By: Phil Hill and Justin Menard. Cross-posted at e-Literate Three and a half years ago Phil wrote a post “Snapshot of LMS Market for Large Online Programs in the US” giving a view into this growing segment of higher education. Large online enrollment institutions typically mean a centrally-coordinated provision of online courses, often with duplicate course sections, and these programs tend to use more of the LMS than ad hoc online courses or blended courses. Further, these programs are dynamic – they are far more likely to grow significantly or shrink significantly than face-to-face or blended programs. As such, this segment can have different usage patterns than the broader market. Thanks to the partnership between e-Literate and ListEdTech, we have a much richer data set now. One of our subscribers asked a question over the weekend about this subject, so it seemed time to update this view.

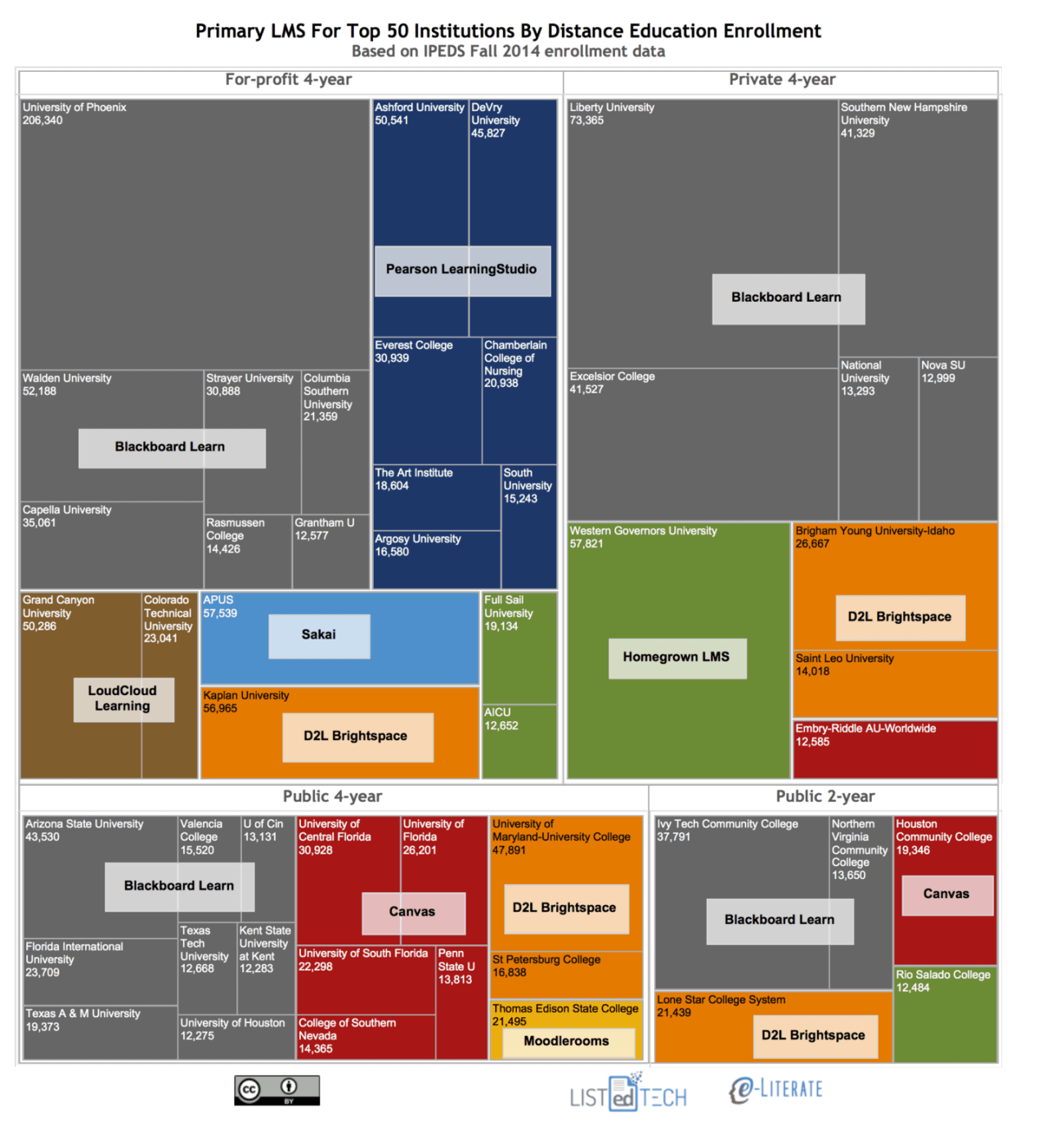

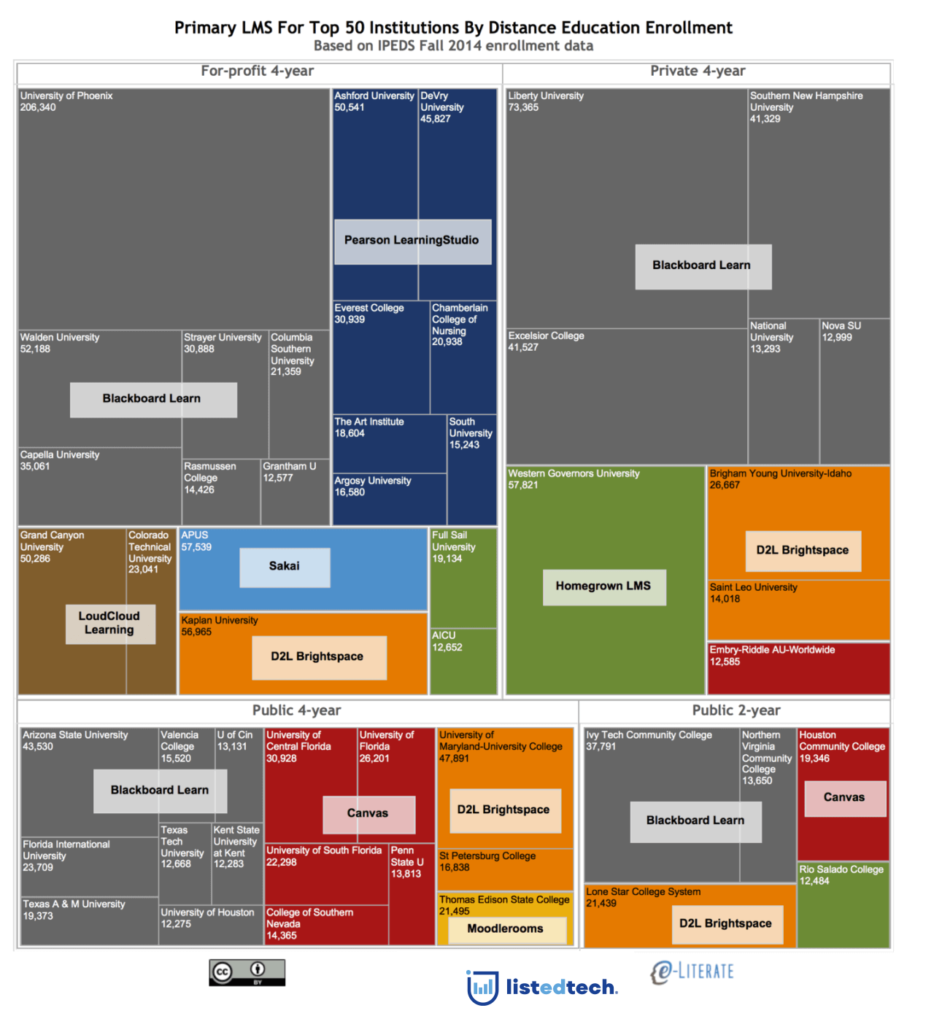

What we are showing below are the 50 institutions with the greatest number of students taking at least one online class based on the IPEDS database, for graduate and undergraduate combined. The most recent enrollment data set was for Fall 2014, so the enrollment data is slightly out of date. But the LMS listings should be up-to-date. In fact, we are showing some leading data, such as the University of Phoenix usage of Blackboard Learn and Kaplan University usage of D2L Brightspace – neither school has fully transitioned to the new LMS, but they have made official decisions and begun deployment. We have grouped the schools by sector, as well.

