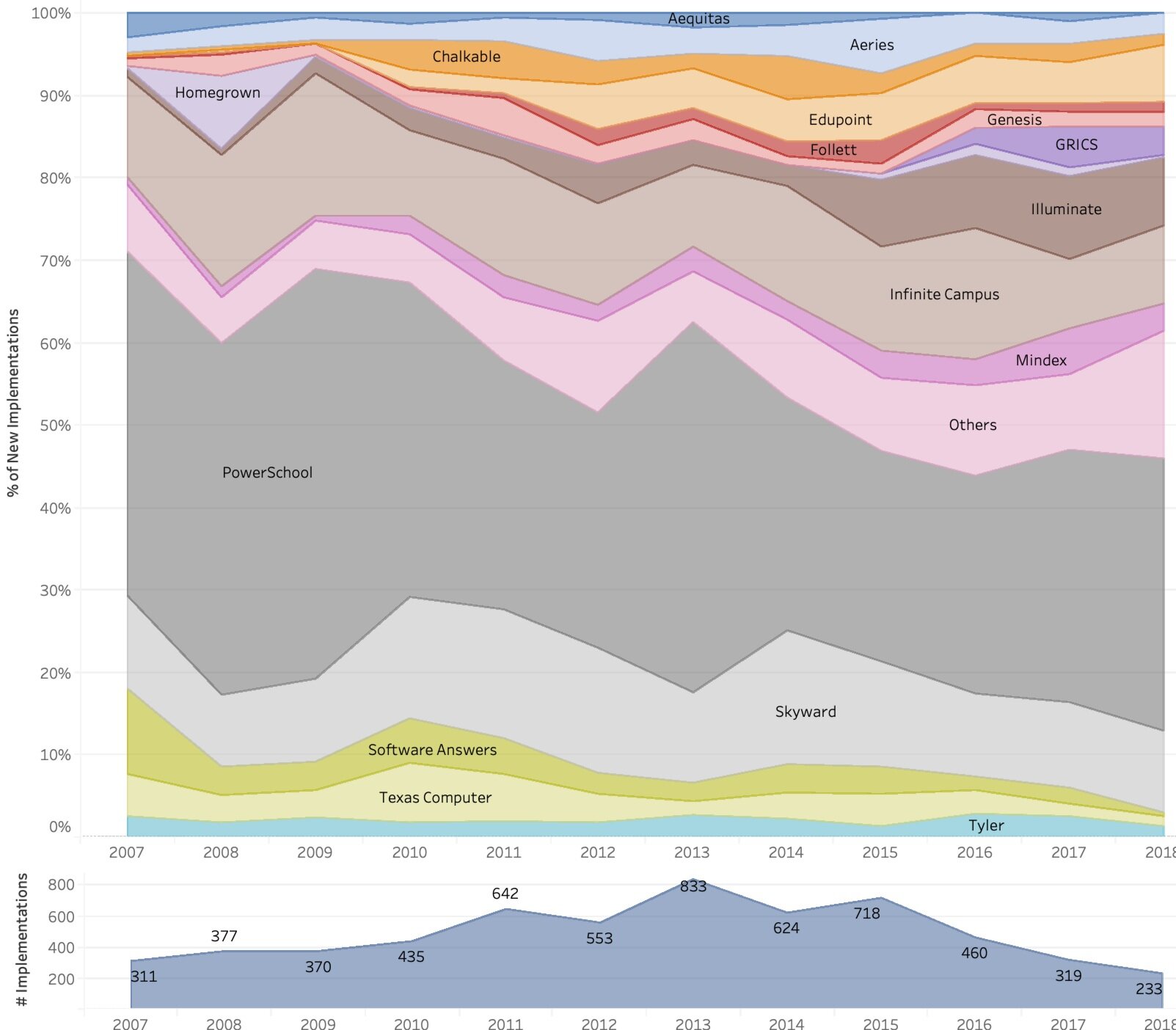

This historical view of new implementations in K12 SIS Student Information Systems is based on almost 7,100 school districts in the USA and Canada. It represents 53 million students or 86% of the total number of students enrolled in elementary and secondary school programs in Canada and the USA.

I like this view since it shows the progression or momentum that a company/product has in maintaining or increasing its market share via new clients. This does not represent market share per se, but it does help illustrate future market share. An example is PowerSchool that currently has 33% of the overall market share as seen in a previous post (https://www.listedtech.com/blog/k12-sis-market-share-update). Therefore, to maintain its market share, PowerSchool would need to average the same 33% in new implementations every year. However, the graph below shows that it has struggled to attain that number and is now down at around 30% of new implementations every year.

Currently, the players who are increasing their percentage of new implementations are Edgpoint, Illuminate, and Mindex. Skyward, on the other hand, has decreased (like PowerSchool) the rate of their new implementations.