Following last week’s post on system lifespan for ERP and LMS systems, some followers and weekly readers asked me if the trend seen for these two systems is applicable for the other product categories.

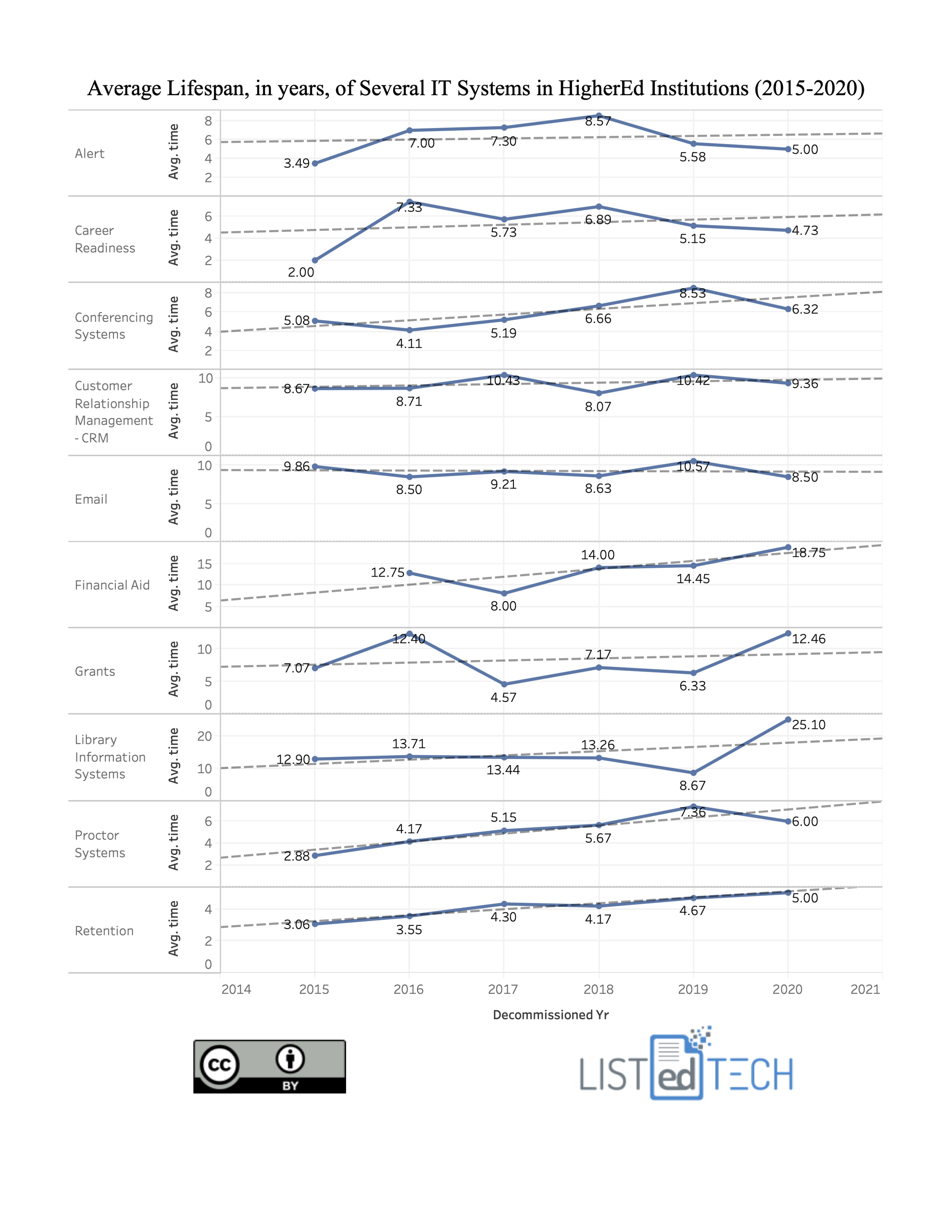

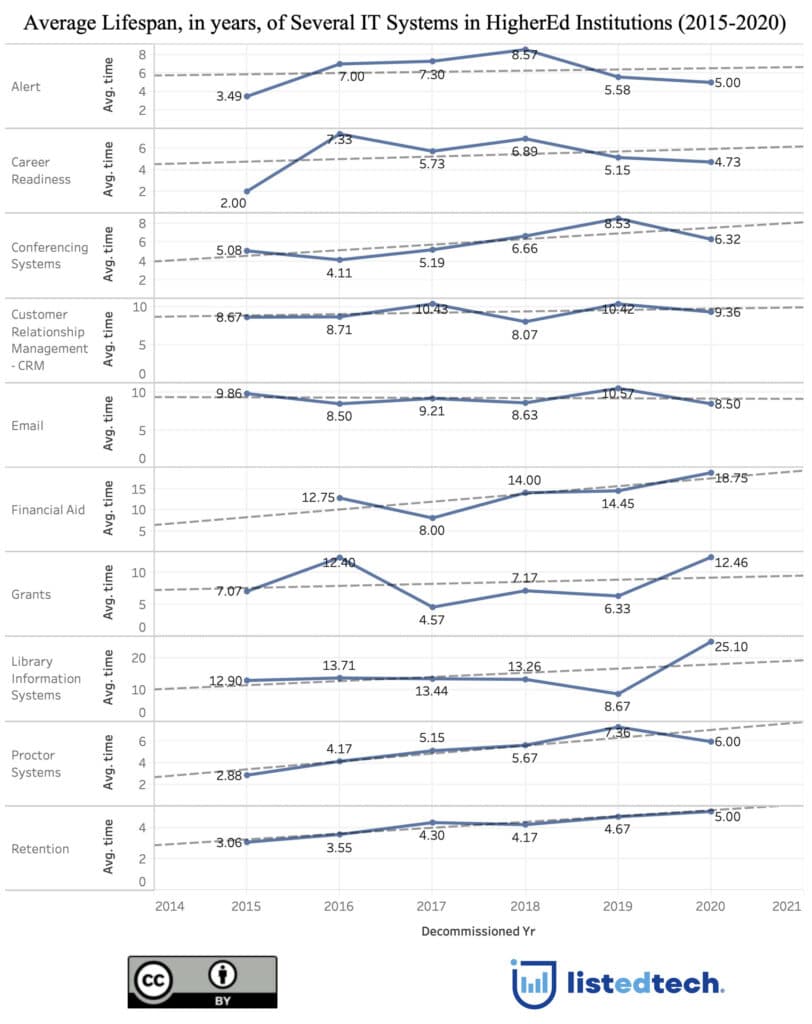

As you can see in the graph below, there is no “one size fits all” in the case of product lifespan. We can place the product categories into three groups:

Flat line (no or very little changes over the past five years): Alert, Career Readiness, CRM, and Grants.

Increase in lifespan (slight or moderate): Conferencing systems, Financial Aid (the biggest one for this week’s graph; comparable to LMS and ERP), Library Management Systems, Proctor, and Retention.

Decrease in lifespan: Email.

Why are email systems the only ones being replaced more frequently? Is it because of the fierce fight between Microsoft and Google to gain more clients? Is it because it is easier nowadays to switch from one email solution to another? One thing is certain: out of all the product categories, email systems are the only ones being replaced at a faster pace in 2020 compared to 2015. And even with this faster pace, it still takes an average of more than 9 years to see a switch in this category.

We can also note that, except for Financial Aid, Grants, and Library Systems (especially in 2019 and 2020 for the latter), the product lifespan for the other product categories remains very close to the trend line.

Interesting in getting more drill-down information on product lifespan? Please reach out to me.

Data Note:

We only selected systems for which we have implementation and decommission dates available.

We also removed all institutions that have closed over the period to avoid data discrepancy.