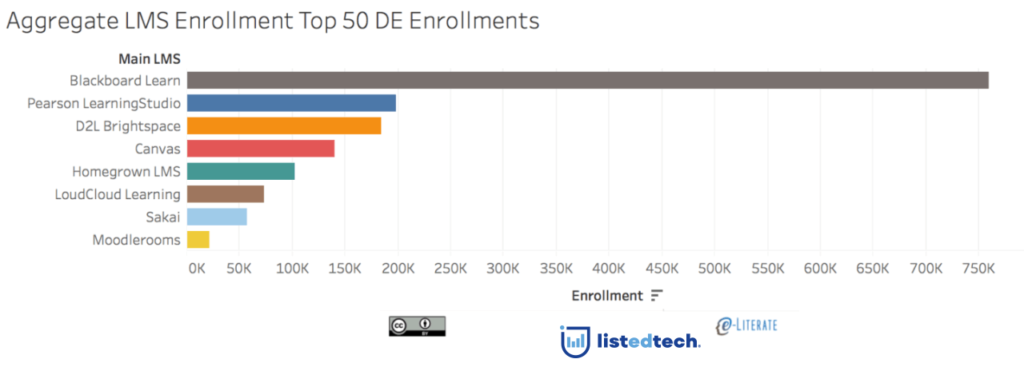

If we aggregate the total enrollment data of these top 50 programs by vendor:

Some notes:

Blackboard clearly dominates this list, but there is an important caveat. The University of Phoenix (206k students in Fall 2014 data) has not fully migrated to Learn Ultra yet, as they move off of their homegrown LMS. But even if one ignored this case, Blackboard is still the largest provider for this segment.

Pearson LearningStudio has been announced as going end-of-life, and all clients will be migrating to other systems by the end of 2017 (roughly). The biggest announced change to date has been Kaplan University, which moved to D2L Brightspace, but there are many more to come. Soon.

The for-profit sectors have taken a beating and current enrollment is lower than the Fall 2014 data.

The Fall 2015 data is expected by January, so we will update accordingly. Also expect changes as more Pearson LearningStudio clients announce their new LMS.

Given the changes in this area, particularly around moves off of LearningStudio, if you see any corrections, let us know in the comments or by using the ‘Contact Us’ page if you’d like to keep it private.

Update: Thanks to a careful reader, we found a mistake in moving the data from the wiki into the visualization software. Two schools – Arogsy University and Saint Leo University – have been corrected.